Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carol Brady lives at 461 Ocean Blvd, Savannah, GA, 31512. Ms. Brady's social security number is 256-74-8432, and she is 55 years old. Carol

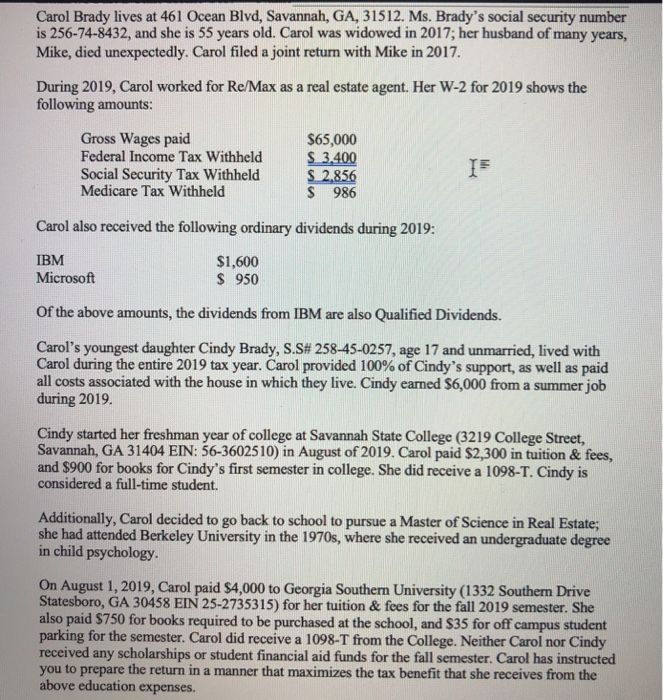

Carol Brady lives at 461 Ocean Blvd, Savannah, GA, 31512. Ms. Brady's social security number is 256-74-8432, and she is 55 years old. Carol was widowed in 2017; her husband of many years, Mike, died unexpectedly. Carol filed a joint return with Mike in 2017. During 2019, Carol worked for Re/Max as a real estate agent. Her W-2 for 2019 shows the following amounts: Gross Wages paid Federal Income Tax Withheld Social Security Tax Withheld Medicare Tax Withheld $65,000 $ 3.400 $ 2.856 $ 986 Carol also received the following ordinary dividends during 2019: IBM Microsoft IF $1,600 $ 950 Of the above amounts, the dividends from IBM are also Qualified Dividends. Carol's youngest daughter Cindy Brady, S.S# 258-45-0257, age 17 and unmarried, lived with Carol during the entire 2019 tax year. Carol provided 100% of Cindy's support, as well as paid all costs associated with the house in which they live. Cindy earned $6,000 from a summer job during 2019. Cindy started her freshman year of college at Savannah State College 219 College Street, Savannah, GA 31404 EIN: 56-3602510) in August of 2019. Carol paid $2,300 in tuition & fees, and $900 for books for Cindy's first semester in college. She did receive a 1098-T. Cindy is considered a full-time student. Additionally, Carol decided to go back to school to pursue a Master of Science in Real Estate; she had attended Berkeley University in the 1970s, where she received an undergraduate degree in child psychology. On August 1, 2019, Carol paid $4,000 to Georgia Southern University (1332 Southern Drive Statesboro, GA 30458 EIN 25-2735315) for her tuition & fees for the fall 2019 semester. She also paid $750 for books required to be purchased at the school, and $35 for off campus student parking for the semester. Carol did receive a 1098-T from the College. Neither Carol nor Cindy received any scholarships or student financial aid funds for the fall semester. Carol has instructed you to prepare the return in a manner that maximizes the tax benefit that she receives from the above education expenses.

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

In come Car ol earned 65 000 in gross wages from Re Max in 2019 She also received 2 550 in ordinary ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started