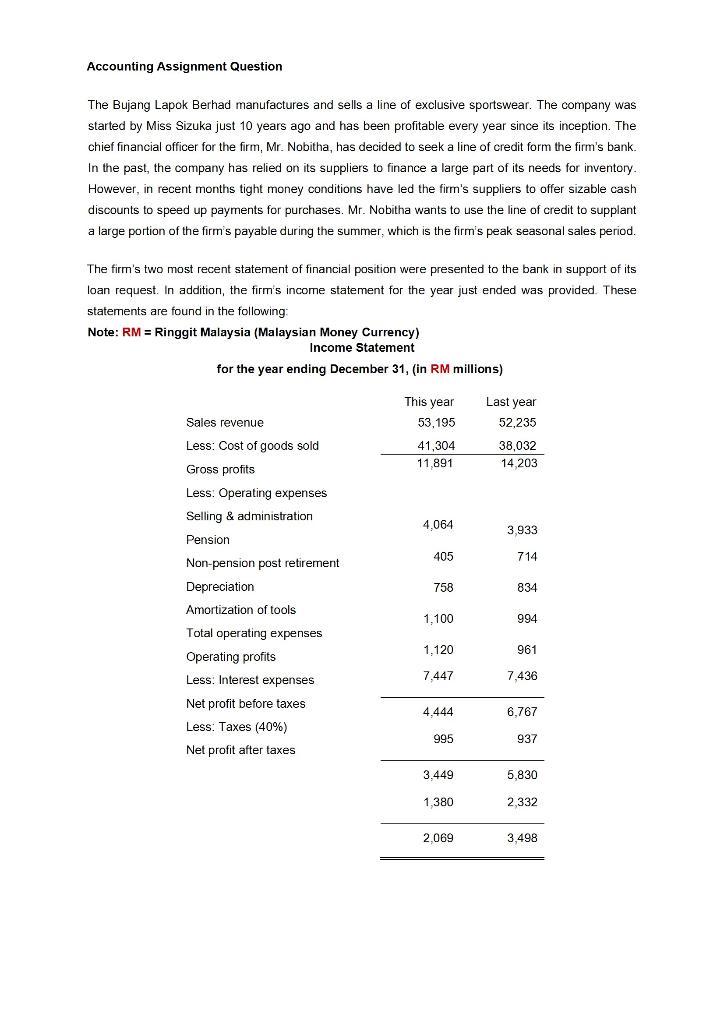

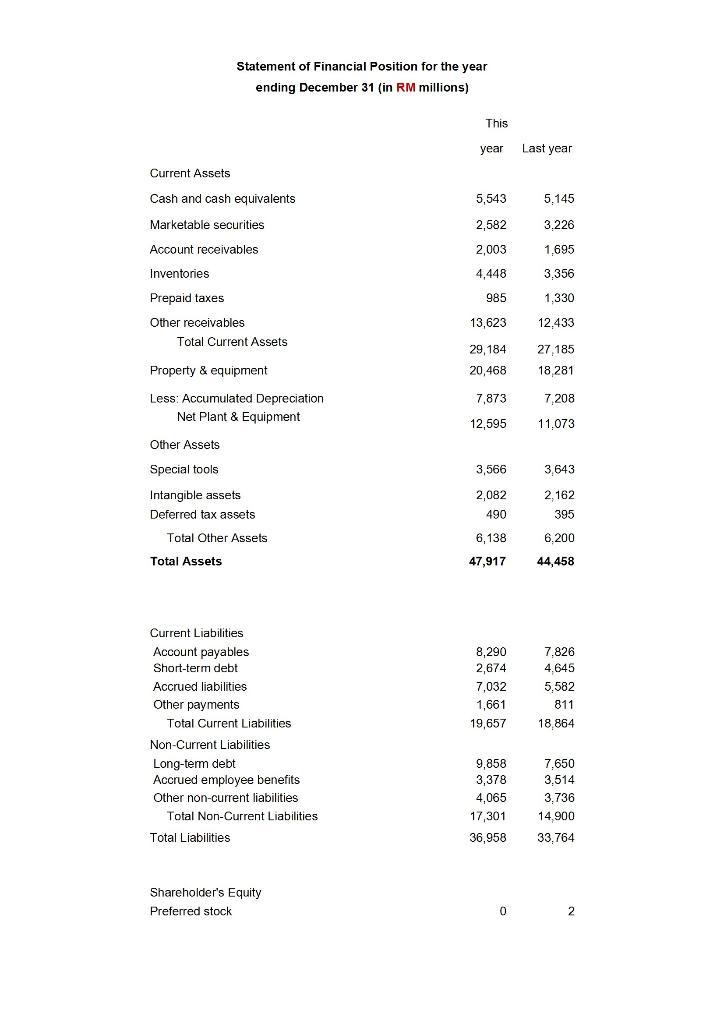

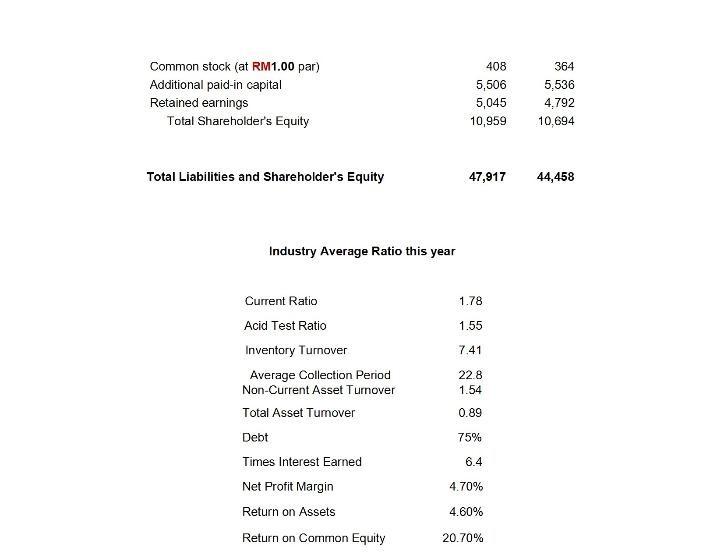

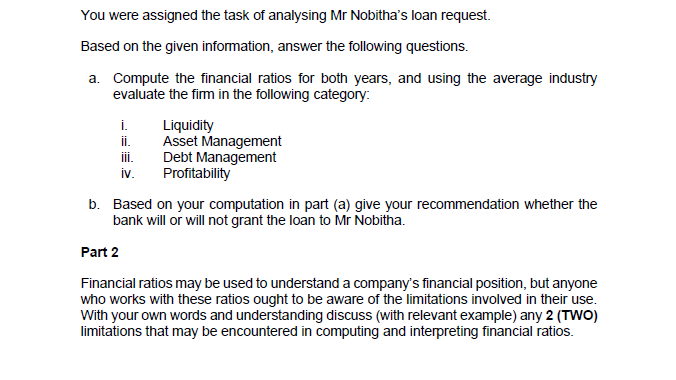

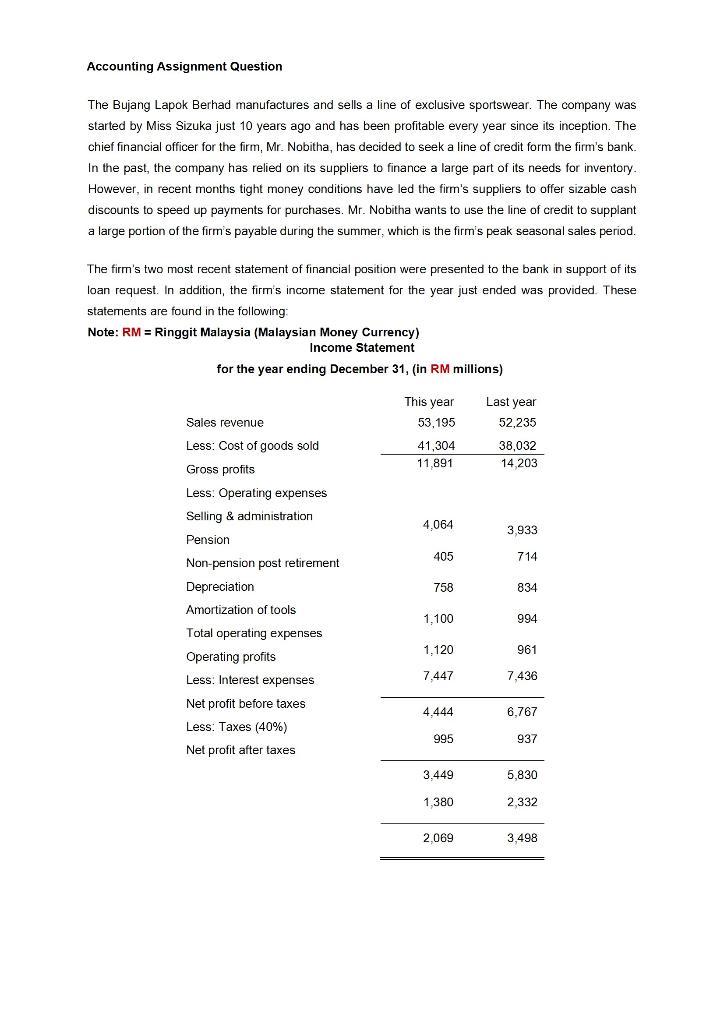

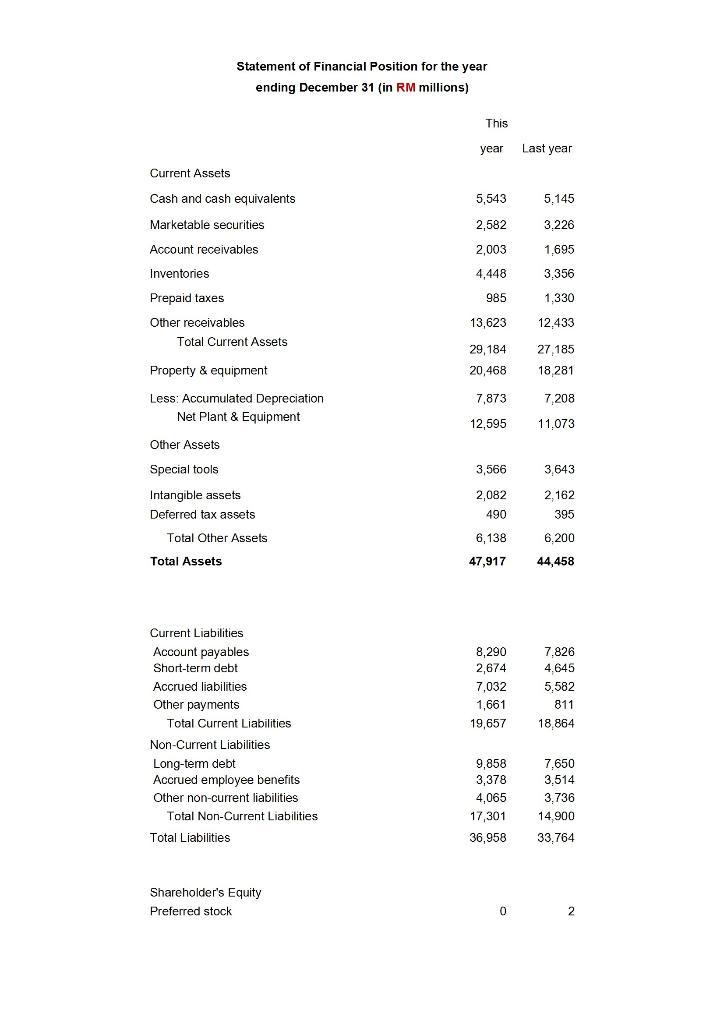

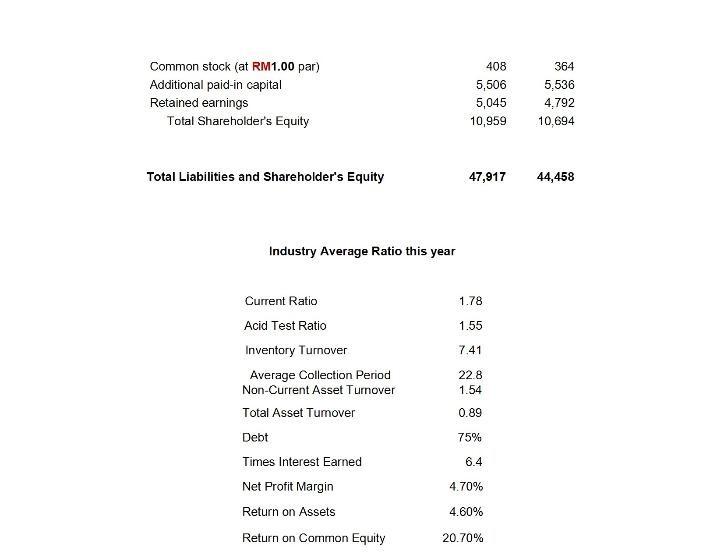

Accounting Assignment Question The Bujang Lapok Berhad manufactures and sells a line of exclusive sportswear. The company was started by Miss Sizuka just 10 years ago and has been profitable every year since its inception. The chief financial officer for the firm, Mr. Nobitha, has decided to seek a line of credit form the firm's bank. In the past, the company has relied on its suppliers to finance a large part of its needs for inventory. However, in recent months tight money conditions have led the firm's suppliers to offer sizable cash discounts to speed up payments for purchases. Mr. Nobitha wants to use the line of credit to supplant a large portion of the firm's payable during the summer, which is the firm's peak seasonal sales period. The firm's two most recent statement of financial position were presented to the bank in support of its loan request. In addition, the firm's income statement for the year just ended was provided. These statements are found in the following Note: RM = Ringgit Malaysia (Malaysian Money Currency) Income Statement for the year ending December 31, (in RM millions) This year Last year 52,235 Sales revenue 53,195 41,304 11,891 38,032 203 4,064 3,933 405 714 758 834 Less: Cost of goods sold Gross profits Less: Operating expenses Selling & administration Pension Non-pension post retirement Depreciation Amortization of tools Total operating expenses Operating profits Less: Interest expenses Net profit before taxes Less: Taxes (40%) Net profit after taxes 1,100 994 1,120 961 7,447 7,436 4,444 6,767 995 937 3.449 5,830 1,380 2,332 2.069 3,498 Statement of Financial Position for the year ending December 31 (in RM millions) This year Last year Current Assets Cash and cash equivalents 5,543 5,145 Marketable securities 2,582 3.226 2,003 1,695 4,448 3,356 Account receivables Inventories Prepaid taxes Other receivables Total Current Assets 985 1,330 13,623 12.433 27,185 29, 184 20,468 Property & equipment 18 281 7,873 7,208 Less: Accumulated Depreciation Net Plant & Equipment 12,595 11.073 Other Assets Special tools 3,566 3.643 2,082 Intangible assets Deferred tax assets 2.162 395 490 Total Other Assets 6,138 6.200 Total Assets 47,917 44,458 8,290 2,674 7,032 1,661 19,657 7.826 4,645 5,582 811 18,864 Current Liabilities Account payables Short-term debt Accrued liabilities Other payments Total Current Liabilities Non-Current Liabilities Long-term debt Accrued employee benefits Other non-current liabilities Total Non-Current Liabilities Total Liabilities 9,858 3,378 4,065 17,301 36,958 7,650 3,514 3,736 14,900 33.764 Shareholder's Equity Preferred stock 0 2 Common stock (at RM1.00 par) Additional paid-in capital Retained earnings Total Shareholder's Equity 408 5,506 5,045 10,959 364 5,536 4.792 10,694 Total Liabilities and Shareholder's Equity 47,917 44,458 Industry Average Ratio this year 1.78 1.55 7.41 Current Ratio Acid Test Ratio Inventory Turnover Average Collection Period Non-Current Asset Turnover Total Asset Tumover 22.8 1.54 0.89 Debt 75% 6.4 4.70% Times Interest Earned Net Profit Margin Return on Assets Return on Common Equity 4.60% 20.70% You were assigned the task of analysing Mr Nobitha's loan request. Based on the given information, answer the following questions. a. Compute the financial ratios for both years, and using the average industry evaluate the firm in the following category: i. Liquidity ii. Asset Management iii. Debt Management iv. Profitability b. Based on your computation in part (a) give your recommendation whether the bank will or will not grant the loan to Mr Nobitha. Part 2 Financial ratios may be used to understand a company's financial position, but anyone who works with these ratios ought to be aware of the limitations involved in their use. With your own words and understanding discuss (with relevant example) any 2 (TWO) limitations that may be encountered in computing and interpreting financial ratios