Answered step by step

Verified Expert Solution

Question

1 Approved Answer

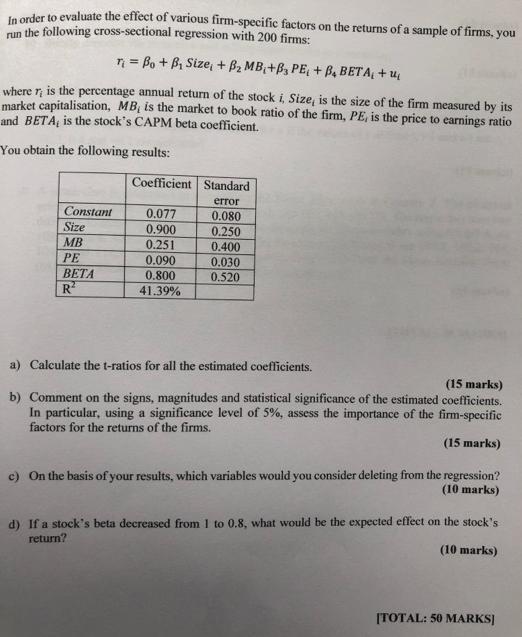

In order to evaluate the effect of various firm-specific factors on the returns of a sample of firms, you run the following cross-sectional regression

In order to evaluate the effect of various firm-specific factors on the returns of a sample of firms, you run the following cross-sectional regression with 200 firms: T = Bo + B Size + B MB + B PE + B BETA, + where r is the percentage annual return of the stock i, Size, is the size of the firm measured by its market capitalisation, MB, is the market to book ratio of the firm, PE, is the price to earnings ratio and BETA, is the stock's CAPM beta coefficient. You obtain the following results: Constant Size MB PE BETA R Coefficient Standard error 0.080 0.077 0.900 0.251 0.090 0.800 41.39% 0.250 0.400 0.030 0.520 a) Calculate the t-ratios for all the estimated coefficients. (15 marks) b) Comment on the signs, magnitudes and statistical significance of the estimated coefficients. In particular, using a significance level of 5%, assess the importance of the firm-specific factors for the returns of the firms. (15 marks) c) On the basis of your results, which variables would you consider deleting from the regression? (10 marks) d) If a stock's beta decreased from 1 to 0.8, what would be the expected effect on the stock's return? (10 marks) [TOTAL: 50 MARKS]

Step by Step Solution

★★★★★

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 For all the Bs we Calculate the TRatios manner of T Coefficientstandard ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started