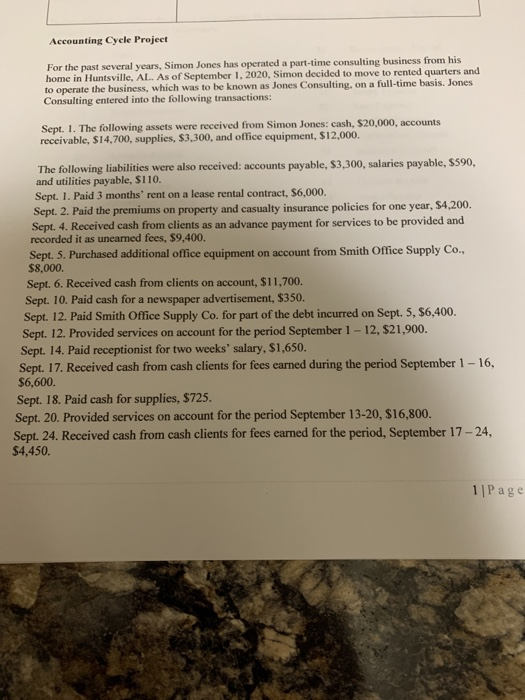

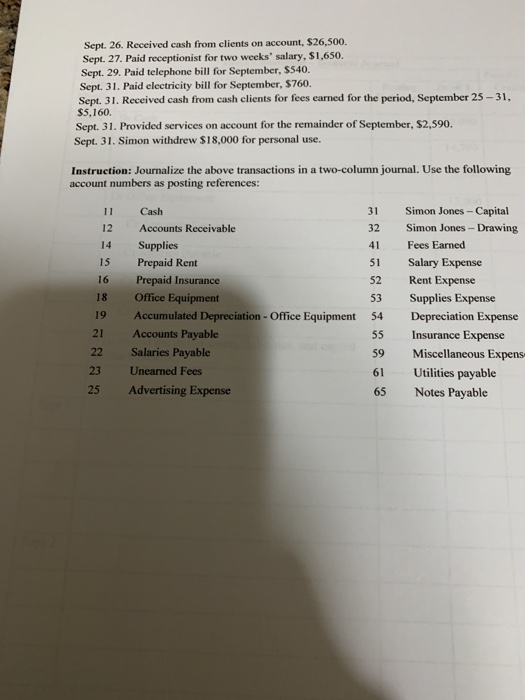

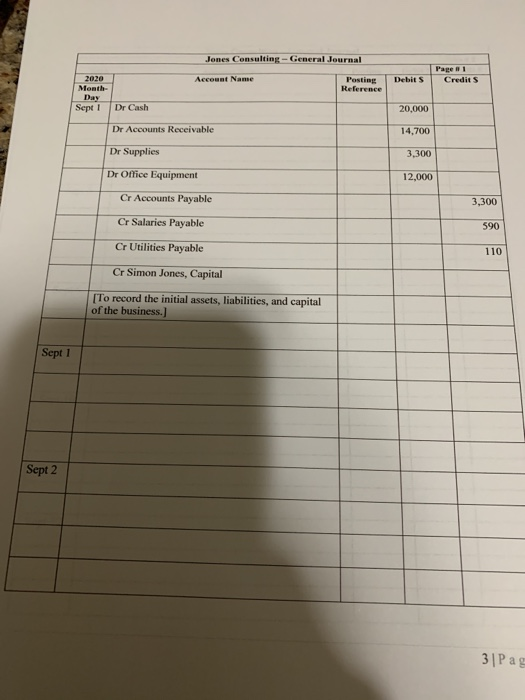

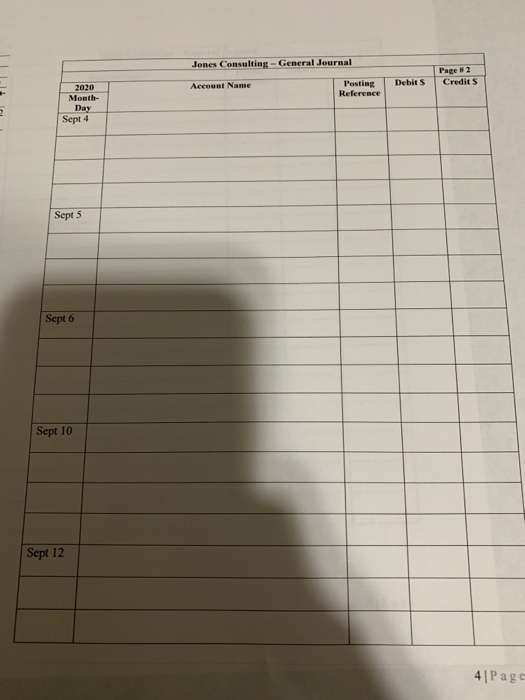

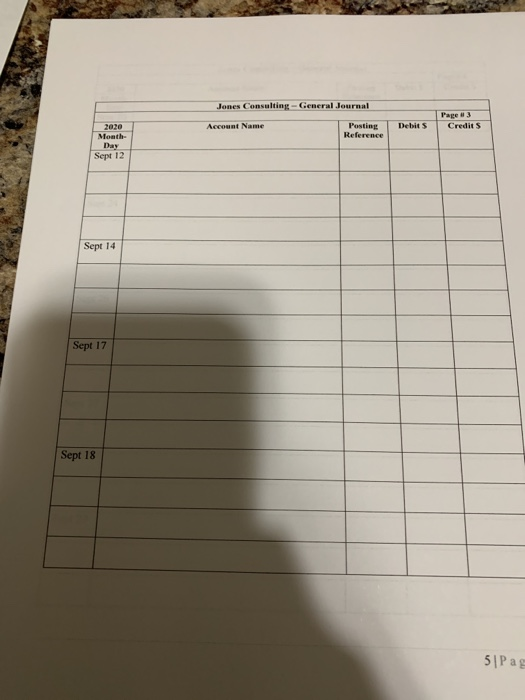

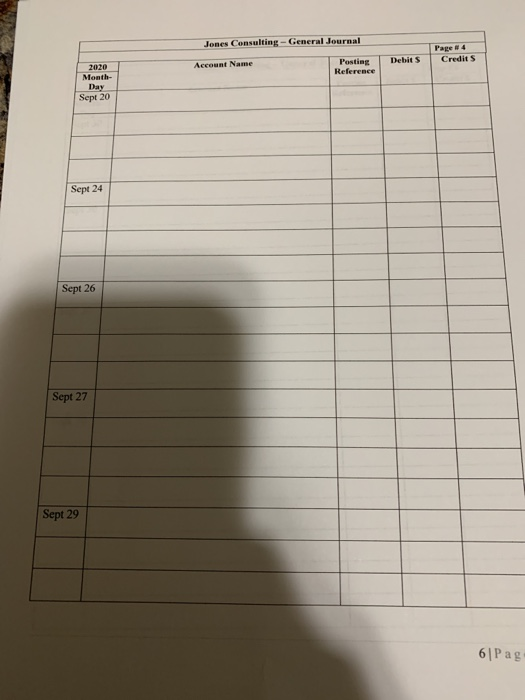

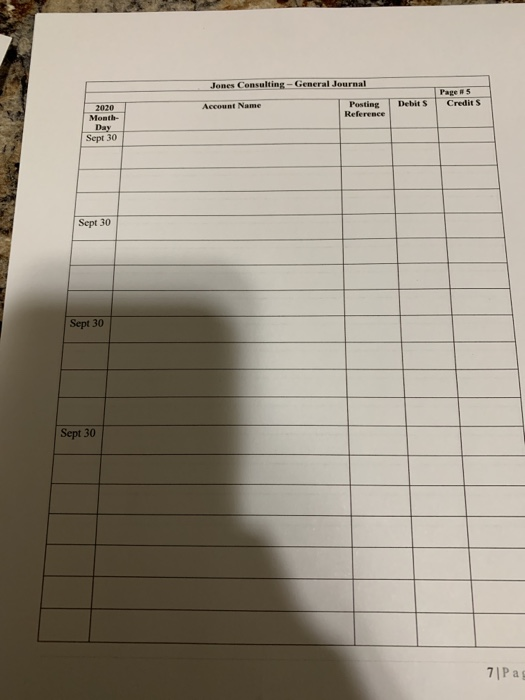

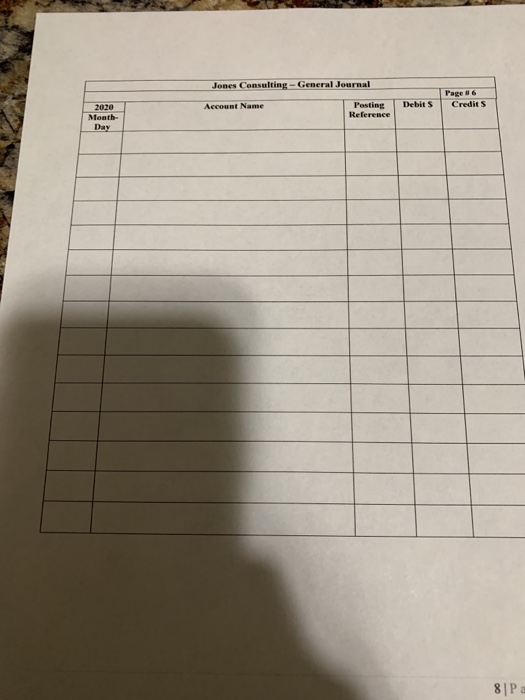

Accounting Cycle Project For the past several years, Simon Jones has operated a part-time consulting business from his home in Huntsville, AL. As of September 1, 2020, Simon decided to move to rented quarters and to operate the business, which was to be known as Jones Consulting, on a full-time basis. Jones Consulting entered into the following transactions: Sept. 1. The following assets were received from Simon Jones: cash, $20,000, accounts receivable, $14,700, supplies, $3,300, and office equipment, $12,000. The following liabilities were also received: accounts payable, $3,300, salaries payable, $590, and utilities payable, $110. Sept. 1. Paid 3 months' rent on a lease rental contract, $6,000. Sept. 2. Paid the premiums on property and casualty insurance policies for one year, $4,200. Sept. 4. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $9.400. Sept. 5. Purchased additional office equipment on account from Smith Office Supply Co., $8.000. Sept. 6. Received cash from clients on account, $11,700. Sept. 10. Paid cash for a newspaper advertisement, $350. Sept. 12. Paid Smith Office Supply Co. for part of the debt incurred on Sept. 5, $6,400. Sept. 12. Provided services on account for the period September 1-12, $21,900. Sept. 14. Paid receptionist for two weeks' salary, $1,650. Sept. 17. Received cash from cash clients for fees earned during the period September 1 -16, $6,600 Sept. 18. Paid cash for supplies, $725. Sept. 20. Provided services on account for the period September 13-20, $16,800. Sept. 24. Received cash from cash clients for fees earned for the period, September 17 - 24, $4,450. 1 Page Sept. 26. Received cash from clients on account, $26,500. Sept. 27. Paid receptionist for two weeks' salary, $1,650 Sept. 29. Paid telephone bill for September, $540. Sept. 31. Paid electricity bill for September, $760. Sept. 31. Received cash from cash clients for fees carned for the period, September 25 - 31, $5,160 Sept. 31. Provided services on account for the remainder of September, $2,590. Sept. 31. Simon withdrew $18,000 for personal use. 14 41 Instruction: Journalize the above transactions in a two-column journal. Use the following account numbers as posting references: 11 Cash 31 Simon Jones - Capital 12 Accounts Receivable 32 Simon Jones - Drawing Supplies Fees Earned 15 Prepaid Rent 51 Salary Expense 16 Prepaid Insurance 52 Rent Expense 18 Office Equipment Supplies Expense 19 Accumulated Depreciation - Office Equipment 54 Depreciation Expense 21 Accounts Payable 55 Insurance Expense 22 Salaries Payable 59 Miscellaneous Expens 23 Unearned Fees 61 Utilities payable 25 Advertising Expense 65 Notes Payable 53 Jones Consulting - General Journal Account Name Page 1 Credits Debits Posting Reference 2020 Month- Day Sept 1 Dr Cash 20,000 Dr Accounts Receivable 14,700 Dr Supplies 3,300 Dr Office Equipment 12,000 Cr Accounts Payable 3,300 Cr Salaries Payable 590 Cr Utilities Payable 110 Cr Simon Jones, Capital [To record the initial assets, liabilities, and capital of the business.) Sept 1 Sept 2 3| Pag Jones Consulting - General Journal Page #2 Account Name Debits Credits Posting Reference 2020 Month- Day Sept 4 Septs Sept 6 Sept 10 Sept 12 4 Page Jones Consulting - General Journal Page 3 Credits Account Name Debits Posting Reference 2010 Month- Day Sept 12 Sept 14 Sept 17 Sept 18 SlPag Jones Consulting - General Journal Page 4 Credits Account Name Debits Posting Reference 2020 Month- Day Sepe 20 Sept 24 Sept 26 Sept 27 Sept 29 6 Pag Jones Consulting - General Journal Page 5 Credits Account Name Debits Posting Reference 2020 Month- Day Sept 30 Sept 30 Sept 30 Sept 30 71 Pag Jones Consulting - General Journal Account Name Debits Page 86 Credits 2020 Month- Day Posting Reference 8 P a