Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help Today, an NFPO, received a number of donations in 20X6. Two of the donations are listed below. On January 1, 20X6, a $500,000

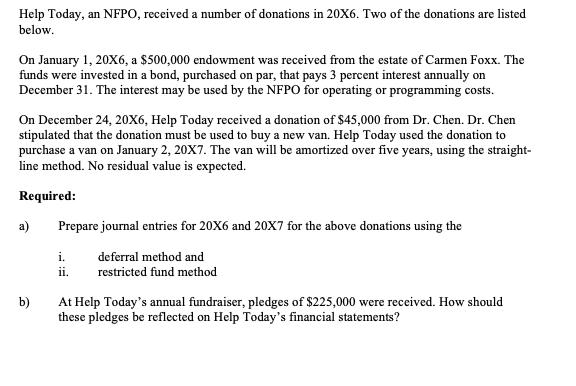

Help Today, an NFPO, received a number of donations in 20X6. Two of the donations are listed below. On January 1, 20X6, a $500,000 endowment was received from the estate of Carmen Foxx. The funds were invested in a bond, purchased on par, that pays 3 percent interest annually on December 31. The interest may be used by the NFPO for operating or programming costs. On December 24, 20XX6, Help Today received a donation of $45,000 from Dr. Chen. Dr. Chen stipulated that the donation must be used to buy a new van. Help Today used the donation to purchase a van on January 2, 20X7. The van will be amortized over five years, using the straight- line method. No residual value is expected. Required: a) Prepare journal entries for 20X6 and 20X7 for the above donations using the i. deferral method and ii. restricted fund method b) At Help Today's annual fundraiser, pledges of $225,000 were received. How should these pledges be reflected on Help Today's financial statements?

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Deferral method i Date Description Debit Credit Jan 1 2016 Cash 500000 Deferred capital contributi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started