Accounting Chapter 13 Challenge Problem

How do you solve this problem?

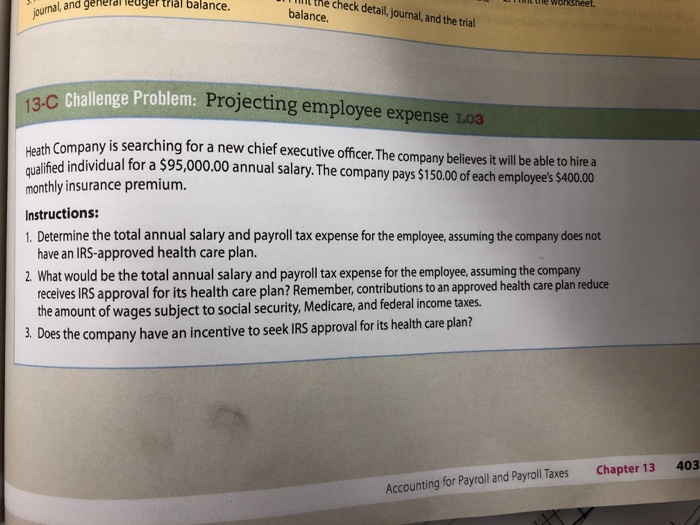

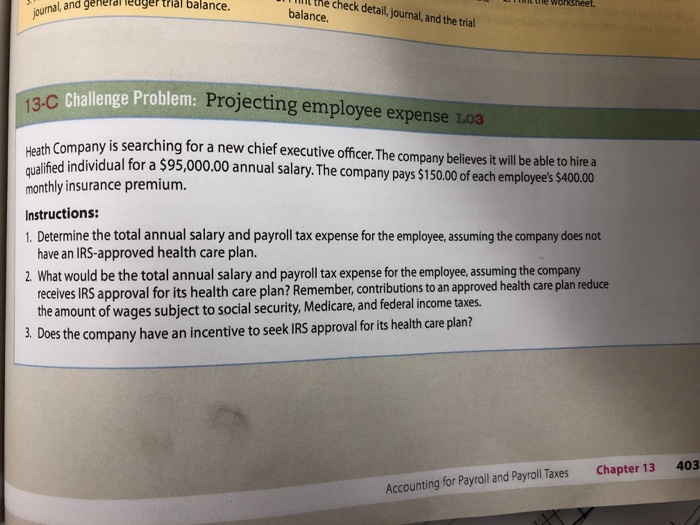

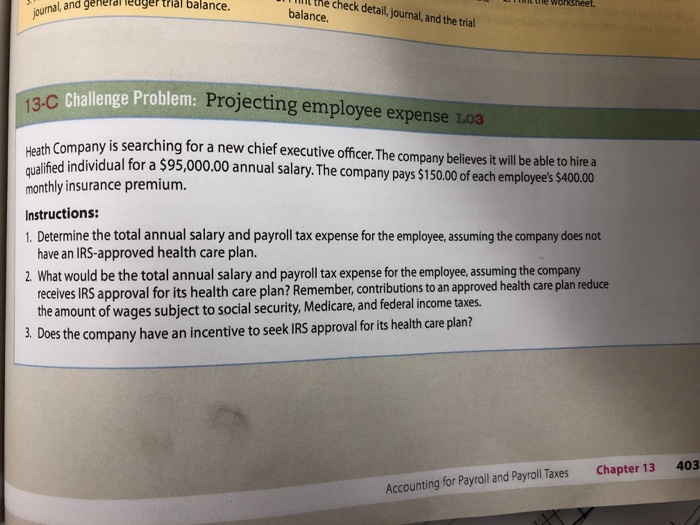

aandHefdl ieuge tl balan ll the check detail, journal, and the trial balance. Challenge Problem: Projecting employee expense Lo3 13-C ath Company is searching for a new chief executive officer. he company believes itwill be able to hirea ified individual for a $95,000.00 annual salary. The company pays $150.00 of each employee's $400.00 monthly insurance premium. Instructions: 1. Determine the total annual salary and payroll tax expense for the employee, assuming the company does not have an IRS-approved health care plan. 2. What would be the total annual salary and payroll tax expense for the employee, assuming the company approved health care plan reduce receives IRS approval for its health care plan? Rememb the amount of wages subject to social security, Medicare, and federal income taxes. r, contributions to an 3. Does the company have an incentive to seek IRS approval for its health care plan? 403 Chapter 13 Accounting for Payroll and Payroll Taxes 13-C CHALLENGE PROBLEM (L03), p: 403 Projecting employee expense 1. Salary Insurance Taxable Amount Tax Rate Tax Total expense for employee 2. Salary Insurance Tax Taxable AmountTax Rate Total expense for employee 3. aandHefdl ieuge tl balan ll the check detail, journal, and the trial balance. Challenge Problem: Projecting employee expense Lo3 13-C ath Company is searching for a new chief executive officer. he company believes itwill be able to hirea ified individual for a $95,000.00 annual salary. The company pays $150.00 of each employee's $400.00 monthly insurance premium. Instructions: 1. Determine the total annual salary and payroll tax expense for the employee, assuming the company does not have an IRS-approved health care plan. 2. What would be the total annual salary and payroll tax expense for the employee, assuming the company approved health care plan reduce receives IRS approval for its health care plan? Rememb the amount of wages subject to social security, Medicare, and federal income taxes. r, contributions to an 3. Does the company have an incentive to seek IRS approval for its health care plan? 403 Chapter 13 Accounting for Payroll and Payroll Taxes 13-C CHALLENGE PROBLEM (L03), p: 403 Projecting employee expense 1. Salary Insurance Taxable Amount Tax Rate Tax Total expense for employee 2. Salary Insurance Tax Taxable AmountTax Rate Total expense for employee 3