Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting for Appropriations Revenue Pineda State College, a public college, receives notification prior to the start of the fiscal year that it will receive

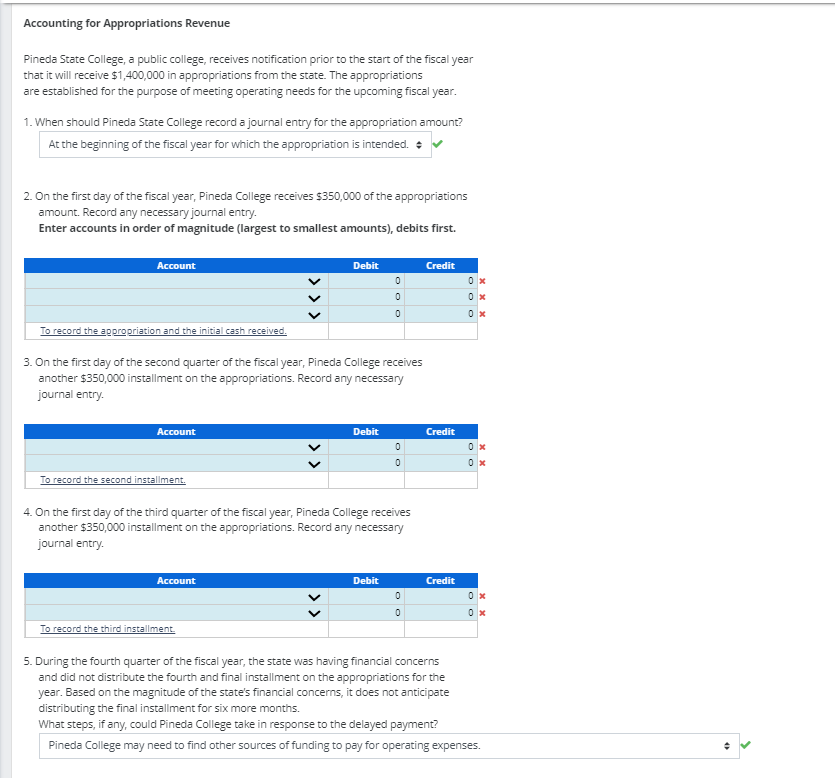

Accounting for Appropriations Revenue Pineda State College, a public college, receives notification prior to the start of the fiscal year that it will receive $1,400,000 in appropriations from the state. The appropriations are established for the purpose of meeting operating needs for the upcoming fiscal year. 1. When should Pineda State College record a journal entry for the appropriation amount? At the beginning of the fiscal year for which the appropriation is intended. + 2. On the first day of the fiscal year, Pineda College receives $350,000 of the appropriations amount. Record any necessary journal entry. Enter accounts in order of magnitude (largest to smallest amounts), debits first. Account > > > Debit 000 Credit 0x 0x 0x To record the appropriation and the initial cash received. 3. On the first day of the second quarter of the fiscal year, Pineda College receives another $350,000 installment on the appropriations. Record any necessary journal entry. Account Debit Credit 0 0x 0 0x To record the second installment. 4. On the first day of the third quarter of the fiscal year, Pineda College receives another $350,000 installment on the appropriations. Record any necessary journal entry. Account Debit Credit 0 0 0x 0x To record the third installment 5. During the fourth quarter of the fiscal year, the state was having financial concerns and did not distribute the fourth and final installment on the appropriations for the year. Based on the magnitude of the state's financial concerns, it does not anticipate distributing the final installment for six more months. What steps, if any, could Pineda College take in response to the delayed payment? Pineda College may need to find other sources of funding to pay for operating expenses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started