Answered step by step

Verified Expert Solution

Question

1 Approved Answer

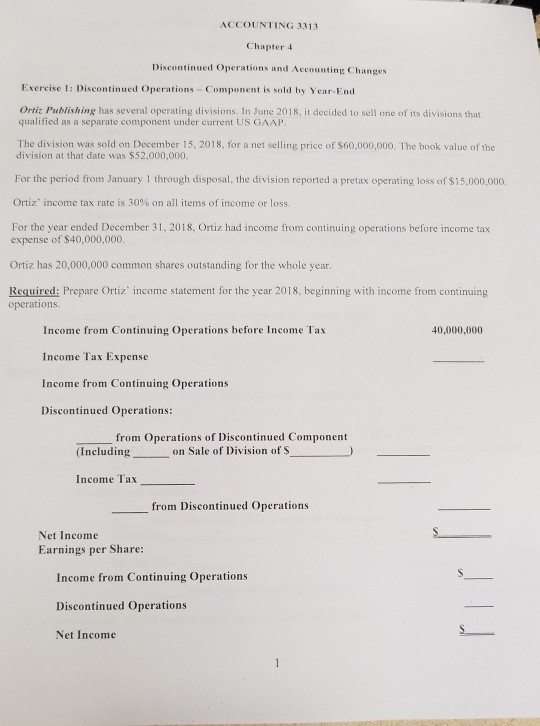

ACCOUNTING 3313 Chapter 4 Discontinued Operations and Accounting Changes Exercise I: Discontinued Operations Component is sold hy Year-End Ortiz Publishing has several operating divisions. In

ACCOUNTING 3313 Chapter 4 Discontinued Operations and Accounting Changes Exercise I: Discontinued Operations Component is sold hy Year-End Ortiz Publishing has several operating divisions. In June 2018, it decided to sell one of its divisions that qualified as a separate component under current US GAAP The division was sold on December 15, 2018, for a net selling price of $60.000,000. The book value of the division at that date was $52,000,000. For the period from January I through disposal, the division reported a pretax operating loss of $15,000,000. Ortiz, income tax rate is 30% on all items of income or loss. For the year ended December 31, 2018, Ortiz had income from continuing operations before income tax expense of $40,000,000. Ortiz has 20,000,000 common shares outstanding for the whole year. Required: Prepare Ortiz income statement for the year 2018, beginning with income from continuing operations Income from Continuing Operations before Income Tax Income Tax Expense Income from Continuing Operations Discontinued Operations: 40,000,000 from Operations of Discontinued Component ing on Sale of Division of S (Including Income Tax from Discontinued Operations Net Income Earnings per Share: Income from Continuing Operations Discontinued Operations Net Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started