Answered step by step

Verified Expert Solution

Question

1 Approved Answer

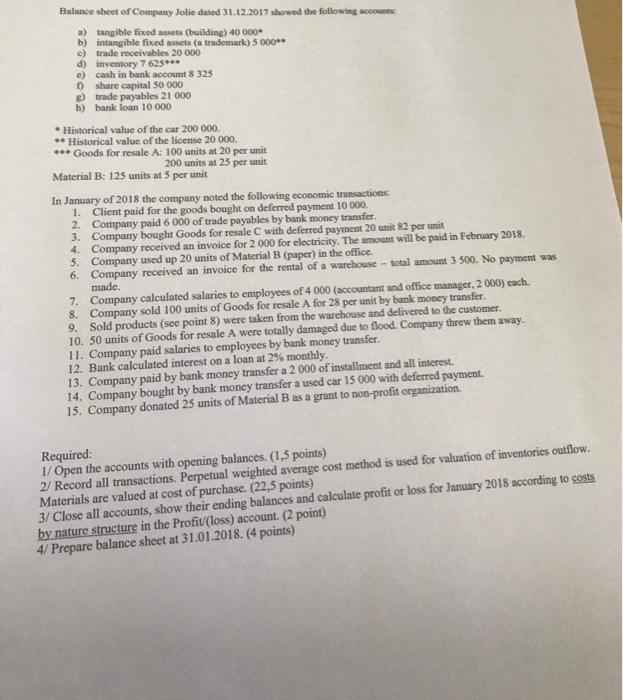

Balance sheet of Company Jolie dated 31.12.2017 showed the following accounte a) tangible fixed assets (building) 40 000 b) intangible fixed assets (a trademark)

Balance sheet of Company Jolie dated 31.12.2017 showed the following accounte a) tangible fixed assets (building) 40 000 b) intangible fixed assets (a trademark) 5 000 e) trade receivables 20 000 d) inventory 7 625*** e) cash in bank account 8 325 O share capital 50 000 9 trade payables 21 000 h) bank loan 10 000 * Historical value of the car 200 000. ** Historical value of the license 20 000. *** Goods for resale A: 100 units at 20 per unit 200 units at 25 per unit Material B: 125 units at 5 per unit In January of 2018 the company noted the following economic transactions 1. Client paid for the goods bought on deferred payment 10 000. 2. Company paid 6 000 of trade payables by bank money transfer. 3. Company bought Goods for resale C with deferred payment 20 unit 82 per unit 4. Company received an invoice for 2 000 for electricity. The amount will be paid in February 2018. 5. Company used up 20 units of Material B (paper) in the office. 6. Company received an invoice for the rental of a warehouse - total amount 3 500. No payment was made. 7. Company calculated salaries to employees of 4 000 (accountant and office manager, 2 000) each. 8. Company sold 100 units of Goods for resale A for 28 per unit by bank money transfer. 9. Sold products (see point 8) were taken from the warehouse and delivered to the customer. 10. 50 units of Goods for resale A were totally damaged due to flood. Company threw them away. 11. Company paid salaries to employees by bank money transfer. 12. Bank calculated interest on a loan at 2% monthly. 13. Company paid by bank money transfer a 2 000 of installment and all interest. 14. Company bought by bank money transfer a used car 15 000 with deferred payment. 15. Company donated 25 units of Material B as a grant to non-profit organization. Required: 1/ Open the accounts with opening balances. (1,5 points) 2/ Record all transactions. Perpetual weighted average cost method is used for valuation of inventories outflow. Materials are valued at cost of purchase. (22,5 points) 3/ Close all accounts, show their ending balances and calculate profit or loss for January 2018 according to costs by nature structure in the Profit/(loss) account. (2 point) 4/ Prepare balance sheet at 31.01.2018. (4 points)

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

IF 1 Amount Amount IDODO 100002 Economic Transaction of Jan 201...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started