Answered step by step

Verified Expert Solution

Question

1 Approved Answer

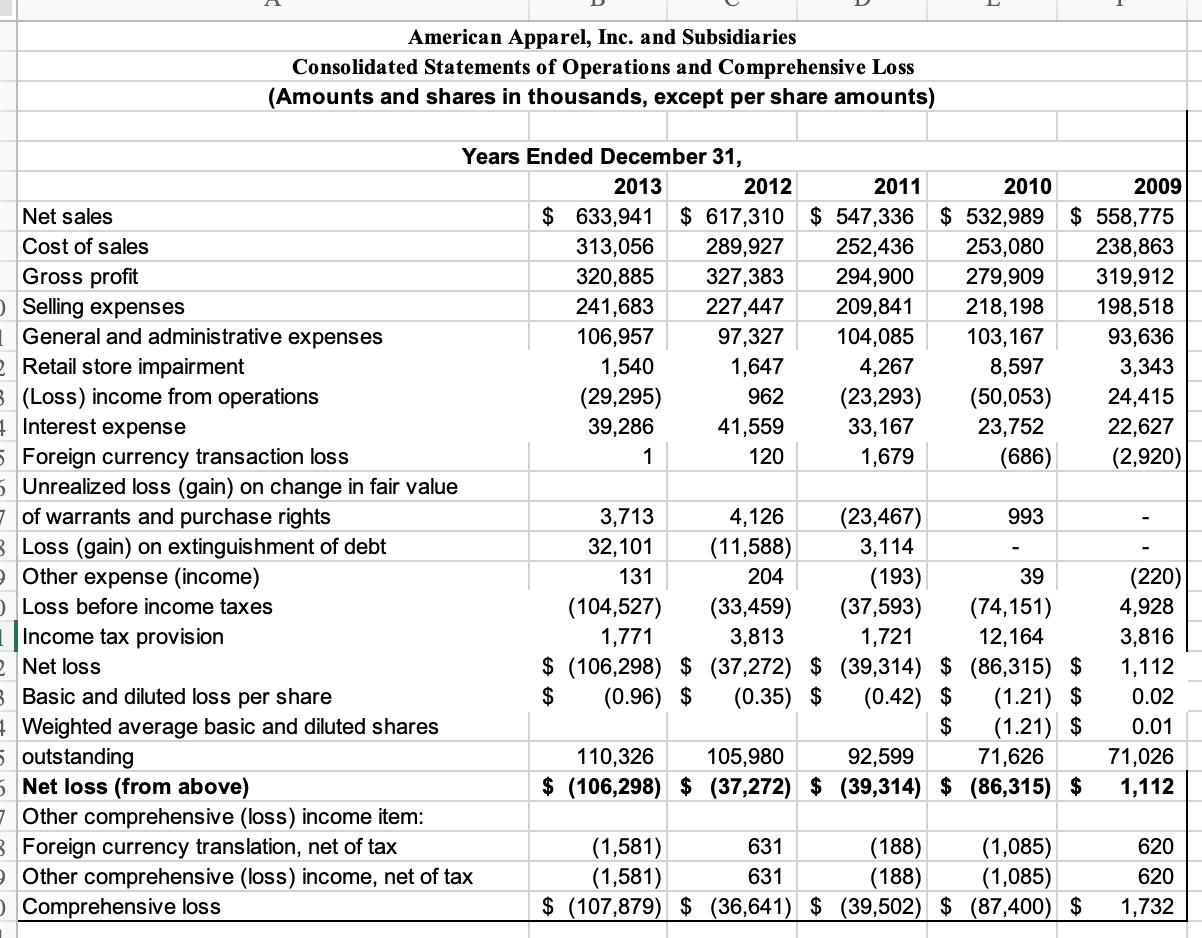

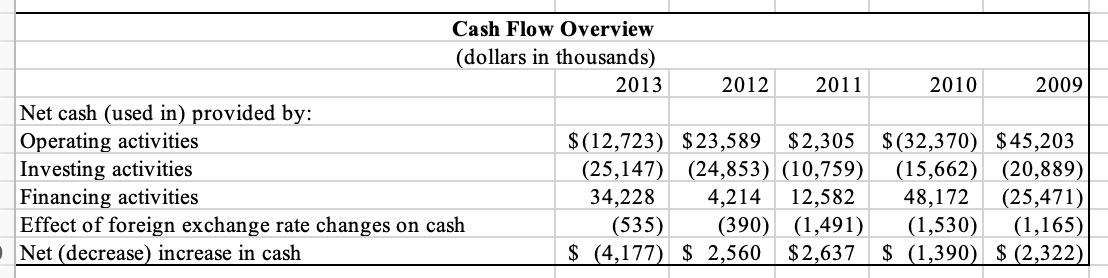

Using a financial ratio analysis, evaluate American Apparels financial performance for the past five years. Analyze the companys financial statements on the basis of its

- Using a financial ratio analysis, evaluate American Apparel’s financial performance for the past five years.

- Analyze the company’s financial statements on the basis of its common size statements. What additional insights do these statements provide?

- In your opinion, does American Apparel have an asset management problem? If so, what is the nature of the problem (for example, fixed assets, receivables, inventory, or other)?

- On the basis of the financial performance analysis, what actions do you recommend to prevent the company from falling further into debt?

- In addition to a narrative explaining your answers, include charts or graphs that illustrate your conclusions.

American Apparel, Inc. and Subsidiaries Consolidated Balance Sheets December 31, 2012 (Amounts and shares in thousands, except per share amounts) ASSETS 2013 2011 2010 2009 CURRENT ASSETS 8,676 $ 12,853 $ 10,293 S 7,656 $ 9,046 20,939 Cash Trade accounts receivable Restricted cash Prepaid expenses and other current assets Inventories, net 22,962 3,733 20,701 16,688 16,907 15,636 9,589 174,229 530 7,631 185,764 5,955 9,401 178,052 4,114 9,994 141,235 4,494 169,378 Income taxes receivable and prepaid income taxes Deferred income taxes, net of valuation allowance Total current assets 306 599 494 148 626 4,627 230,730 67,438 1,529 224,390 186,303 215,296 69,303 2,426 46,727 216,537 85,400 1,695 Property and equipment, net Deffered taxes 103,310 12,033 25,933 333,752 $328,212 $324,721 S 327,950 $327,579 67,778 1,261 34,783 Other assets, net 25,024 24,318 TOTAL ASSETS LIABILITIES AND STOCKHOLDERS' (DEFICIT) EQUITY CURRENT LIABILITIES Cash overdraft 3,993 $ $ 1,921 S 3,328 S 3,741 Revolving credit facilities and current portion of long-term debt 60,556 38,160 6,346 19,705 30,573 2,608 138,478 31,534 44,042 50,375 Accounts payable Accrued expenses and other current liabilities Fair value of warrant liability Income taxes payable Deferred income tax liability, current 38,290 33,920 43,725 50,018 20,954 41,516 17,241 39,028 9,633 2,445 993 1,742 1,241 2,137 230 296 150 Current portion of capital lease obligations 1,709 1,703 1,181 143,350 560 1,907 Total current liabilities 161,989 161,609 214,151 64,880 LONG-TERM DEBT, net of unamortized discount of $5,779 and $27,929 at December 31, 2013 and 2012, respectively Subordinated notes payble to related party Capital lease obligations, net of current portion Deferred tax liability Deferred rent, net of current portion 213,468 5,453 110,012 2,844 97,142 444 4,611 65,997 1,726 542 4,355 1,020 536 262 96 260 18,225 20,706 22,231 12,046 24,924 22,052 Other long-term liabilities Total long Tem Liabilites 11,485 10,695 7,994 11,934 144,519 133,241 276,591 38,775 105,358 249,167 411,156 TOTAL LIABILITIES 306,128 252,926 $170,238 STOCKHOLDERS' (DEFICIT) EQUITY shares outstanding at December 31, 2012 11 11 11 8. 7 Additional paid-in capital Accumulated other comprehensive loss Accumulated deficit 185,472 (4,306) 177,081 (2,725) 166,486 (3,356) 153,881 (3,168) (73,540) 150,449 (2,083) 19,012 Less: Treasury stock, 304 shares at cost TOTAL STOCKHOLDERS' (DEFICIT) EQUITY TOTAL LIABILITIES AND STOCKHOLDERS' (DEFICIT) EQUITY (256,424) (150,126) (112,854) (2,157) (77,404) (2,157) 48,130 333,752 $328,212 $324,721 $327,950 $ 327,579 (2,157) 22,084 (2,157) (10,044) 157,341 75,024

Step by Step Solution

★★★★★

3.50 Rating (190 Votes )

There are 3 Steps involved in it

Step: 1

Note All th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started