Question

?Now this doesn?t make any sense at all,? said Flora Fisher, financial vice president for Warner Company. ?Our sales have been steadily rising over the

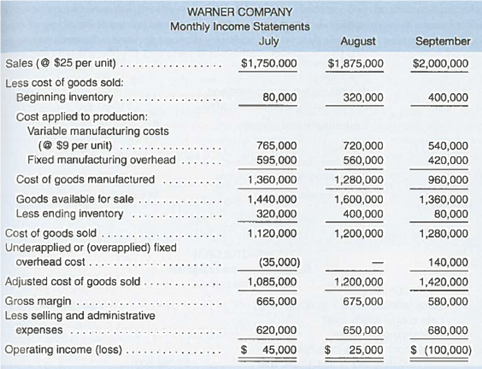

?Now this doesn?t make any sense at all,? said Flora Fisher, financial vice president for Warner Company. ?Our sales have been steadily rising over the last several months, but profits have been going in the opposite direction. In September we finally hit $2,000,000 in sales, but the bottom line for that month drops off to a $100,000 loss. Why aren?t profits more closely correlated with sales??

The statements to which Ms. Fisher was referring are shown on page 305 (absorption costing basis):

Hal Taylor, a recent graduate from Saint Mary?s University who has just been hired by Warner Company, has stated to Ms. Fisher that the contribution approach, with variable costing, is a much better way to report profit data to management. Sales and production data for the last quarter follow:

Additional information about the company?s operations is given below:

a. Five thousand units were in inventory on July 1.

b. Fixed manufacturing overhead costs total $1,680,000 per quarter and are incurred evenly throughout the quarter. This fixed manufacturing overhead cost is applied to units of product on the basis of a budgeted production volume of 80,000 units per month.

c. Variable selling and administrative expenses are $6 per unit sold. The remainder of the selling and administrative expenses on the statements above are fixed.

d. The company uses a FIFO inventory flow assumption. Work in process inventories are insignificant and can be ignored.

?I know production is somewhat out of step with sales,? said Carla Vorhees, the company?s controller. ?But we had to build inventory early in the quarter in anticipation of a strike in September. Since the union settled without a strike, we then had to cut back production in September in order to reduce the excess inventories. The income statements you have are completely accurate.?

Required:

1. Prepare a variable costing income statement for each month using the contribution approach.

2. Compute the monthly break-even point under variable costing.

3. Explain to Ms. Fisher why profits have moved erratically over the three month period shown in the absorption costing statements and why profits have not been more closely related to changes in sales volume.

4. Reconcile the variable costing and absorption costing operating income (loss) figures for each month. Show all computations, and show how you derived each figure used in your reconciliation.

5. Assume that the company had decided to introduce JIT inventory methods at the beginning of September. (Sales and production during July and August were as shown above.)

a. How many units would have been produced during September under JIT?

b. Starting with the next quarter (October, November, and December), would you expect any difference between the income reported under absorption costing and under variable costing? Explain why there would or would not be any difference.

c. Refer to your computations in (2) above. How would JIT help break-even analysis ?make sense? under absorption costing?

Sales ($25 per unit) Less cost of goods sold: Beginning inventory WARNER COMPANY Monthly Income Statements July $1,750,000 Cost applied to production: Variable manufacturing costs (@ $9 per unit) Fixed manufacturing overhead Cost of goods manufactured Goods available for sale.. Less ending inventory Cost of goods sold Underapplied or (overapplied) fixed overhead cost. Adjusted cost of goods sold Gross margin ..... Less selling and administrative expenses Operating income (loss). 80,000 765,000 595,000 1,360,000 1,440,000 320,000 1,120,000 (35,000) 1,085,000 665,000 August $1,875,000 320,000 720,000 560,000 1,280,000 1,600,000 400,000 1,200,000 1,200,000 675,000 620,000 650,000 $ 45,000 $ 25,000 September $2,000,000 400,000 540,000 420,000 960,000 1,360,000 80,000 1,280,000 140,000 1,420,000 580,000 680,000 $ (100,000)

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started