Answered step by step

Verified Expert Solution

Question

1 Approved Answer

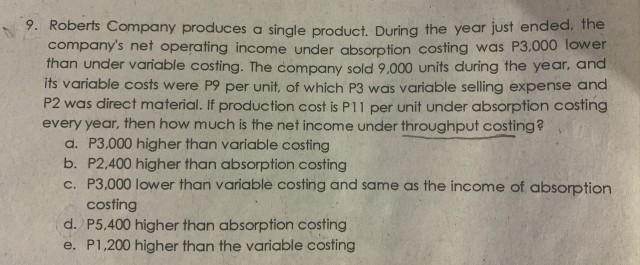

9. Roberts Company produces a single product. During the year just ended, the company's net operating income under absorption costing was P3,000 lower than

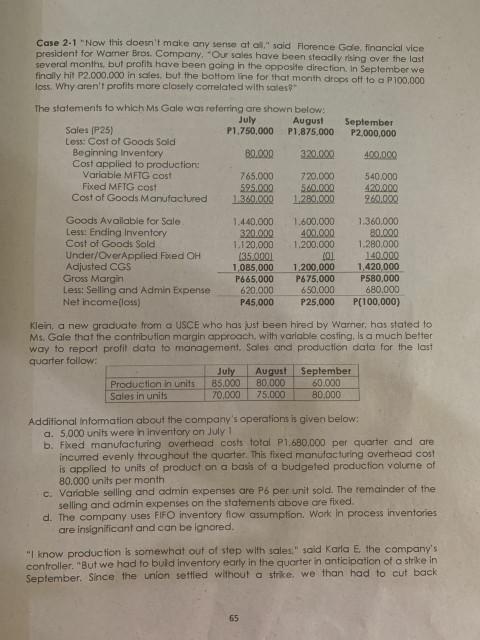

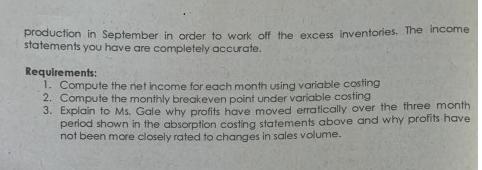

9. Roberts Company produces a single product. During the year just ended, the company's net operating income under absorption costing was P3,000 lower than under variable costing. The company sold 9.000 units during the year, and its variable costs were P9 per unit, of which P3 was variable selling expense and P2 was direct material. If production cost is P11 per unit under absorption costing every year, then how much is the net income under throughput costing? a. P3,000 higher than variable costing b. P2,400 higher than absorption costing c. P3,000 lower than variable costing and same as the income of absorption costing d. P5,400 higher than absorption costing e. P1,200 higher than the variable costing Case 2-1 "Now this doesn't make any sense at all." said Florence Gale, financial vice president for Warner Bros. Company. "Our sales have been steadly rising over the last several months, but profits have been going in the opposite direction. In September we finally hit P2.000.000 in sales, but the bottom line for that month drops off to a P100.000 loss. Why aren't profits more closely correlated with sales The statements to which Ms Gale was referring are shown below: August P1,875,000 Sales (P25) Less: Cost of Goods Sold Beginning Inventory Cost applied to production: Variable MFTG cost Fixed METG cost Cost of Goods Manufactured Goods Available for Sale. Less: Ending Inventory Cost of Goods Sold Under/OverApplied Fixed OH Adjusted CGS Gross Margin Less: Selling and Admin Expense Net income(loss) July P1,750,000 80.000 765.000 595.000 1.360.000 1.440,000 1,600,000 320.000 400.000 1,120,000 1.200.000 101 1,200,000 P675,000 650,000 P25,000 (35.0001 1,085,000 P665,000 620.000 P45,000 July Production in units 85.000 Sales in units 70,000 320.000 720.000 5.60.000 1,280,000 August 80,000 75.000 65 September P2,000,000 400.000 Klein, a new graduate from a USCE who has just been hired by Warner, has stated to Ms. Gale that the contribution margin approach, with variable costing, is a much better way to report profit data to management. Sales and production data for the last quarter follow: 540,000 420.000 960,000 September 60.000 80,000 1.360.000 80.000 1.280.000 140.000 1,420,000 P580,000 680.000 P(100,000) Additional Information about the company's operations is given below: a. 5,000 units were in inventory on July 1 b. Fixed manufacturing overhead costs total P1.680.000 per quarter and are incurred evenly throughout the quarter. This fixed manufacturing overhead cost is applied to units of product on a basis of a budgeted production volume of 80.000 units per month c. Variable selling and admin expenses are P per unit sold. The remainder of the selling and admin expenses on the statements above are fixed. d. The company uses FIFO inventory flow assumption. Work in process inventories are insignificant and can be ignored. "I know production is somewhat out of step with sales." said Karla E. the company's controller. "But we had to build inventory early in the quarter in anticipation of a strike in September. Since the union settled without a strike, we than had to cut back production in September in order to work off the excess inventories. The income statements you have are completely accurate. Requirements: 1. Compute the net income for each month using variable costing 2. Compute the monthly breakeven point under variable costing 3. Explain to Ms. Gale why profits have moved erratically over the three month period shown in the absorption costing statements above and why profits have not been more closely rated to changes in sales volume.

Step by Step Solution

★★★★★

3.56 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Net income for each month under variable costing July P 70 000 85 000 x P 9 P 6 x 70 000 P 5 000 A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started