Answered step by step

Verified Expert Solution

Question

1 Approved Answer

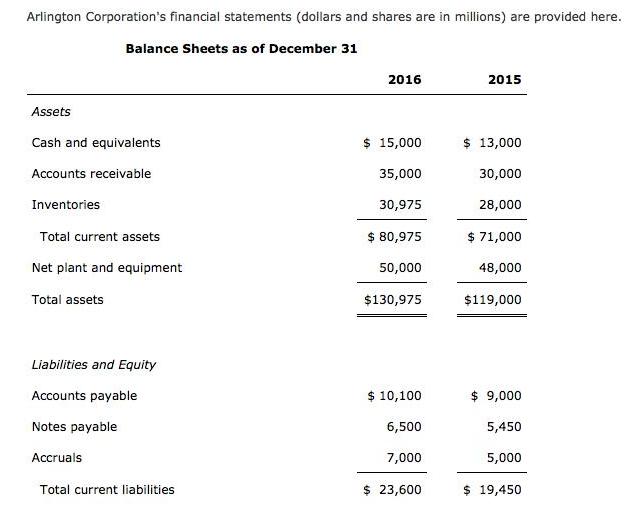

Arlington Corporation's financial statements (dollars and shares are in millions) are provided here. Balance Sheets as of December 31 2016 2015 Assets Cash and

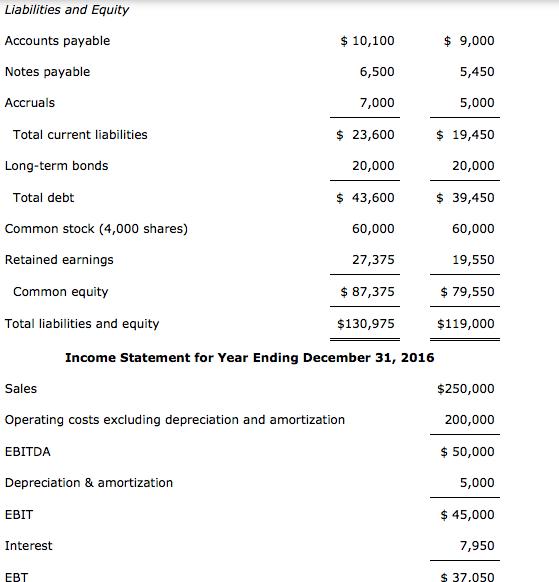

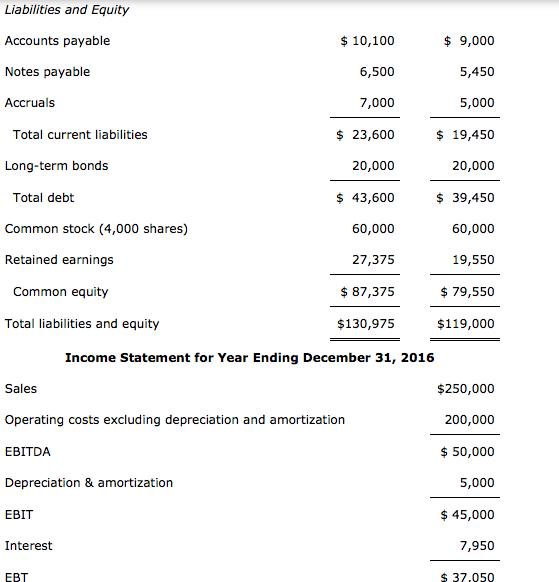

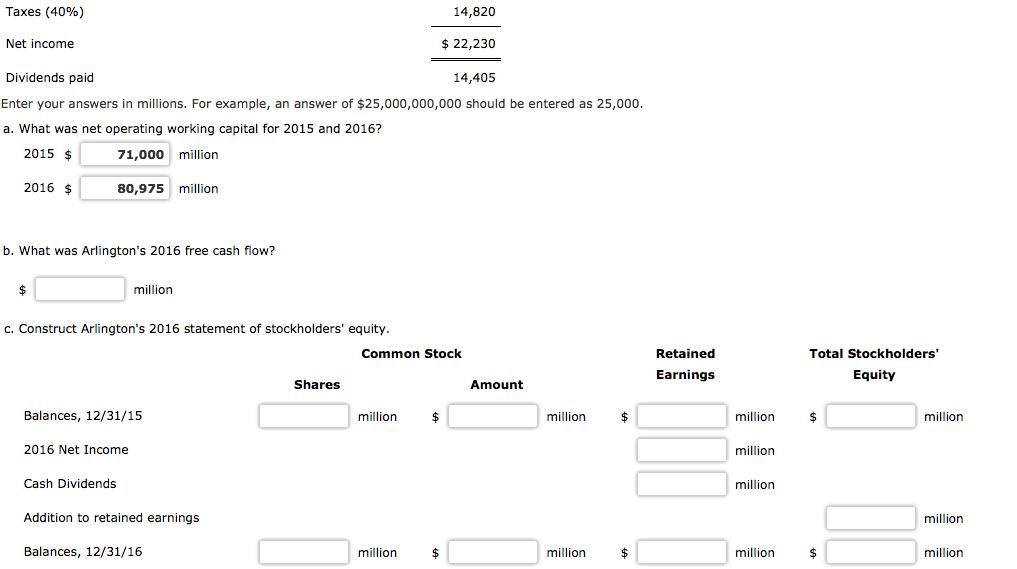

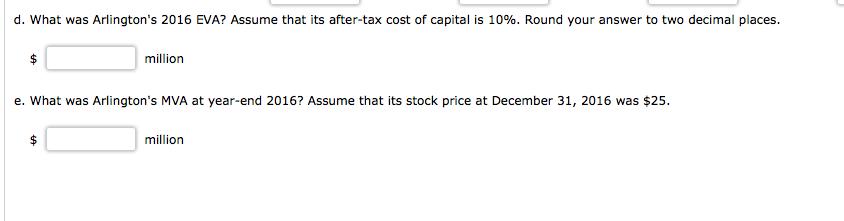

Arlington Corporation's financial statements (dollars and shares are in millions) are provided here. Balance Sheets as of December 31 2016 2015 Assets Cash and equivalents $ 15,000 $ 13,000 Accounts receivable 35,000 30,000 Inventories 30,975 28,000 Total current assets $ 80,975 $ 71,000 Net plant and equipment 50,000 48,000 Total assets $130,975 $119,000 Liabilities and Equity Accounts payable $ 10,100 $ 9,000 Notes payable 6,500 5,450 Accruals 7,000 5,000 Total current liabilities $ 23,600 $ 19,450 Liabilities and Equity Accounts payable $ 10,100 $ 9,000 Notes payable 6,500 5,450 Accruals 7,000 5,000 $ 23,600 $ 19,450 Total current liabilities Long-term bonds 20,000 20,000 Total debt $ 43,600 $ 39,450 Common stock (4,000 shares) 60,000 60,000 Retained earnings 27,375 19,550 Common equity $ 87,375 $ 79,550 Total liabilities and equity $130,975 $119,000 Income Statement for Year Ending December 31, 2016 Sales $250,000 Operating costs excluding depreciation and amortization 200,000 EBITDA $ 50,000 Depreciation & amortization 5,000 EBIT $ 45,000 Interest 7,950 EBT $ 37.050 Liabilities and Equity Accounts payable $ 10,100 $ 9,000 Notes payable 6,500 5,450 Accruals 7,000 5,000 $ 23,600 $ 19,450 Total current liabilities Long-term bonds 20,000 20,000 Total debt $ 43,600 $ 39,450 Common stock (4,000 shares) 60,000 60,000 Retained earnings 27,375 19,550 Common equity $ 87,375 $ 79,550 Total liabilities and equity $130,975 $119,000 Income Statement for Year Ending December 31, 2016 Sales $250,000 Operating costs excluding depreciation and amortization 200,000 EBITDA $ 50,000 Depreciation & amortization 5,000 EBIT $ 45,000 Interest 7,950 EBT $ 37.050 Taxes (40%) 14,820 Net income $ 22,230 Dividends paid 14,405 Enter your answers in millions. For example, an answer of $25,000,000,000 should be entered as 25,000. a. What was net operating working capital for 2015 and 2016? 2015 $ 71,000 million 2016 $ 80,975 million b. What was Arlington's 2016 free cash flow? $4 million c. Construct Arlington's 2016 statement of stockholders' equity. Common Stock Retained Total Stockholders' Earnings Equity Shares Amount Balances, 12/31/15 million $ million million 24 million 2016 Net Income million Cash Dividends million Addition to retained earnings million Balances, 12/31/16 million %24 million 24 million 2$ million d. What was Arlington's 2016 EVA? Assume that its after-tax cost of capital is 10%. Round your answer to two decimal places. $ million e. What was Arlington's MVA at year-end 2016? Assume that its stock price at December 31, 2016 was $25. $ million %24

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer PagenaO a Net openating wooking capital for ao15 werent aiseta Cirrent liabilhionokpayate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started