Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Automatic Zoom Below is the balance sheet of McDowell Company as of January 1, 2019: Assets Liabilities & Owners' Equity Current Assets: Cash Accounts

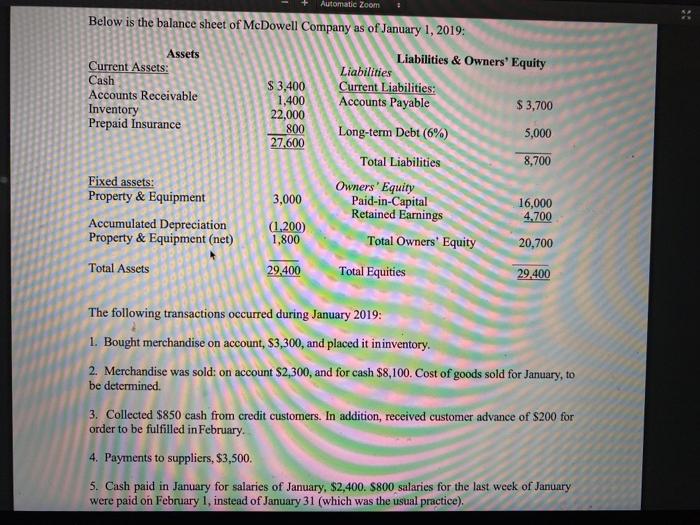

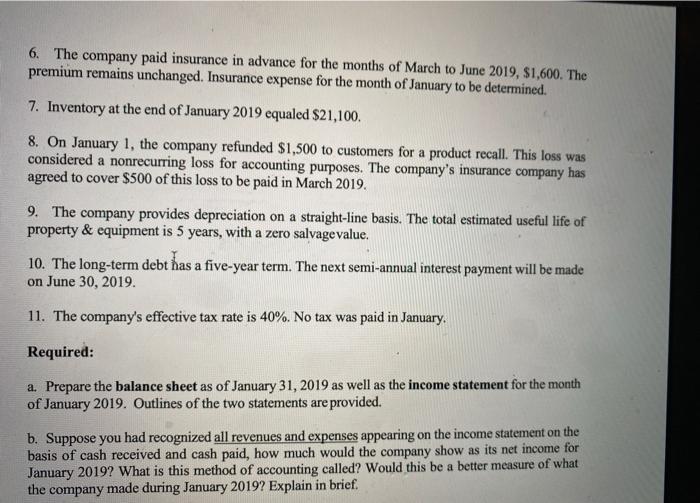

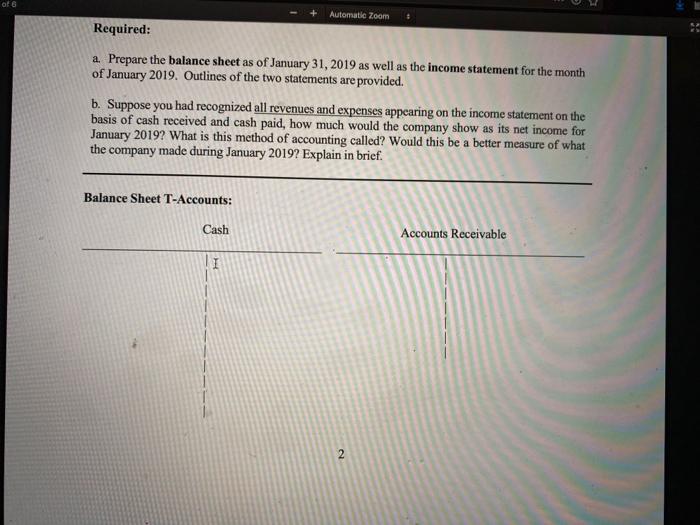

Automatic Zoom Below is the balance sheet of McDowell Company as of January 1, 2019: Assets Liabilities & Owners' Equity Current Assets: Cash Accounts Receivable Inventory Prepaid Insurance $ 3,400 1,400 22,000 800 27.600 Liabilities Current Liabilities: Accounts Payable $ 3,700 Long-term Debt (6%) 5,000 Total Liabilities 8,700 Fixed assets: Property & Equipment Owners' Equity Paid-in-Capital Retained Earnings 3,000 16,000 4,700 Accumulated Depreciation Property & Equipment (net) (1,200) 1,800 Total Owners' Equity 20,700 Total Assets 29,400 Total Equities 29.400 The following transactions occurred during January 2019: 1. Bought merchandise on account, $3,300, and placed it ininventory. 2. Merchandise was sold: on account $2,300, and for cash $8,100. Cost of goods sold for January, to be determined. 3. Collected $850 cash from credit customers. In addition, received customer advance of $200 for order to be fulfilled in February. 4. Payments to suppliers, $3,500. 5. Cash paid in January for salaries of January, $2,400. S800 salaries for the last week of January were paid on February 1, instead of January 31 (which was the usual practice), 6. The company paid insurance in advance for the months of March to June 2019, $1,600. The premium remains unchanged. Insurance expense for the month of January to be determined. 7. Inventory at the end of January 2019 equaled $21,100. 8. On January 1, the company refunded $1,500 to customers for a product recall. This loss was considered a nonrecurring loss for accounting purposes. The company's insurance company has agreed to cover $500 of this loss to be paid in March 2019. 9. The company provides depreciation on a straight-line basis. The total estimated useful life of property & equipment is 5 years, with a zero salvagevalue. 10. The long-term debt has a five-year term. The next semi-annual interest payment will be made on June 30, 2019. 11. The company's effective tax rate is 40%. No tax was paid in January. Required: a. Prepare the balance sheet as of January 31, 2019 as well as the income statement for the month of January 2019. Outlines of the two statements are provided. b. Suppose you had recognized all revenues and expenses appearing on the income statement on the basis of cash received and cash paid, how much would the company show as its net income for January 2019? What is this method of accounting called? Would this be a better measure of what the company made during January 2019? Explain in brief. Automatic Zoom Required: a. Prepare the balance sheet as of January 31, 2019 as well as the income statement for the month of January 2019. Outlines of the two statements are provided. b. Suppose you had recognized all revenues and expenses appearing on the income statement on the basis of cash received and cash paid, how much would the company show as its net income for January 2019? What is this method of accounting called? Would this be a better measure of what the company made during January 2019? Explain in brief. Balance Sheet T-Accounts: Cash Accounts Receivable Automatic Zoom Below is the balance sheet of McDowell Company as of January 1, 2019: Assets Liabilities & Owners' Equity Current Assets: Cash Accounts Receivable Inventory Prepaid Insurance $ 3,400 1,400 22,000 800 27.600 Liabilities Current Liabilities: Accounts Payable $ 3,700 Long-term Debt (6%) 5,000 Total Liabilities 8,700 Fixed assets: Property & Equipment Owners' Equity Paid-in-Capital Retained Earnings 3,000 16,000 4,700 Accumulated Depreciation Property & Equipment (net) (1,200) 1,800 Total Owners' Equity 20,700 Total Assets 29,400 Total Equities 29.400 The following transactions occurred during January 2019: 1. Bought merchandise on account, $3,300, and placed it ininventory. 2. Merchandise was sold: on account $2,300, and for cash $8,100. Cost of goods sold for January, to be determined. 3. Collected $850 cash from credit customers. In addition, received customer advance of $200 for order to be fulfilled in February. 4. Payments to suppliers, $3,500. 5. Cash paid in January for salaries of January, $2,400. S800 salaries for the last week of January were paid on February 1, instead of January 31 (which was the usual practice), 6. The company paid insurance in advance for the months of March to June 2019, $1,600. The premium remains unchanged. Insurance expense for the month of January to be determined. 7. Inventory at the end of January 2019 equaled $21,100. 8. On January 1, the company refunded $1,500 to customers for a product recall. This loss was considered a nonrecurring loss for accounting purposes. The company's insurance company has agreed to cover $500 of this loss to be paid in March 2019. 9. The company provides depreciation on a straight-line basis. The total estimated useful life of property & equipment is 5 years, with a zero salvagevalue. 10. The long-term debt has a five-year term. The next semi-annual interest payment will be made on June 30, 2019. 11. The company's effective tax rate is 40%. No tax was paid in January. Required: a. Prepare the balance sheet as of January 31, 2019 as well as the income statement for the month of January 2019. Outlines of the two statements are provided. b. Suppose you had recognized all revenues and expenses appearing on the income statement on the basis of cash received and cash paid, how much would the company show as its net income for January 2019? What is this method of accounting called? Would this be a better measure of what the company made during January 2019? Explain in brief. Automatic Zoom Required: a. Prepare the balance sheet as of January 31, 2019 as well as the income statement for the month of January 2019. Outlines of the two statements are provided. b. Suppose you had recognized all revenues and expenses appearing on the income statement on the basis of cash received and cash paid, how much would the company show as its net income for January 2019? What is this method of accounting called? Would this be a better measure of what the company made during January 2019? Explain in brief. Balance Sheet T-Accounts: Cash Accounts Receivable

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Working notes 1 Cost of goods sold for the month of January 2019 Opening inventory on January 1 2019 22000 Add Purchases during the month 3300 25300 Less Closing inventory on January 31 2019 21100 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started