Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting 2400Y&YA Group Assignment Fall 2023 Louisville Slugger Incorporated Louisville Slugger Incorporated (LSI) is a manufacturer of traditional baseball equipment. The company was established

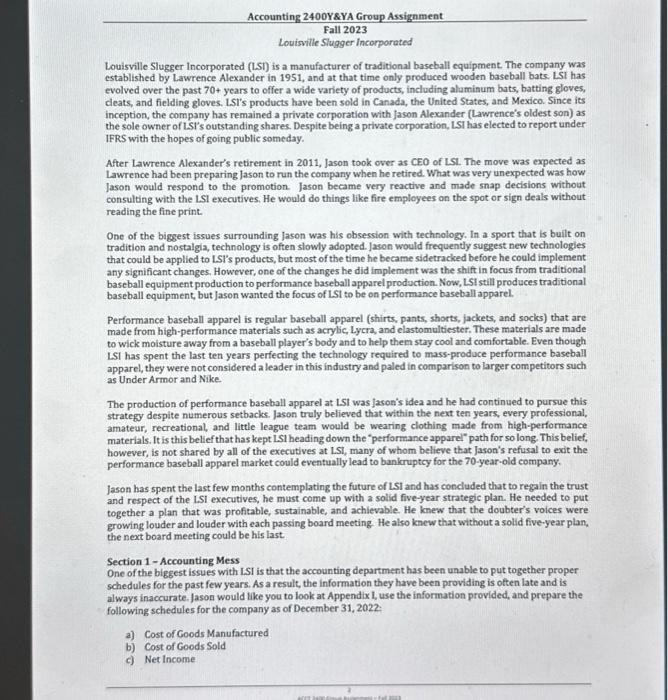

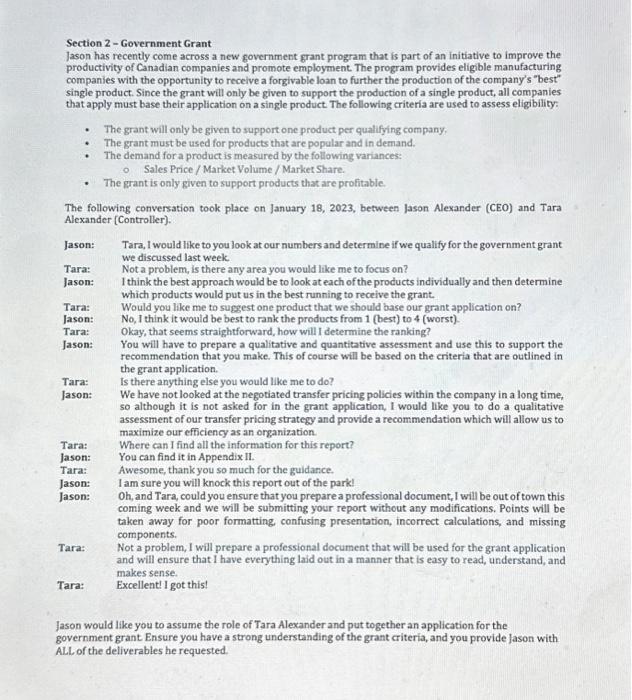

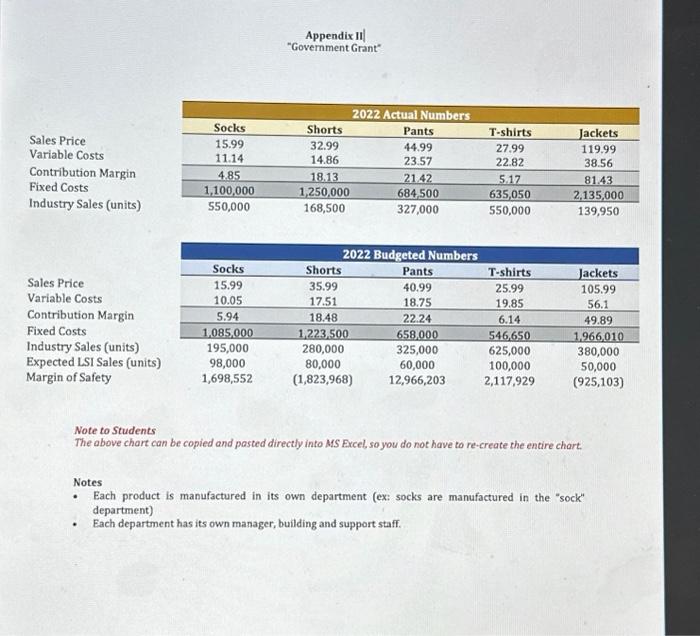

Accounting 2400Y&YA Group Assignment Fall 2023 Louisville Slugger Incorporated Louisville Slugger Incorporated (LSI) is a manufacturer of traditional baseball equipment. The company was established by Lawrence Alexander in 1951, and at that time only produced wooden baseball bats. LSI has evolved over the past 70+ years to offer a wide variety of products, including aluminum bats, batting gloves, cleats, and fielding gloves. LSI's products have been sold in Canada, the United States, and Mexico. Since its inception, the company has remained a private corporation with Jason Alexander (Lawrence's oldest son) as the sole owner of LSI's outstanding shares. Despite being a private corporation, LSI has elected to report under IFRS with the hopes of going public someday. After Lawrence Alexander's retirement in 2011, Jason took over as CEO of LSI. The move was expected as Lawrence had been preparing Jason to run the company when he retired. What was very unexpected was how Jason would respond to the promotion. Jason became very reactive and made snap decisions without consulting with the LSI executives. He would do things like fire employees on the spot or sign deals without reading the fine print. One of the biggest issues surrounding Jason was his obsession with technology. In a sport that is built on tradition and nostalgia, technology is often slowly adopted. Jason would frequently suggest new technologies that could be applied to LSI's products, but most of the time he became sidetracked before he could implement any significant changes. However, one of the changes he did implement was the shift in focus from traditional baseball equipment production to performance baseball apparel production. Now, LSI still produces traditional baseball equipment, but Jason wanted the focus of LSI to be on performance baseball apparel. Performance baseball apparel is regular baseball apparel (shirts, pants, shorts, jackets, and socks) that are made from high-performance materials such as acrylic, Lycra, and elastomultiester. These materials are made to wick moisture away from a baseball player's body and to help them stay cool and comfortable. Even though LSI has spent the last ten years perfecting the technology required to mass-produce performance baseball apparel, they were not considered a leader in this industry and paled in comparison to larger competitors such as Under Armor and Nike. The production of performance baseball apparel at LSI was Jason's idea and he had continued to pursue this strategy despite numerous setbacks. Jason truly believed that within the next ten years, every professional, amateur, recreational, and little league team would be wearing clothing made from high-performance materials. It is this belief that has kept LSI heading down the "performance apparel" path for so long. This belief, however, is not shared by all of the executives at LSI, many of whom believe that Jason's refusal to exit the performance baseball apparel market could eventually lead to bankruptcy for the 70-year-old company. Jason has spent the last few months contemplating the future of LSI and has concluded that to regain the trust and respect of the LSI executives, he must come up with a solid five-year strategic plan. He needed to put together a plan that was profitable, sustainable, and achievable. He knew that the doubter's voices were growing louder and louder with each passing board meeting. He also knew that without a solid five-year plan, the next board meeting could be his last. Section 1-Accounting Mess One of the biggest issues with LSI is that the accounting department has been unable to put together proper schedules for the past few years. As a result, the information they have been providing is often late and is always inaccurate. Jason would like you to look at Appendix I, use the information provided, and prepare the following schedules for the company as of December 31, 2022: a) Cost of Goods Manufactured b) Cost of Goods Sold c) Net Income Section 2-Government Grant Jason has recently come across a new government grant program that is part of an initiative to improve the productivity of Canadian companies and promote employment. The program provides eligible manufacturing companies with the opportunity to receive a forgivable loan to further the production of the company's "best" single product. Since the grant will only be given to support the production of a single product, all companies that apply must base their application on a single product. The following criteria are used to assess eligibility: The grant will only be given to support one product per qualifying company, The grant must be used for products that are popular and in demand. The demand for a product is measured by the following variances: Sales Price / Market Volume / Market Share. The grant is only given to support products that are profitable. The following conversation took place on January 18, 2023, between Jason Alexander (CEO) and Tara Alexander (Controller). Jason: Tara: Jason: Tara: Jason: Tara: Jason: Tara: Jason: Tara: Jason: Tara: Jason: Jason: Tara: Tara: Tara, I would like to you look at our numbers and determine if we qualify for the government grant we discussed last week. Not a problem, is there any area you would like me to focus on? I think the best approach would be to look at each of the products individually and then determine which products would put us in the best running to receive the grant. Would you like me to suggest one product that we should base our grant application on? No, I think it would be best to rank the products from 1 (best) to 4 (worst). Okay, that seems straightforward, how will I determine the ranking? You will have to prepare a qualitative and quantitative assessment and use this to support the recommendation that you make. This of course will be based on the criteria that are outlined in the grant application. Is there anything else you would like me to do? We have not looked at the negotiated transfer pricing policies within the company in a long time, so although it is not asked for in the grant application, I would like you to do a qualitative assessment of our transfer pricing strategy and provide a recommendation which will allow us to maximize our efficiency as an organization. Where can I find all the information for this report? You can find it in Appendix II. Awesome, thank you so much for the guidance. I am sure you will knock this report out of the park! Oh, and Tara, could you ensure that you prepare a professional document, I will be out of town this coming week and we will be submitting your report without any modifications. Points will be taken away for poor formatting, confusing presentation, incorrect calculations, and missing components. Not a problem, I will prepare a professional document that will be used for the grant application and will ensure that I have everything laid out in a manner that is easy to read, understand, and makes sense. Excellent! I got this! Jason would like you to assume the role of Tara Alexander and put together an application for the government grant Ensure you have a strong understanding of the grant criteria, and you provide Jason with ALL of the deliverables he requested. Appendix II "Government Grant 2022 Actual Numbers Socks Shorts Pants T-shirts Jackets Sales Price 15.99 32.99 44.99 27.99 119.99 Variable Costs 11.14 14.86 23.57 22.82 38.56 Contribution Margin 4.85 18.13 21.42 5.17 Fixed Costs 1,100,000 1,250,000 684,500 635,050 81.43 2,135,000 Industry Sales (units) 550,000 168,500 327,000 550,000 139,950 2022 Budgeted Numbers Socks Shorts Pants T-shirts Jackets Sales Price 15.99 35.99 40.99 25.99 105.99 Variable Costs 10.05 17.51 18.75 19.85 56.1 Contribution Margin 5.94 18.48 22.24 6.14 49.89 Fixed Costs 1,085,000 1,223,500 658,000 546,650 1,966,010 Industry Sales (units) 195,000 280,000 325,000 625,000 380,000 Expected LSI Sales (units) 98,000 80,000 60,000 100,000 50,000 Margin of Safety 1,698,552 (1,823,968) 12,966,203 2,117,929 (925,103) Note to Students The above chart can be copied and pasted directly into MS Excel, so you do not have to re-create the entire chart. Notes Each product is manufactured in its own department (ex: socks are manufactured in the "sock" department) Each department has its own manager, building and support staff.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Dear Jason Per your request please find below my analysis and recommendations regarding Louisville Slugger Incorporateds application for the governmen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started