Answered step by step

Verified Expert Solution

Question

1 Approved Answer

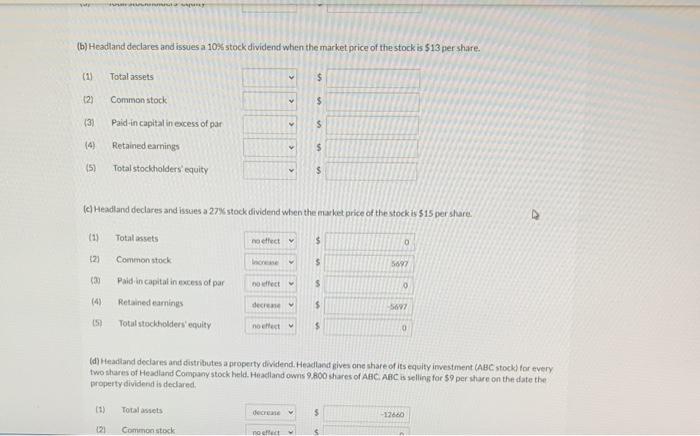

(b) Headland declares and issues a 10% stock dividend when the market price of the stock is $13 per share. (1) Total assets (2)

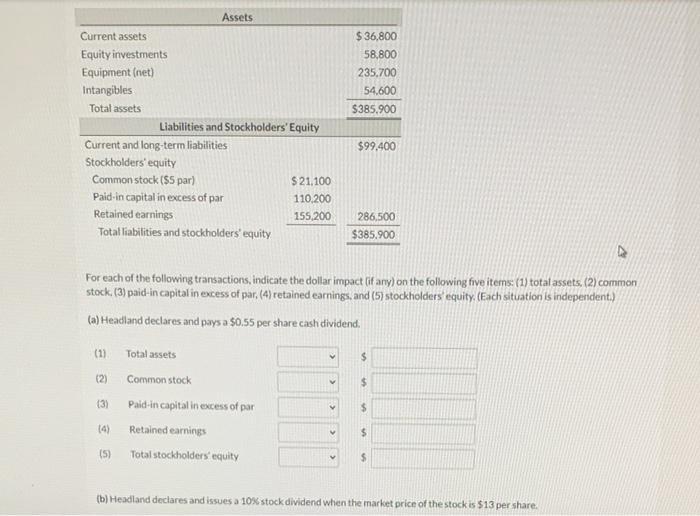

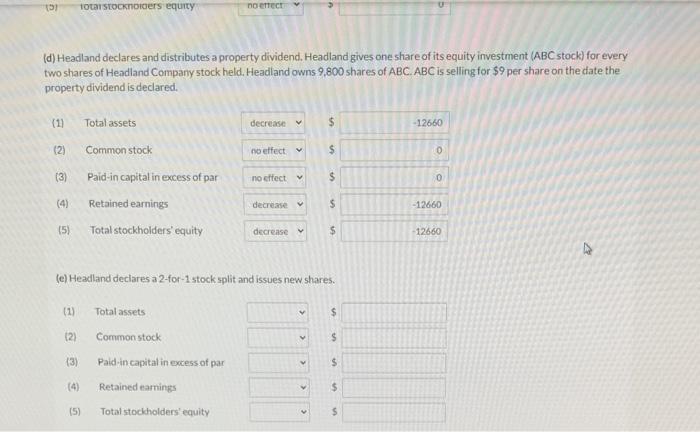

(b) Headland declares and issues a 10% stock dividend when the market price of the stock is $13 per share. (1) Total assets (2) Common stock (3) Paid-in capital in excess of par (4) Retained earnings (5) Total stockholders' equity (c) Headland declares and issues a 27% stock dividend when the market price of the stock is $15 per share (1) Total assets no etfect v (2) Common stock Increase 5697 (3) Paid-in capital in excess of par no effect (4) Retained earnings %24 decrease v (S) Total stockholders' equity no ettect (d) Headland declares and distributes a property dividend. Headland gives one share of its equity investment (ABC stock) for every two shares of Headland Company stock held. Headland owns 9.800 shares of ABC. ABC is selling for $9 per share on the date the property dividend is declared, (1) Total assets decrease 12660 121 Common stock no effect Assets Current assets $36,800 Equity investments 58,800 Equipment (net) 235,700 Intangibles 54,600 Total assets $385.900 Liabilities and Stockholders' Equity Current and long-term liabilities $99,400 Stockholders' equity Common stock ($5 par) Paid-in capital in excess of par $21,100 110,200 Retained earnings 155,200 286,500 Total liabilities and stockholders' equity $385.900 For each of the following transactions, indicate the dollar impact (if any) on the following five items: (1) total assets. (2) common stock, (3) paid-in capital in excess of par, (4) retained earnings, and (5) stockholders' equity. (Each situation is independent.) (a) Headland declares and pays a $0.55 per share cash dividend. (1) Total assets 24 (2) Common stock (3) Paid-in capital in excess of par %24 (4) Retained earnings 24 (5) Total stockholders equity %24 (b) Headland declares and issues a 10% stock dividend when the market price of the stock is $13 per share. 1otar stOCKnOIOers equity no ettect (d) Headland declares and distributes a property dividend. Headland gives ane share of its equity investment (ABC stock) for every two shares of Headland Company stock held. Headland owns 9,800 shares of ABC. ABC is selling for $9 per share on the date the property dividend is declared. (1) Total assets decrease v -12660 (2) Common stock no effect v %24 (3) Paid-in capital in excess of par no effect v (4) Retained earnings decrease -12660 (5) Total stockholders' equity decrease V -12660 (e) Headland declares a 2-for-1 stock split and issues new shares. (1) Total assets %24 (2) Common stock (3) Paid-in capital in excess of par (4) Retained earnings (5) Total stockholders' equity %24 %24 %24 24

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer cLare 2 Declarn and 055 Carh dividend pershare pay 055 Cah 4220 Sharn on...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started