Answered step by step

Verified Expert Solution

Question

1 Approved Answer

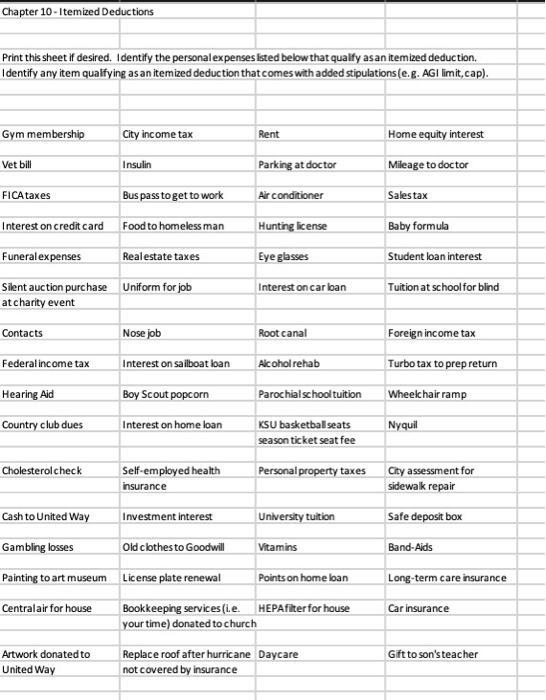

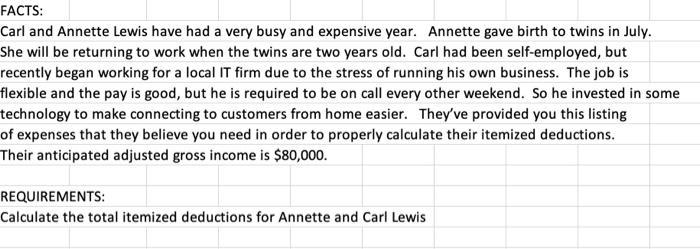

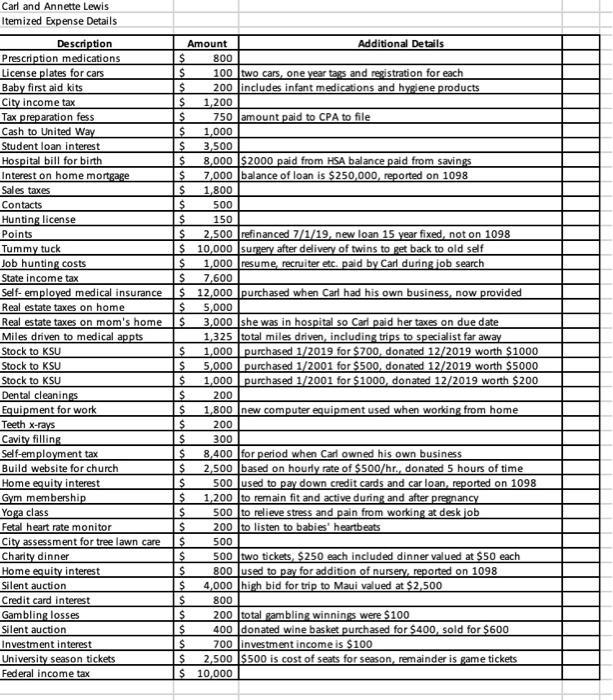

Chapter 10 - Itemized Deductions Print this sheet if desired. Identify the personalexpenses isted below that qualify asan itemized deduction. I dentify any item

Chapter 10 - Itemized Deductions Print this sheet if desired. Identify the personalexpenses isted below that qualify asan itemized deduction. I dentify any item qualfying asan itemized deduction that comes with added stipulations(e.g. AGI limit,cap). Gym membership City income tax Rent Home equity interest Vet bill Insulin Parking at doctor Mileage to doctor FICAtaxes Bus pass to get to work Air conditioner Sales tax Interest on credit card Food to homelessman Hunting license Baby formula Funeralexpenses Realestate taxes Eye glasses Student loan interest Silent auction purchase Uniform for job Interest on car loan Tuition at school for blind atcharity event Contacts Nose job Root canal Foreign income tax Federalincome tax Interest on sailboat loan Aicohol rehab Turbo tax to prep return Hearing Aid Boy Scout popcorn Parochialschooltuition Wheek hair ramp Country club dues KSU basketbal seats Interest on home loan Nyquil season ticket seat fee Cholesterolcheck Self-employed health Personal property taxes City assessment for sidewak repair insurance Cash to United Way Investment interest University tuition Safe deposit box Gambling losses Old clothes to Goodwill Vitamins Band-Aids Painting to art museum License plate renewal Points on home loan Long-term care insurance Bookkeeping services (Le. HEPAfiter for house your time) donated to church Centralair for house Car insurance Artwork donated to Gift to son'steacher Replace roof after hurricane Daycare not covered by insurance United Way FACTS: Carl and Annette Lewis have had a very busy and expensive year. Annette gave birth to twins in July. She will be returning to work when the twins are two years old. Carl had been self-employed, but recently began working for a local IT firm due to the stress of running his own business. The job is flexible and the pay is good, but he is required to be on call every other weekend. So he invested in some technology to make connecting to customers from home easier. They've provided you this listing of expenses that they believe you need in order to properly calculate their itemized deductions. Their anticipated adjusted gross income is $80,000. REQUIREMENTS: Calculate the total itemized deductions for Annette and Carl Lewis Carl and Annette Lewis Itemized Expense Details Additional Details Description Prescription medications License plates for cars Baby first aid kits City income tax Tax preparation fess Cash to United Way Student loan interest Hospital bill for birth Interest on home mortgage Sales taxes Amount 800 100 two cars, one year tags and registration for each 200 includes infant medications and hygiene products 1,200 750 Jamount paid to CPA to file 1,000 3,500 8,000 $2000 paid from HSA balance paid from savings 7,000 balance of loan is $250,000, reported on 1098 1,800 500 Contacts Hunting license 150 2,500 refinanced 7/1/19, new loan 15 year fixed, not on 1098 S 10,000 surgery after delivery of twins to get back to old self 1,000 resume, recruiter etc. paid by Carl during job search 7,600 $ 12,000 purchased when Carl had his own business, now provided 5,000 3,000 she was in hospital so Carl paid her taxes on due date 1,325 total miles driven, including trips to specialist far away 1,000 purchased 1/2019 for $700, donated 12/2019 worth $1000 5,000 purchased 1/2001 for $500, donated 12/2019 worth $5000 1,000 purchased 1/2001 for $1000, donated 12/2019 worth $200 Points Tummy tuck Job hunting costs State income tax Self- employed medical insurance Real estate taxes on home Real estate taxes on mom's home Miles driven to medical appts Stock to KSU Stock to KSU Stock to KSU Dental cleanings Equipment for work 5. $ 2$ 200 1,800 new computer equipment used when working from home Teeth x-rays 200 Cavity filling Self-employment tax Build website for church Home equity interest Gym membership Yoga class Fetal heart rate monitor City assessment for tree lawn care Charity dinner Home equity interest 300 8,400 for period when Carl owned his own business 2,500 based on hourly rate of $500/hr., donated 5 hours of time 500 used to pay down credit cards and car loan, reported on 1098 1,200 to remain fit and active during and after pregnancy 500 to relieve stress and pain from working at desk job 200 to listen to babies' heartbeats 5. 500 500 two tickets, $250 each inciuded dinner valued at $50 each 800 used to pay for addition of nursery, reported on 1098 4,000 high bid for trip to Maui valued at $2,500 800 Silent auction Credit card interest Gambling losses Silent auction Investment interest University season tickets Federal income tax 200 total gambling winnings were $100 400 donated wine basket purchased for $400, sold for $600 700 linvestment income is $100 2,500 $500 is cost of seats for season, remainder is game tickets $ 10,000

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started