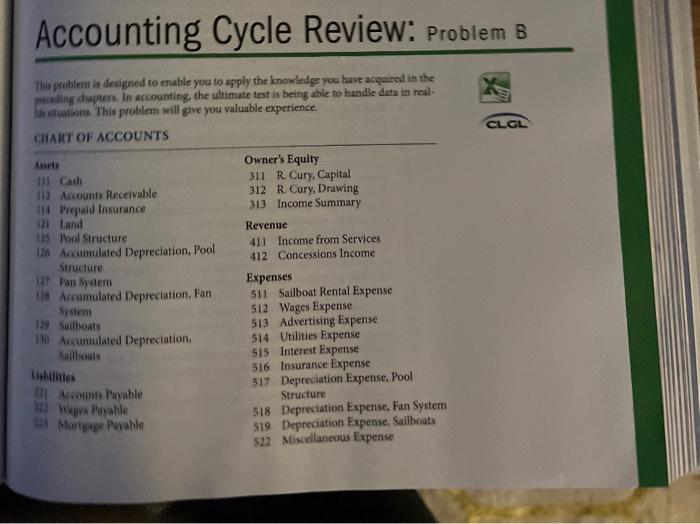

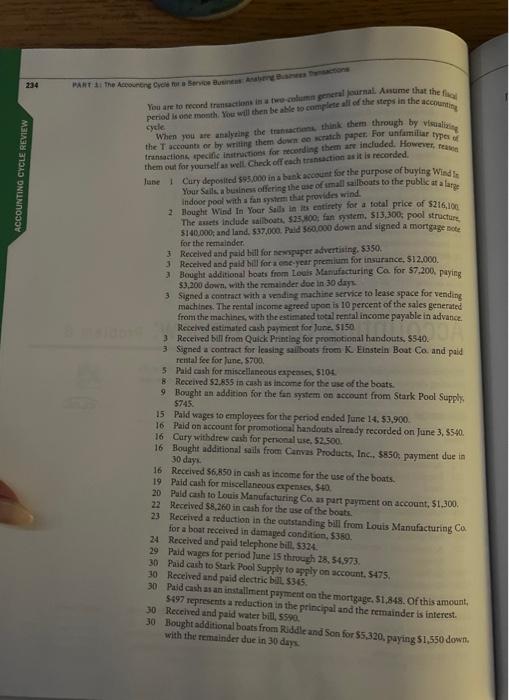

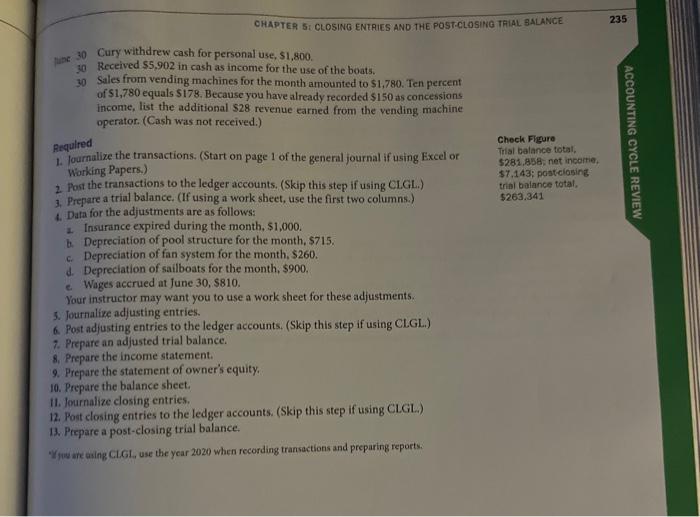

Accounting Cycle Review: Problem B cycle. the Taccountr or by writing them down co wexteh puper. For unfamtifiar types of them out for younelfat well. Cinck off cach transaction as if is recorded. Your Sulk a buthes offering the obe of amall ralboats to the public at a farg 2 Hought What In Your Suld in its entircty for a toul price of $216,100 5140,000 , and land, 537,000 . Puid $60,000 down and signed a mortgage bole. for the remainder: 3. Recelved and pald bit for nempuper afvertining, $350. 3 Bought additional boats from Looks Manufacturitig Ca for $7,200 paying \$3,200 down, whth the remainder doe in 30 dayk 3 Sagned a contrict with a vestiog machite service to lease space for vending machtnes, The fentat income agreed upon in 10 percent of the sales generated from the machines, with the esimused total ferial income payable in advance. Recelvod estimated cah payment for lurie, 5150 3 Received bill from Quick Printing for promotional handouts. 5540 . 3 Signed a contract for lessing salfoegts froen K Einstein Boat Co and paid rental fee for lune, 5700 . 5. Pali eath for miscellaneotserpeaies, s10t 8 Received $2, R55 ia cash as income for the use of the boats. 9. Bonght an addition for the fan system on account from Stark Pool Supply. $745. 15. Pald wages to employes for the period ended Jane 14,$3,900 16 Paid on account for promotiocal handouts already tecorded on June 3,3540 . 16 Bought additional sails from Canve Products, Inc, $850, payment due in 30 dayk 16 . Received 56.850 in cash as incone for the use of the boath. 19 Paid cash for miscellancous expenues, St) 22 Received $ s, 260 in cuih for the use of the boats. 23 Received a reduction in the outstanding bill from Louis Manufacturing CO for a bost iecived in damaged condition, 5350 . 24 Received and paidselephone bill, 5324 . 29 Paid wages for period lune is through 28, 54.903. 30. Paid cash to Stark Pool Supply to apply on accotant, 5475 , 30 Recelirod ind paid electric bin, s3is, 30 Pajd cashas an inataliment pryment on the mortgage, $1,848. Of this amount, $497 represcrits a reduction in the principal and the remainder is interest. 30 - Receined and paid water bill, 5590 . 30 Bought additional boats from Ruddl s and Son for 55,320, paying 51,550 down, with the renainder due in 30dax. CHAPTEA 5: CLOSING ENTRIES AND THE POST-CLOSIIV THIAL SALANCE. 235 30 Cury withdrew cash for personal use, $1,800. 30 Received $5,902 in cash as income for the use of the boats. 30. Sales from vending machines for the month amounted to \$1,780. Ten percent of $1,780 equals $178. Because you have already recorded $150 as concessions income, list the additional $28 revenue earned from the vending machine operator. (Cash was not received.) Requled 1. fournalize the transactions. (Start on page 1 of the general journal if using Excel or Working Papers.) 2. Post the transactions to the ledger accounts. (Skip this step if using CLGL.) 3. Prepare a trial balance. (If using a work sheet, use the first two columns.) Check Figure Trial balance totai. sogt.958 net insortie. \$7, 143; postciosing tribi bolance total. 4. Data for the adjustments are-as follows: $263.341 2. Insurance expired during the month, $1,000. b. Depreciation of pool structure for the month, $715. c. Depreciation of fan system for the month, $260. d. Depreciation of saitboats for the month, $900. c. Wages accrued at june 30,$810. Your instructor may want you to use a work sheet for these adjustments. 5. Journalize adjusting entries. 6. Post adjusting entries to the ledger accounts. (Skip this step if using CLGL) 7. Prepare an adjusted trial balance. 8. Prepare the income statement. 9. Prepare the statement of owner's equity. 10. Prepare the balance sheet. 11. Journalize closing entries. 12. Poit closing entries to the ledger accounts. (Skip this step if using CLGL.) 13. Prepare a post-closing trial balance. Whue wre wing CLLGL, use the year 2020 when recording transactions and preparing reports