Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Another firm has expanded its sales territory outside of its headquarter city. Most customers pay by check, and the 6 days, on average,

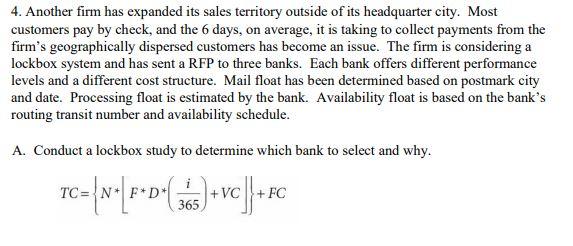

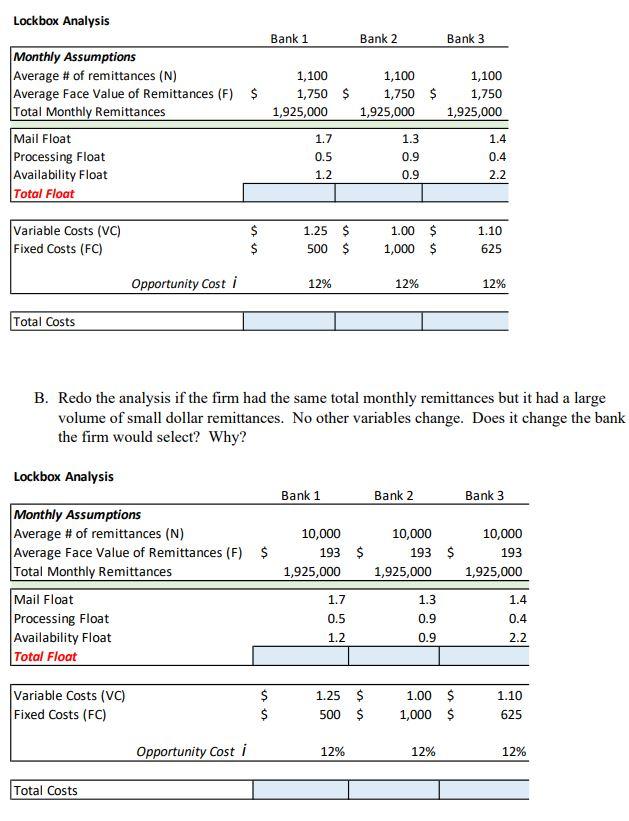

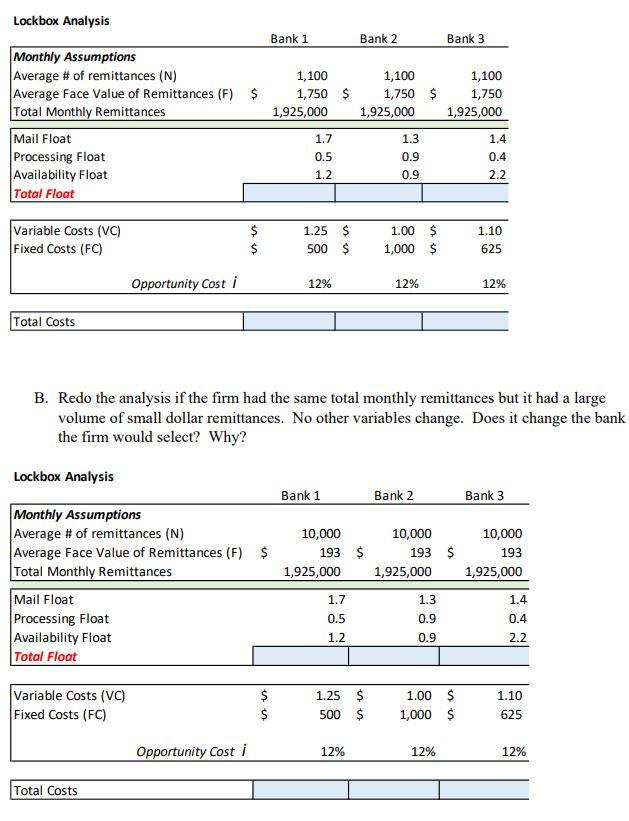

4. Another firm has expanded its sales territory outside of its headquarter city. Most customers pay by check, and the 6 days, on average, it is taking to collect payments from the firm's geographically dispersed customers has become an issue. The firm is considering a lockbox system and has sent a RFP to three banks. Each bank offers different performance levels and a different cost structure. Mail float has been determined based on postmark city and date. Processing float is estimated by the bank. Availability float is based on the bank's routing transit number and availability schedule. A. Conduct a lockbox study to determine which bank to select and why. D* i + VC FC 365 Lockbox Analysis Bank 1 Bank 2 Bank 3 Monthly Assumptions Average # of remittances (N) Average Face Value of Remittances (F) $ Total Monthly Remittances Mail Float Processing Float Availability Float Total Float 1,100 1,100 1,100 1,750 $ 1,750 $ 1,750 1,925,000 1,925,000 1,925,000 1.7 1.3 1.4 0.5 0.9 0.4 1.2 0.9 2.2 Variable Costs (VC) Fixed Costs (FC) 1.25 $ 500 $ $ 1.00 $ 1,000 $ 1.10 625 Opportunity Cost i 12% 12% 12% Total Costs B. Redo the analysis if the firm had the same total monthly remittances but it had a large volume of small dollar remittances. No other variables change. Does it change the bank the firm would select? Why? Lockbox Analysis Bank 1 Bank 2 Bank 3 Monthly Assumptions Average # of remittances (N) Average Face Value of Remittances (F) $ Total Monthly Remittances 10,000 10,000 10,000 193 $ 193 $ 193 1,925,000 1,925,000 1,925,000 Mail Float Processing Float Availability Float Total Float 1.7 1.3 1.4 0.5 0.9 0.4 1.2 0.9 2.2 Variable Costs (VC) Fixed Costs (FC) $ $ 1.25 $ 1.00 $ 1.10 500 $ 1,000 $ 625 Opportunity Cost i 12% 12% 12% Total Costs Lockbox Analysis Bank 1 Bank 2 Bank 3 Monthly Assumptions Average # of remittances (N) Average Face Value of Remittances (F) $ Total Monthly Remittances Mail Float Processing Float Availability Float Total Float 1,100 1,100 1,100 1,750 $ 1,750 $ 1,750 1,925,000 1,925,000 1,925,000 1.7 1.3 1.4 0.5 0.9 0.4 1.2 0.9 2.2 Variable Costs (VC) Fixed Costs (FC) 1.25 $ 500 $ $ 1.00 $ 1,000 $ 1.10 625 Opportunity Cost i 12% 12% 12% Total Costs B. Redo the analysis if the firm had the same total monthly remittances but it had a large volume of small dollar remittances. No other variables change. Does it change the bank the firm would select? Why? Lockbox Analysis Bank 1 Bank 2 Bank 3 Monthly Assumptions Average # of remittances (N) Average Face Value of Remittances (F) $ Total Monthly Remittances 10,000 10,000 10,000 193 $ 193 $ 193 1,925,000 1,925,000 1,925,000 Mail Float Processing Float Availability Float Total Float 1.7 1.3 1.4 0.5 0.9 0.4 1.2 0.9 2.2 Variable Costs (VC) Fixed Costs (FC) $ $ 1.25 $ 1.00 $ 1.10 500 $ 1,000 $ 625 Opportunity Cost i 12% 12% 12% Total Costs 5. A firm is considering paying its suppliers using electronic payments versus paper checks. The assumptions for the analysis follow: ASSUMPTIONS PRESENT (PAPER PROPOSED (ACH DEBIT) CKS) Average Payment Credit Terms $30,000 40 days 4 Days $8.35 $30,000 40 Days 1 Day $3.00 Float Processing Costs Per Item The present system is more expensive, but has longer float. The proposed system is less expensive, but the firm loses three-days float. Given an i of 12%, calculate the per period cost of the disbursement options. Should the firm switch to electronic payments? Perform an NPV analysis and explain which payment system the firm should use.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Part A Total float Mail float Processing float Availability float Hence the total float for Ban...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started