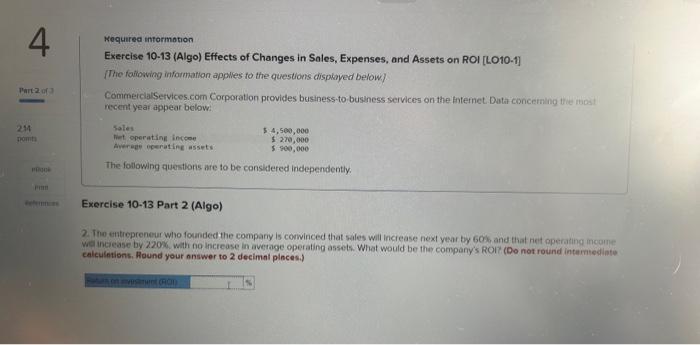

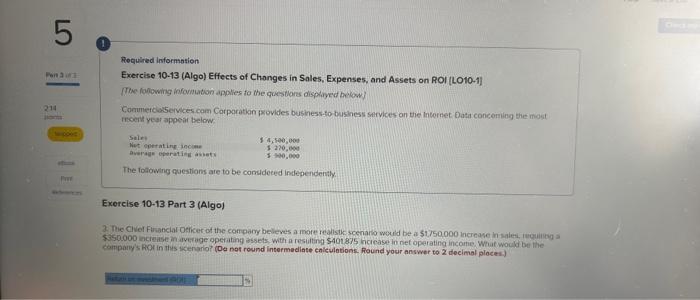

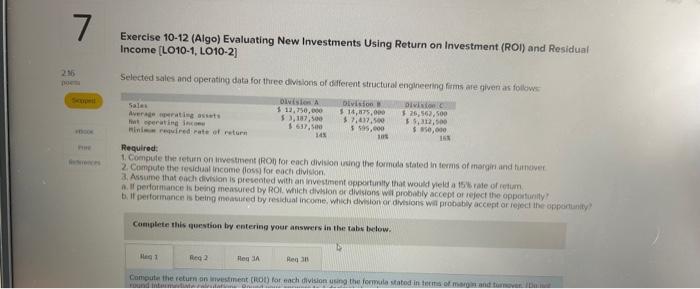

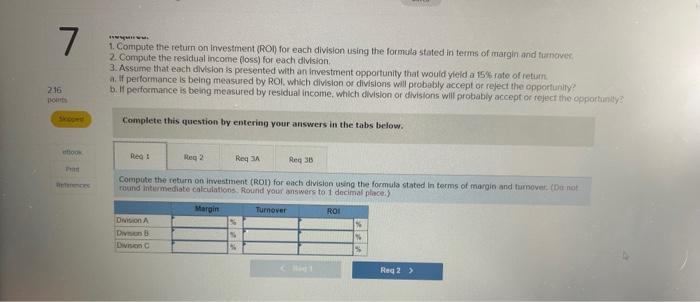

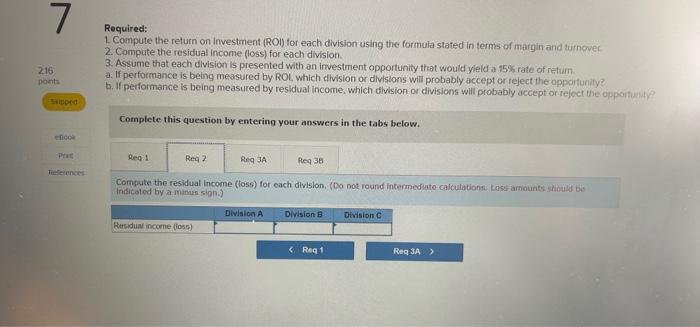

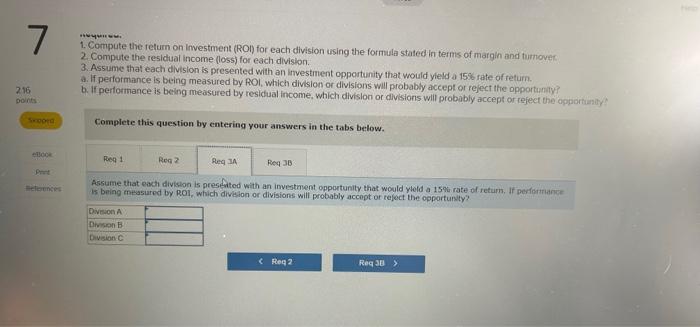

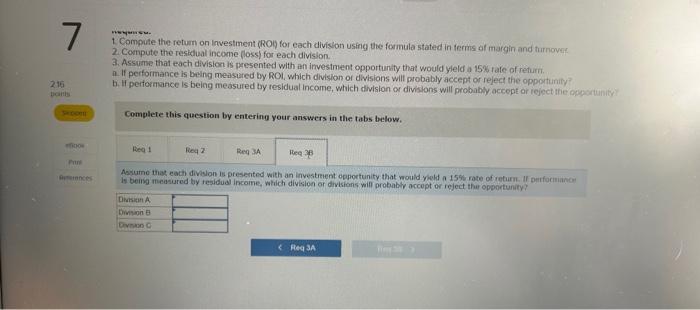

1. Compute the return on investment (RO) for each division using the formula stated in terms of margin and tumover 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 15% rate of retum. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or refect the opportun Complete this question by entering your answers in the tabs below. Assume that each division is presefited with an investment opportunity that would yleld a 15% rate of returm, If performance is being eneasured by ROI, which division or divisions will probably accept of refect the opportunity? 1 Compute the retum on Investment (RO) for each divislon using the formula stated in ferms of margin and turnovef 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an irvestment opportunity that would yleld a 15% fafe of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportininy Complete this question by entering your answers in the tabs below. is being measured by residual incoine, which divisien or divisions will probably accept or reject thar opportunity? Exercise 10-12 (Algo) Evaluating New Investments Using Return on Investment (ROI) and Residua! Income [LO10-1, LO10-2] Selected sales and operating data for three divalons of diferent structural engineening firms are given as follows Required: 2. Gompate the residual income doss for each division 3. Assume that each division is preseoted whth an investment opportamily that would yield a 155 rate of retim. Comiptete this nuestion by entering your answers in the tabs below: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and furnaver. 2. Compute the residual income floss) for each division. 3. Assume that each diviston is presented with an investment opportunity that would yield a 15% rate of retuin. a. If pertormance is being messured by ROI, Which division or divisions will probably accept or reject the opporturity? b. If perfornance is being measured by residual income, which division or divisions will probably arcepf or teject the opportin ty. Complete this question by entering your answers in the tabs below. Compute the return on imvestment (ROI) for each division using the formula stated in terms of margin and turnover, (Du not Kequirea intormotion Exereise 10-13 (Algo) Effects of Changes in Sales, Expenses, and Assets on ROI [LO10-1] (The foitowing information apples fo the questions dispiayed below]. Commercialservices.com Corporation provides business-to bushess services on the fortemet. Data concerming the mos recent year appear below: The following questions are to be considered independently. Exercise 10-13 Part 2 (Algo) 2. The entrepreneur who founded the compary is corvinced that sales will increase next year by 606 and that net operating incoune we increase by 220%, with no increase in average operating assets. What would be the company's ROr? (Do not round intemedinte calculetions, Hound your onswer to 2 decimal places.) Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of maigin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yleld a 15% rate of retum. a. If performance is being measured by ROL, which clivision or dlvisions will probably accept or reject the opporfunity? b. If performance is being measured by residuat income, which division or divisions witl probably accept or rejoct the oppoithyin Complete this question by entering your answers in the tabs below. Compute the residual income (loss) for each division, (Do not round incermediate calculations. Loss amounts sticuild bes indicoted by a minis sign.) Required informotion Exercise 10-13 (Algo) Effects of Changes in Sales, Expenses, and Assets on ROI (LO10-1] Coqumerdas ervices com Corporatian provides business to bushess stervices on the Intornet Data conceming the most rocent yeur appear below. The foliowing questions are to be comudered independently. Exercise 10-13 Part 3 (Algo) Compary's ROY in this scenario? (Da not round intermediate calculations, found your answer to 2 decimal plocas.)