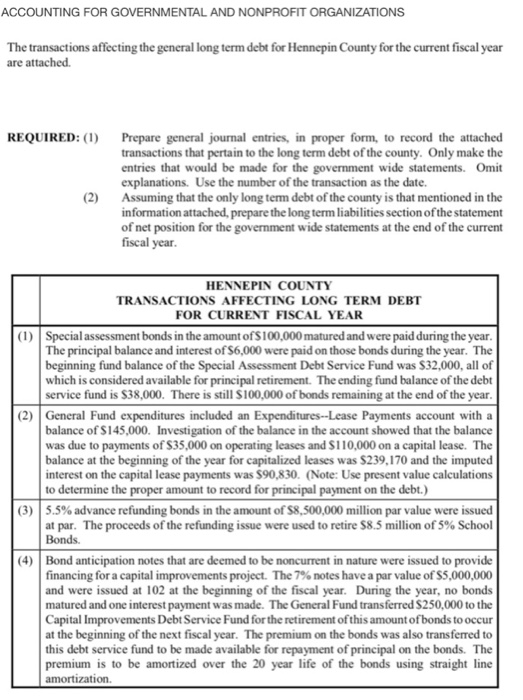

ACCOUNTING FOR GOVERNMENTAL AND NONPROFIT ORGANIZATIONS The transactions affecting the general long term debt for Hennepin County for the current fiscal year are attached. REQUIRED: () Prepare general journal entries, in proper form, to record the attached transactions that pertain to the long term debt of the county. Only make the entries that would be made for the government wide statements. Omit explanations. Use the number of the transaction as the date. Assuming that the only long term debt of the county is that mentioned in the information attached, prepare the long term liabilities section of the statement of net position for the government wide statements at the end of the current (2) HENNEPIN COUNTY TRANSACTIONS AFFECTING LONG TERM DEBT FOR CURRENT FISCAL YEAR (1) Special assessment bonds in the amount of$100,000 matured and were paid during the year The principal balance and interest of S6,000 were paid on those bonds during the year. The beginning fund balance of the Special Assessment Debt Service Fund was $32,000, all of which is considered available for principal retirement. The ending fund balance of the debt service fund is $38,000. There is still S100,000 of bonds remaining at the end of the year (2) General Fund expenditures included an Expenditures--Lease Payments account with a balance of $145,000. Investigation of the balance in the account showed that the balance was due to payments of $35,000 on operating leases and S110,000 on a capital lease. The balance at the beginning of the year for capitalized leases was $239,170 and the imputed interest on the capital lease payments was $90,830. (Note: Use present value calculations to determine the proper amount to record for principal payment on the debt.) 5.5% advance refunding bonds in the amount of$8,500,000 million par value were issued at par. The proceeds of the refunding issue were used to retire $8.5 million of 5% School (3) (4) Bond anticipation notes that are deemed to be noncurrent in nature were issued to provide financing for a capital improvements project. The 7% notes have a par value of$5,000,000 and were issued at 102 at the beginning of the fiscal year. During the year, no bonds matured and one interest payment was made. The General Fund transferred $250,000 to the Capital Improvements Debt Service Fund for the retirement of this amount of bonds to occur at the beginning of the next fiscal year. The premium on the bonds was also transferred to this debt service fund to be made available for repayment of principal on the bonds. The premium is to be amortized over the 20 year life of the bonds using straight line amortization