Question

both tax purposes and accounting purposes, the company uses a June 30 year end. This Marcon Ltd. is Canadian company that is publicly traded

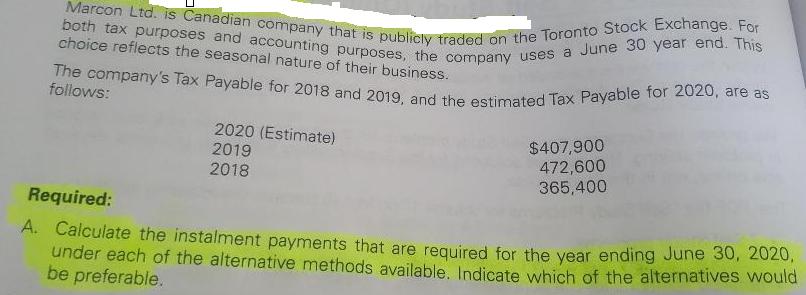

both tax purposes and accounting purposes, the company uses a June 30 year end. This Marcon Ltd. is Canadian company that is publicly traded on the Toronto Stock Exchange. For The company's Tax Payable for 2018 and 2019, and the estimated Tax Payable for 2020, are as choice reflects the seasonal nature of their business. follows: 2020 (Estimate) 2019 $407,900 472,600 365,400 2018 Required: A. Calculate the instalment payments that are required for the vear ending June 30, 2020, under each of the alternative methods available, Indicate which of the alternatives would be preferable.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Your specific tax situation will determine which payment options are available to you Payment o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Supply Chain Network Design Applying Optimization and Analytics to the Global Supply Chain

Authors: Michael Watson, Sara Lewis, Peter Cacioppi, Jay Jayaraman

1st edition

133017370, 978-0133017373

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App