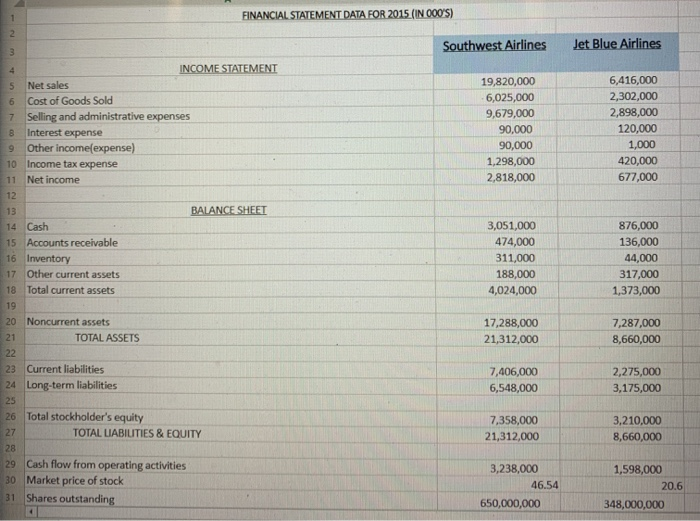

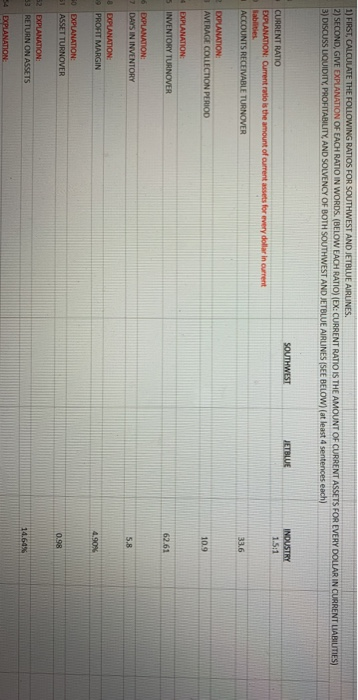

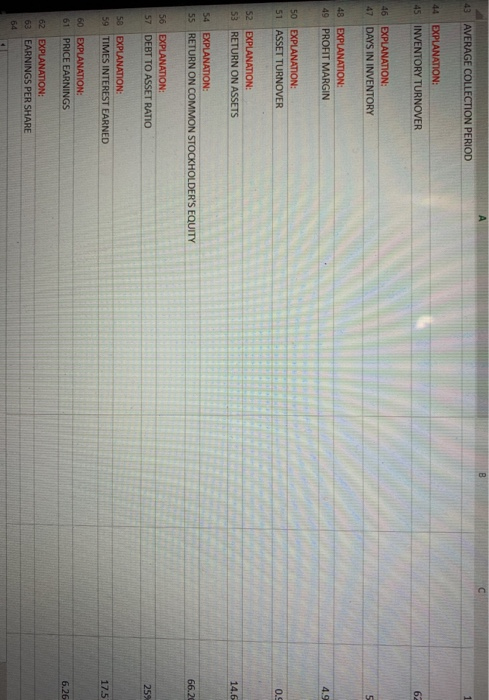

FINANCIAL STATEMENT DATA FOR 2015 (IN 000'S) Southwest Airlines Jet Blue Airlines INCOME STATEMENT Net sales Cost of Goods Sold Selling and administrative expenses Interest expense Other income expense) 10 Income tax expense 11 Net income 19,820,000 6,025,000 9,679,000 90,000 90,000 1,298,000 2,818,000 6,416,000 2,302,000 2,898,000 120,000 1,000 420,000 677,000 BALANCE SHEET 14 Cash 15 Accounts receivable 16 Inventory 17 Other current assets 18 Total current assets 3,051,000 474,000 311,000 188,000 4,024,000 876,000 136,000 44,000 317,000 1,373,000 20 Noncurrent assets TOTAL ASSETS 17,288,000 21,312,000 7,287,000 8,660,000 Current liabilities Long-term liabilities 7,406,000 6,548,000 2,275,000 3,175,000 Total stockholder's equity TOTAL LIABILTIES & EQUITY 7,358,000 21,312,000 3,210,000 8,660,000 29 Cash flow from operating activities 30 Market price of stock 31 Shares outstanding 3,238,000 46.54 650,000,000 1,598,000 20.6 348,000,000 1) FIRST, CALCULATE THE FOLLOWING RATIOS FOR SOUTHWEST AND JETBLUE AIRLINES. 2) SECOND, GIVE EXPLANATION OF EACH RATIO IN WORDS (BELOW EACH RATIO) (EX: CURRENT RATIO IS THE AMOUNT OF CURRENT ASSETS FOR EVERY DOLLAR IN CURRENT LIABILITIES) 3) DISCUSS LIQUIDITY, PROFITABILITY, AND SOLVENCY OF BOTH SOUTHWEST AND JETBLUE AIRLINES (SEE BELOW) (at least 4 sentences each) SOUTHWEST JETBLUE INDUSTRY 1.5:1 CURRENT RATIO EXPLANATION: Ourrent ratio is the amount of current assets for every dollar in current Babilities ACCOUNTS RECEIVABLE TURNOVER 33.6 DXPLANATION AVERAGE COLLECTION PERIOD 4 EXPLANATION 5 INVENTORY TURNOVER 6 EXPLANATION 7 DAYS IN INVENTORY & EXPLANATION PROFIT MARGIN GO EXPLANATION 51 ASSET TURNOVER 52 EXPLANATION 53 RETURN ON ASSETS 14.64 54 ECPLANATION 43 AVERAGE COLLECTION PERIOD 44 EXPLANATION: 45 INVENTORY TURNOVER 46 EXPLANATION: 47 DAYS IN INVENTORY 48 EXPLANATION: 49 PROFIT MARGIN 50 EXPLANATION: 51 ASSET TURNOVER 52 EXPLANATION: 53 RETURN ON ASSETS 14.6 54 EXPLANATION: 55 RETURN ON COMMON STOCKHOLDER'S EQUITY 66.20 56 EXPLANATION: 57 DEBT TO ASSET RATIO 58 59 EXPLANATION: TIMES INTEREST EARNED 17.5 60 EXPLANATION: 61 PRICE EARNINGS 6.26 EXPLANATION: 63 EARNINGS PER SHARE