accounting cycle projecting

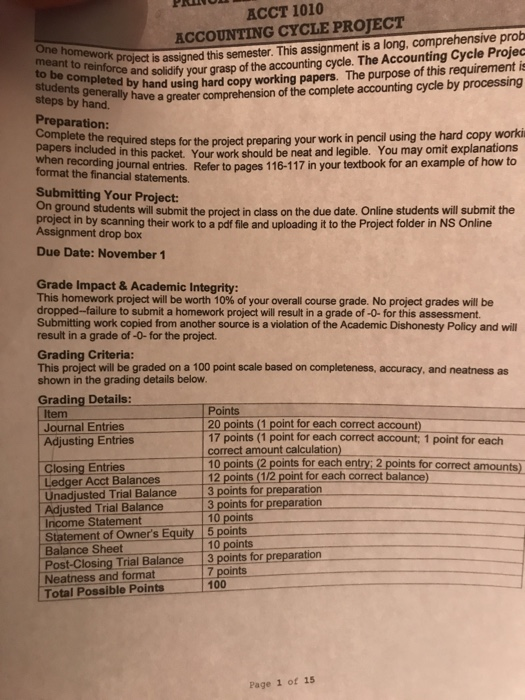

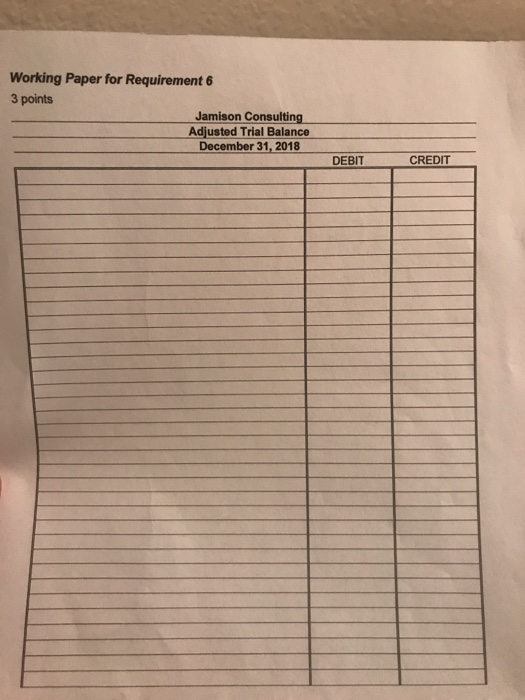

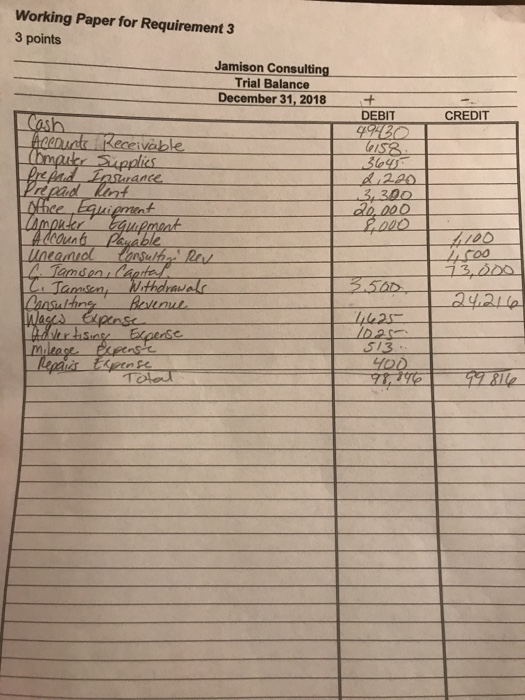

PAUL One homework project is a meant to reinforce and solidity to be completed by hand using students generally have a greate steps by hand. Preparation: ACCT 1010 ACCOUNTING CYCLE PROJECT project is assigned this semester. This assignment is a long, comprehensive prob rce and solidify your grasp of the accounting cycle. The Accounting Cycle Projec d by hand using hard copy working papers. The purpose of this requirement is ally have a greater comprehension of the complete accounting cycle by processing he required steps for the project preparing your work in pencil using the hard copy worki cluded in this packet Your work should be neat and legible. You may omit explanations cording journal entries. Refer to pages 116-117 in your textbook for an example of how to format the financial statements. Submitting Your Project: on ground students will submit the project in class on the due date. Online students will submit the project in by scanning their work to a pdf file and uploading it to the Project folder in NS Online Assignment drop box Due Date: November 1 Grade Impact & Academic Integrity: This homework project will be worth 10% of your overall course grade. No project grades will be dropped-failure to submit a homework project will result in a grade of -- for this assessment. Submitting work copied from another source is a violation of the Academic Dishonesty Policy and will result in a grade of -- for the project. Grading Criteria: This project will be graded on a 100 point scale based on completeness, accuracy, and neatness as shown in the grading details below. Grading Details: Item Points Journal Entries 20 points (1 point for each correct account) Adjusting Entries 17 points (1 point for each correct account: 1 point for each correct amount calculation) Closing Entries 10 points (2 points for each entry: 2 points for correct amounts) Ledger Acct Balances 12 points (1/2 point for each correct balance) Unadjusted Trial Balance 3 points for preparation Adjusted Trial Balance 3 points for preparation Income Statement 10 points Statement of Owner's Equity 5 points Balance Sheet 10 points Post-Closing Trial Balance 3 points for preparation Neatness and format | 7 points 100 Total Possible Points Page 1 of 15 Working Paper for Requirement 3 3 points Jamison Consulting Trial Balance December 31, 2018 CREDIT DEBIT 49460 6158 &226 3,390 20,000 2.000 Acedurt Receivable Computer Supplies Prepaid Insurance Prepaid Rent office Equipment Omputer Equipment Account Pauable Uneamed Consulting Rev G. Tamson, Capital T. Jamison, Withdrawals Consulting Revenue Wages Expense advertising Expense mileage expense Repairs Expense Tota 200 od 3.500 13,000 24,216 10.25 513 YOD 99816 PAUL One homework project is a meant to reinforce and solidity to be completed by hand using students generally have a greate steps by hand. Preparation: ACCT 1010 ACCOUNTING CYCLE PROJECT project is assigned this semester. This assignment is a long, comprehensive prob rce and solidify your grasp of the accounting cycle. The Accounting Cycle Projec d by hand using hard copy working papers. The purpose of this requirement is ally have a greater comprehension of the complete accounting cycle by processing he required steps for the project preparing your work in pencil using the hard copy worki cluded in this packet Your work should be neat and legible. You may omit explanations cording journal entries. Refer to pages 116-117 in your textbook for an example of how to format the financial statements. Submitting Your Project: on ground students will submit the project in class on the due date. Online students will submit the project in by scanning their work to a pdf file and uploading it to the Project folder in NS Online Assignment drop box Due Date: November 1 Grade Impact & Academic Integrity: This homework project will be worth 10% of your overall course grade. No project grades will be dropped-failure to submit a homework project will result in a grade of -- for this assessment. Submitting work copied from another source is a violation of the Academic Dishonesty Policy and will result in a grade of -- for the project. Grading Criteria: This project will be graded on a 100 point scale based on completeness, accuracy, and neatness as shown in the grading details below. Grading Details: Item Points Journal Entries 20 points (1 point for each correct account) Adjusting Entries 17 points (1 point for each correct account: 1 point for each correct amount calculation) Closing Entries 10 points (2 points for each entry: 2 points for correct amounts) Ledger Acct Balances 12 points (1/2 point for each correct balance) Unadjusted Trial Balance 3 points for preparation Adjusted Trial Balance 3 points for preparation Income Statement 10 points Statement of Owner's Equity 5 points Balance Sheet 10 points Post-Closing Trial Balance 3 points for preparation Neatness and format | 7 points 100 Total Possible Points Page 1 of 15 Working Paper for Requirement 3 3 points Jamison Consulting Trial Balance December 31, 2018 CREDIT DEBIT 49460 6158 &226 3,390 20,000 2.000 Acedurt Receivable Computer Supplies Prepaid Insurance Prepaid Rent office Equipment Omputer Equipment Account Pauable Uneamed Consulting Rev G. Tamson, Capital T. Jamison, Withdrawals Consulting Revenue Wages Expense advertising Expense mileage expense Repairs Expense Tota 200 od 3.500 13,000 24,216 10.25 513 YOD 99816