Answered step by step

Verified Expert Solution

Question

1 Approved Answer

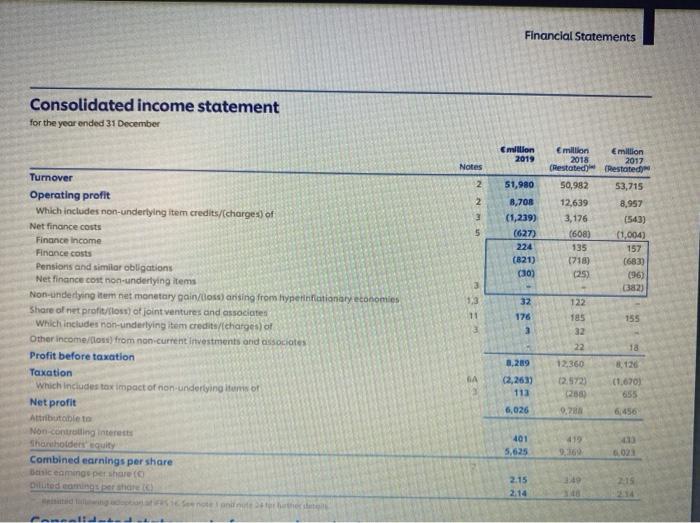

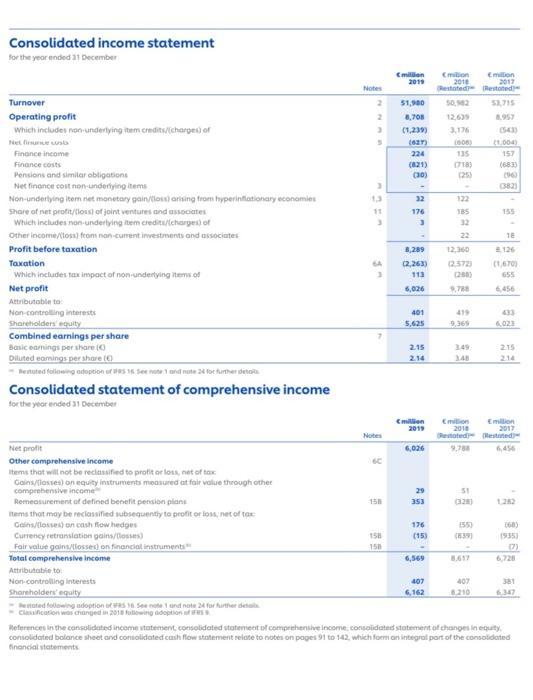

I need to know what the 1. revenue is, 2. what is cost of goods sold, 3. operating expense, 4. interest expense, 5. non recurring

I need to know what the 1. revenue is, 2. what is cost of goods sold, 3. operating expense, 4. interest expense, 5. non recurring events, 6.tax is for this corporation off this income statement all for the year 2019. Please explain

Consolidated income statement for the year ended 31 December Turnover Operating profit Which includes non-undertying item credits/(charges) of Net finance costs Finance Income Finance costs Pensions and similar obligations Net finance cost non-underlying items Non-underlying item net monetary gain/lloss) arising from hyperinflationary economies Share of net profit/(loss) of joint ventures and associates Which includes non-underlying item credits/(charges) of Other income/loss) from non-current investments and associates Profit before taxation Taxation which includes tax impact of non-underlying items of Net profit Attributable to Non-controlling interests Shareholders' equity Combined earnings per share Basic eamings per share (C) Diluited comings per share (6) Concald Notes 2 UTWNN 2 3 33=3 1,3 11 GA Financial Statements Emillion 2019 51,980 8,708 (1,239) (627) 224 (821) (30) 32 176 3 8,289 (2,263) 113 6,026 401 5,625 2.15 2.14 Emillion 2018 (Restated) 50,982 12,639 3,176 (608) 135 (718) (25) 122 185 32 22 12,360 (2.572) (288) 9,788 419 349 348 Emillion 2017 (Restated) 53,715 8,957 (543) (1,004) 157 (683) (96) (382) 155 18 8,126 (1,670) 655 6,456 433 6,023 2:15

Step by Step Solution

★★★★★

3.64 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The amount of revenue cost of goods sold operating expenses interest expenses nonrecurring events ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started