Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Time Bhd. owned few vehicles as part of their non-current assets, namely, motor car, van, lorry and tractor. All non-current assets are depreciated on

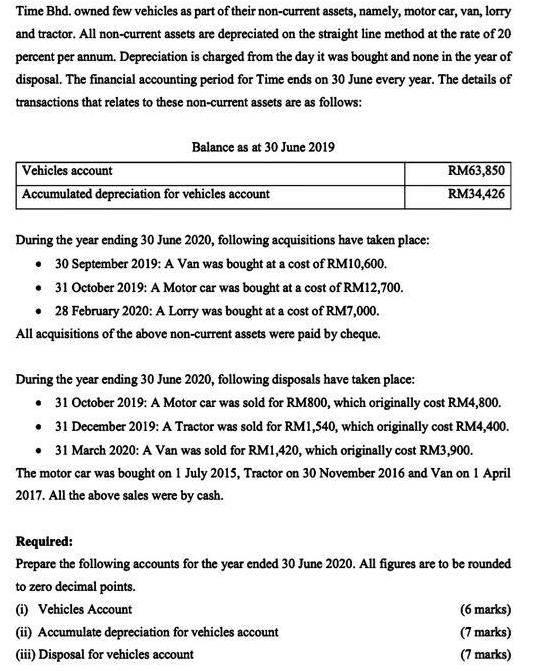

Time Bhd. owned few vehicles as part of their non-current assets, namely, motor car, van, lorry and tractor. All non-current assets are depreciated on the straight line method at the rate of 20 percent per annum. Depreciation is charged from the day it was bought and none in the year of disposal. The financial accounting period for Time ends on 30 June every year. The details of transactions that relates to these non-current assets are as follows: Balance as at 30 June 2019 Vehicles account Accumulated depreciation for vehicles account RM63,850 RM34,426 During the year ending 30 June 2020, following acquisitions have taken place: 30 September 2019: A Van was bought at a cost of RM10,600. 31 October 2019: A Motor car was bought at a cost of RM12,700. 28 February 2020: A Lorry was bought at a cost of RM7,000. All acquisitions of the above non-current assets were paid by cheque. During the year ending 30 June 2020, following disposals have taken place: 31 October 2019: A Motor car was sold for RM800, which originally cost RM4,800. 31 December 2019: A Tractor was sold for RM1,540, which originally cost RM4,400. 31 March 2020: A Van was sold for RM1,420, which originally cost RM3,900. The motor car was bought on 1 July 2015, Tractor on 30 November 2016 and Van on 1 April 2017. All the above sales were by cash. Required: Prepare the following accounts for the year ended 30 June 2020. All figures are to be rounded to zero decimal points. (i) Vehicles Account (6 marks) (ii) Accumulate depreciation for vehicles account (7 marks) (ii) Disposal for vehicles account (7 marks)

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Complete solution is given b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started