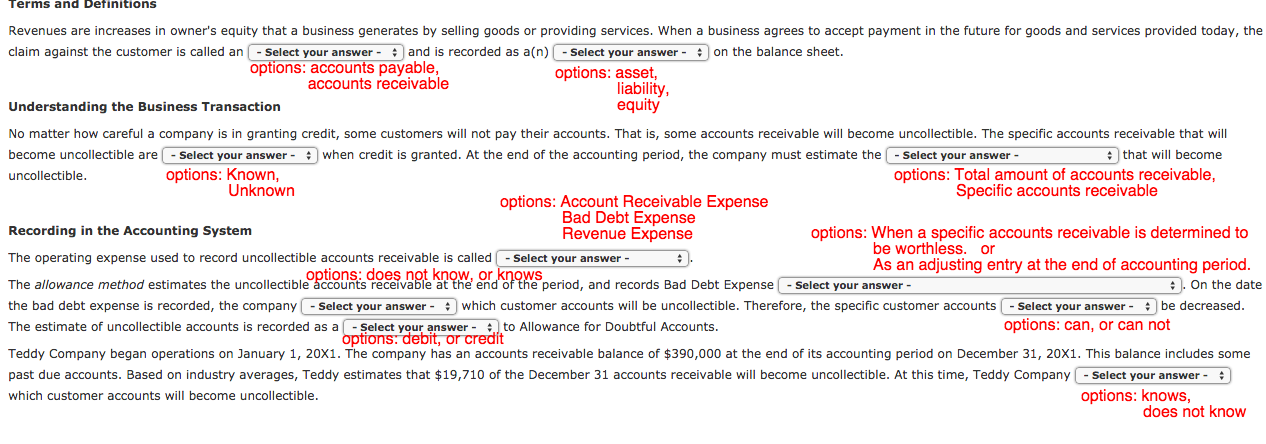

Accounting Allowance Method fill in the blank. Options for each box are given.

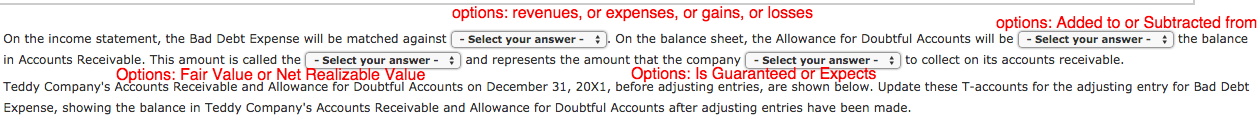

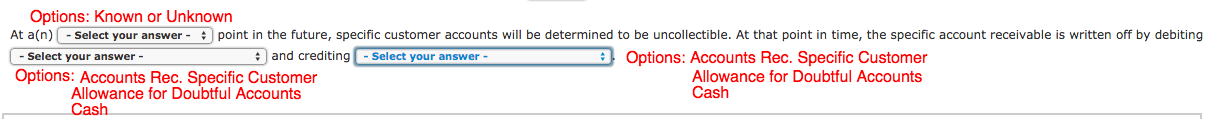

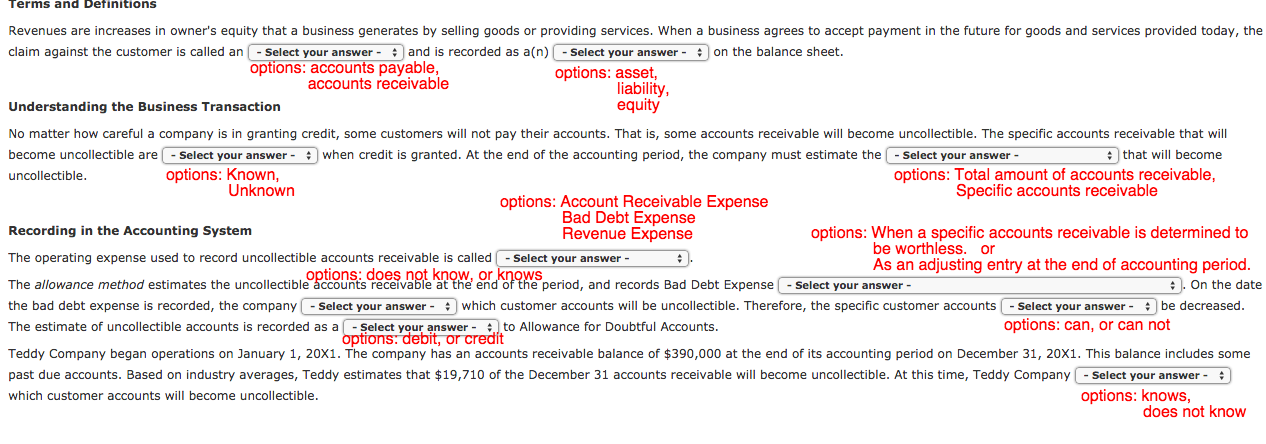

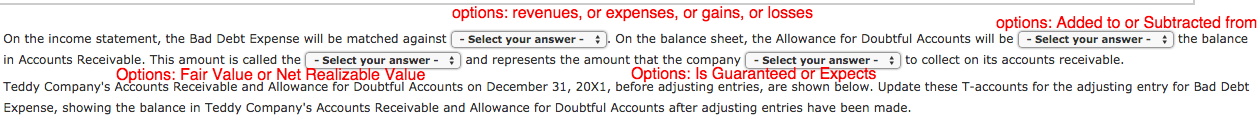

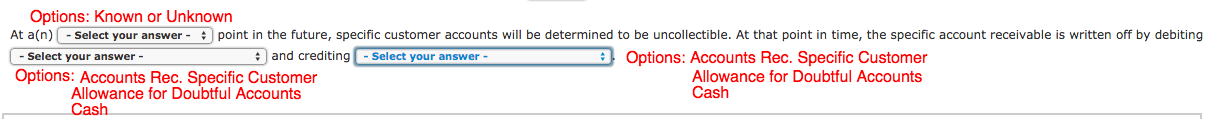

Options: Known or Unknown At a(n) - Select your answer - : point in the future, specific customer accounts will be determined to be uncollectible. At that point in time, the specific account receivable is written off by debiting - Select your answer - :1 and crediting [ - select your answer - : Options: Accounts Rec. Specific Customer Options: Accounts Rec. Specific Customer Allowance for Doubtful Accounts Allowance for Doubtful Accounts Cash Cash Terms and Conditions Revenues are increases in owners equity that a business generates by selling goods or providing services. When a business agrees to accept payment in the future for goods and services provided today, the claim against the customer is called an - Select your answer- : and is recorded as a(n) Select your answer on the balance sheet. options: accounts payable, options asset accounts receivable Liability, Understanding the Business Transaction equity No matter how careful a company is in granting credit, some customers will not pay their accounts. That is, some accounts receivable will become uncollectible. The specific accounts receivable that will become uncollectible are -Select your answer- : when credit is granted At the end of the accounting period, the company must estimate the : Select your answer that will become uncollectible. options: Known, options: Total amount of accounts receivable, Unknown . . Specific accounts receivable options: Account Receivable Expense Bad Debt Expense Recording in the Accounting System Revenue Expense options: When a specific accounts receivable is determined to The operating expense used to record uncollectible accounts receivable s called Select your answer :Hentry at the end of accounting period. The allowance method estimates the uncollectible 0 period, and records Bad Debt Expense - Select your answer - :. On the date the bad debt expense is recorded, the company Select your answer - : which customer accounts will be uncollectible. Therefore, the specific customer accounts :select your answer be decreased. The estimate of uncollectible accounts is recorded as aI - Select your answer - : to Allowance for Doubtful Accounts. options: can, or can not options: debit, or cred Teddy Company began operations on January 1, 20X1. The company has an accounts receivable balance of $390,000 at the end of its accounting period on December 31, 20X1. This balance includes some past due accounts. Based on industry averages, Teddy estimates that $19,710 of the December 31 accounts receivable will become uncollectible. At this time, Teddy Company -Select your answer -1 which customer accounts will become uncollectible. options: knows, does not know