Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting for Notes Receivable Yarnell Electronics sells computer systems to small businesses. Yarnell engaged in the following activities involving notes receivable: a. On September

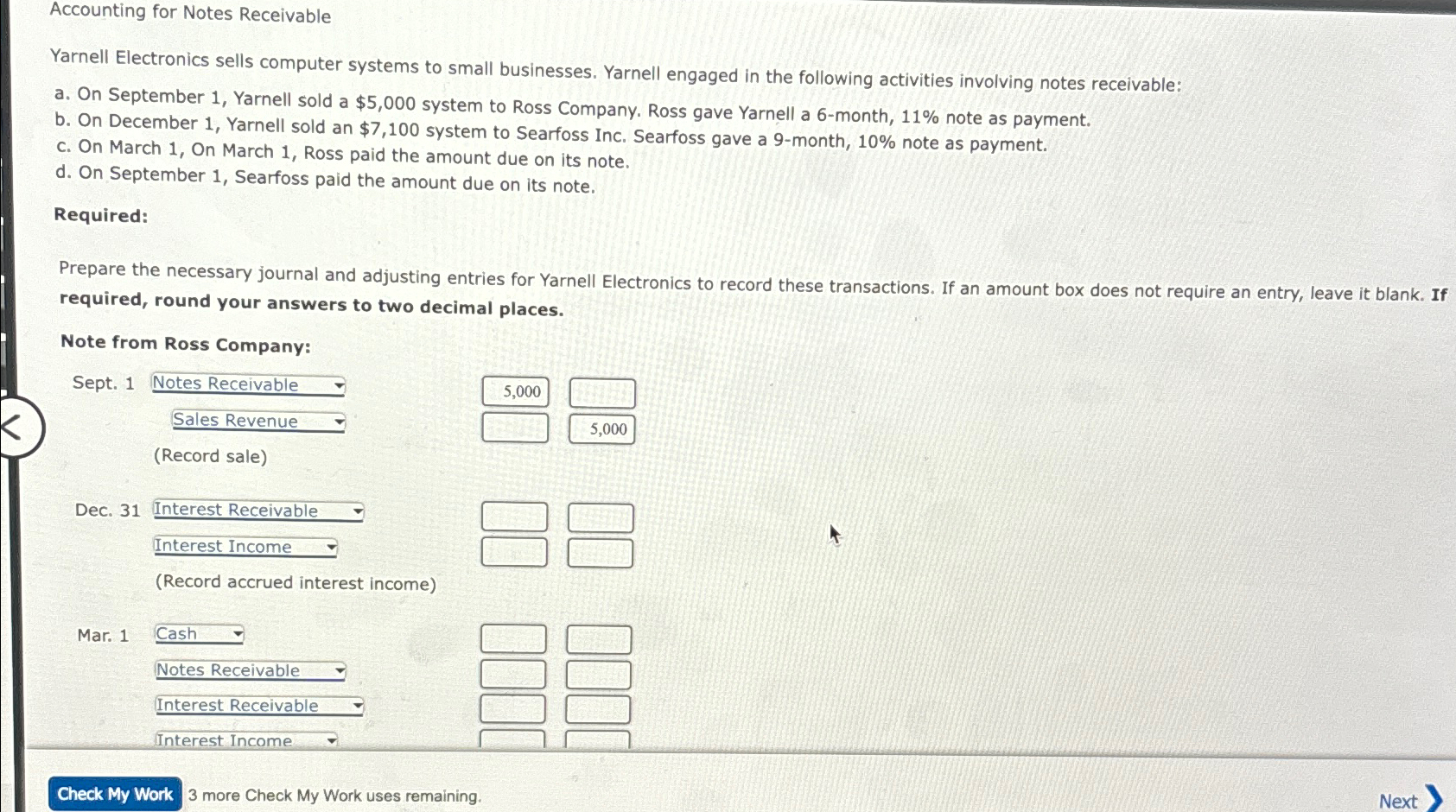

Accounting for Notes Receivable Yarnell Electronics sells computer systems to small businesses. Yarnell engaged in the following activities involving notes receivable: a. On September 1, Yarnell sold a $5,000 system to Ross Company. Ross gave Yarnell a 6-month, 11% note as payment. b. On December 1, Yarnell sold an $7,100 system to Searfoss Inc. Searfoss gave a 9-month, 10% note as payment. c. On March 1, On March 1, Ross paid the amount due on its note. d. On September 1, Searfoss paid the amount due on its note. Required: Prepare the necessary journal and adjusting entries for Yarnell Electronics to record these transactions. If an amount box does not require an entry, leave it blank. If required, round your answers to two decimal places. Note from Ross Company: Sept. 1 Notes Receivable Sales Revenue (Record sale) Dec. 31 Interest Receivable Mar. 1 Interest Income (Record accrued interest income) Cash Notes Receivable Interest Receivable Interest Income Check My Work 3 more Check My Work uses remaining. 5,000 5,000 Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started