Answered step by step

Verified Expert Solution

Question

1 Approved Answer

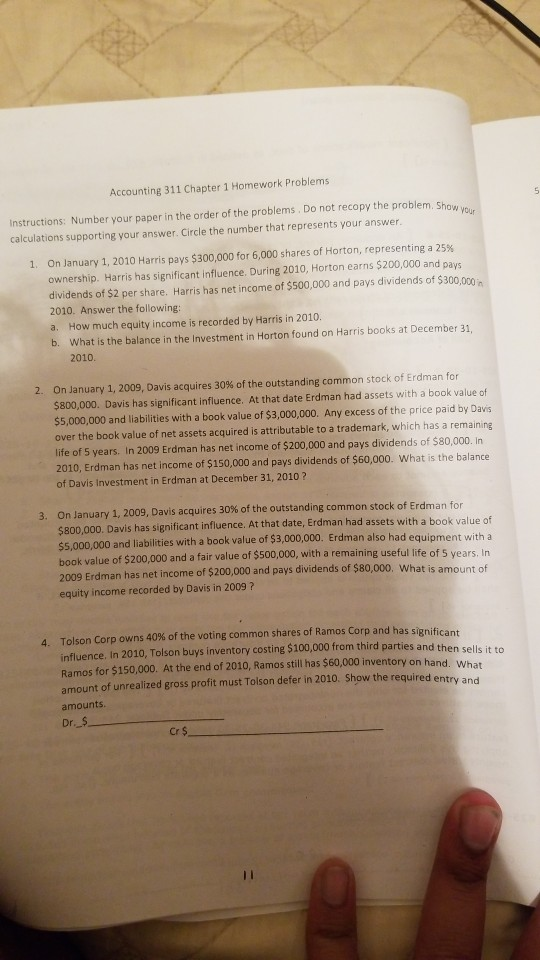

Accounting 311 Chapter 1 Homework Problems Instructions: Number your paper in the order of the problems. Do not recopy the problem. Show calculations supporting your

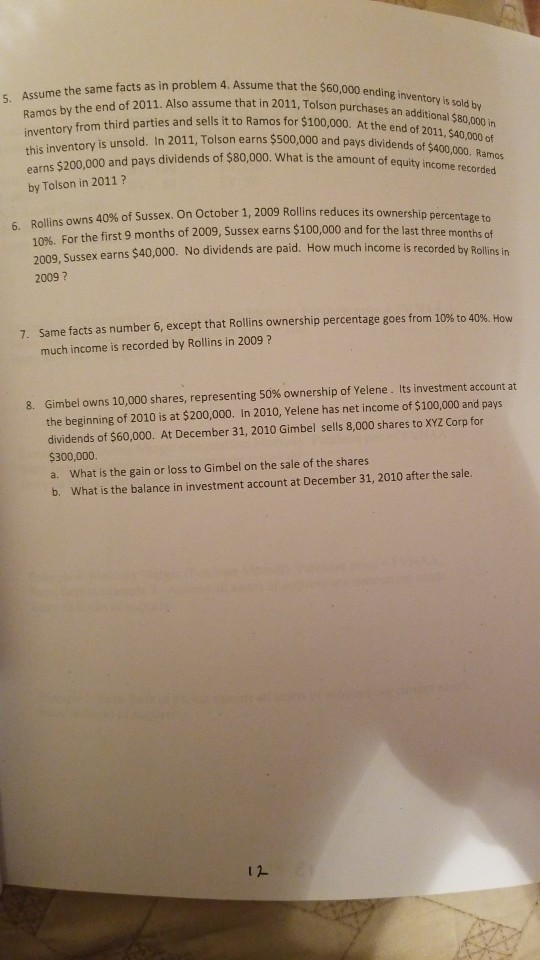

Accounting 311 Chapter 1 Homework Problems Instructions: Number your paper in the order of the problems. Do not recopy the problem. Show calculations supporting your answer. Circle the number that represents your answer. 1. On January 1, 2010 Harris pays $300,000 for 6,000 shares of Horton, representing a 25% ownership. Harris has significant influence. During 2010, Horton earns $200,000 and pays dividends of $2 per share. Harris has net income of $500,000 and pays dividends of $300,000 2010. Answer the following: a. How much equity income is recorded by Harris in 2010. b. What is the balance in the Investment in Horton found on Harris books at December 31, 2010 2. On January 1, 2009, Davis acquires 30% of the outstanding common stock of Erdman for $800,000. Davis has significant influence. At that date Erdman had assets with a book value of $5,000,000 and liabilities with a book value of $3,000,000. Any excess of the price paid by Davis over the book value of net assets acquired is attributable to a trademark, which has a remaining life of 5 years. In 2009 Erdman has net income of $200,000 and pays dividends of $80,000. In 2010, Erdman has net income of $150,000 and pays dividends of $60,000. What is the balance of Davis Investment in Erdman at December 31, 2010? 3. On January 1, 2009, Davis acquires 30% of the outstanding common stock of Erdman for SROD.000. Davis has significant influence. At that date, Erdman had assets with a book value of $5,000,000 and liabilities with a book value of $3,000,000. Erdman also had equipment with a book value of $200,000 and a fair value of $500,000, with a remaining useful life of 5 years. In 2009 Erdman has net income of $200,000 and pays dividends of $80,000. What is amount of equity income recorded by Davis in 2009? 4. Tolson Corp owns 40% of the voting common shares of Ramos Corp and has significant influence. In 2010. Tolson buys Inventory costing $100,000 from third parties and then sollte Ramos for $150,000. At the end of 2010, Ramos still has $60,000 inventory on hand, Whs. amount of unrealized gross profit must Tolson defer in 2010. Show the required entru amounts. Dr. $ Cr$ ne that the $60,000 ending inventory is sold by 1. Tolson purchases an additional $80,000 in for $100,000. At the end of 2011, $40,000 of and pays dividends of $400,000. Ramos What is the amount of equity income recorded Assume the same facts as in problem 4. Assume that the Damos by the end of 2011. Also assume that in 2011, Tolson nur ventory from third parties and sells it to Ramos for $100.000 this inventory is unsold. In 2011, Tolson ear earns $200,000 and pays dividends of $80,000. What is the amo by Tolson in 2011 ? t 6. Rollins owns 40% of Sussex. On October lins reduces its ownership percentage to Sussex earns $100,000 and for the last three months of 1096 For the first 9 months of 2009, Sussex earns $100,000 and for the last thr sex earns $40,000. No dividends are paid. How much income is recorded by Rollins in 2009? 7. Same facts as number 6, except that Rollins ownership percentage goes from 10% to 40%. How much income is recorded by Rollins in 2009 ? 8. Gimbel owns 10,000 shares, representing 50% ownership of Yelene. Its investment account at the beginning of 2010 is at $200,000. In 2010, Yelene has net income of $100,000 and pays dividends of $60,000. At December 31, 2010 Gimbel sells 8,000 shares to XYZ Corp for $300,000 a. What is the gain or loss to Gimbel on the sale of the shares b. What is the balance in investment account at December 31, 2010 after the sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started