Answered step by step

Verified Expert Solution

Question

1 Approved Answer

p1 p2 p3 Jane Jackson resides in Vancouver, BC, and has been employed by ABC Ltd. for a number of years as its accountant. i

p1

p1

p2

p3

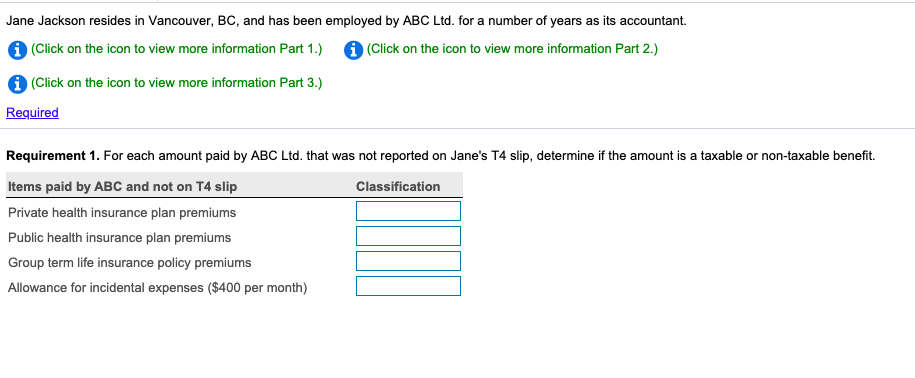

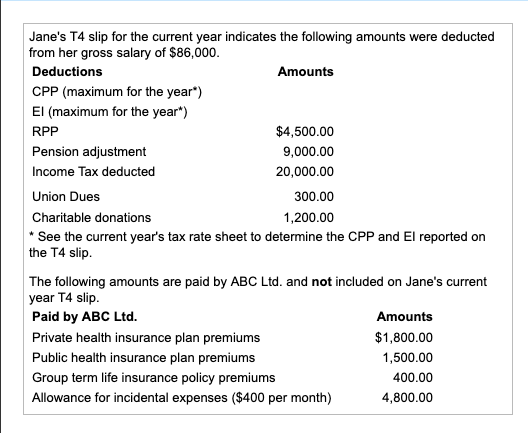

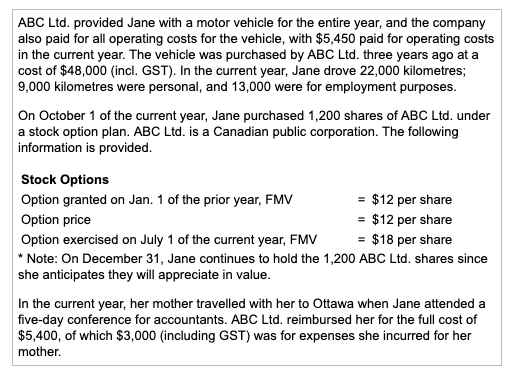

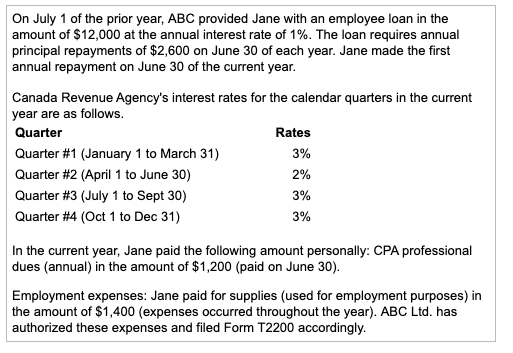

Jane Jackson resides in Vancouver, BC, and has been employed by ABC Ltd. for a number of years as its accountant. i (Click on the icon to view more information Part 1.) 1 (Click on the icon to view more information Part 2.) 1 (Click on the icon to view more information Part 3.) Required Requirement 1. For each amount paid by ABC Ltd. that was not reported on Jane's T4 slip, determine if the amount is a taxable or non-taxable benefit. Items paid by ABC and not on T4 slip Classification Private health insurance plan premiums Public health insurance plan premiums Group term life insurance policy premiums Allowance for incidental expenses ($400 per month) Jane's T4 slip for the current year indicates the following amounts were deducted from her gross salary of $86,000. Deductions CPP (maximum for the year*) El (maximum for the year*) RPP Amounts $4,500.00 9,000.00 20,000.00 Pension adjustment Income Tax deducted Union Dues 300.00 Charitable donations 1,200.00 * See the current year's tax rate sheet to determine the CPP and El reported on the T4 slip. Private health insurance plan premiums Public health insurance plan premiums The following amounts are paid by ABC Ltd. and not included on Jane's current year T4 slip. Paid by ABC Ltd. Group term life insurance policy premiums Allowance for incidental expenses ($400 per month) Amounts $1,800.00 1,500.00 400.00 4,800.00 ABC Ltd. provided Jane with a motor vehicle for the entire year, and the company also paid for all operating costs for the vehicle, with $5,450 paid for operating costs in the current year. The vehicle was purchased by ABC Ltd. three years ago at a cost of $48,000 (incl. GST). In the current year, Jane drove 22,000 kilometres; 9,000 kilometres were personal, and 13,000 were for employment purposes. On October 1 of the current year, Jane purchased 1,200 shares of ABC Ltd. under a stock option plan. ABC Ltd. is a Canadian public corporation. The following information is provided. Stock Options Option granted on Jan. 1 of the prior year, FMV Option price = $12 per share = $12 per share Option exercised on July 1 of the current year, FMV = $18 per share * Note: On December 31, Jane continues to hold the 1,200 ABC Ltd. shares since she anticipates they will appreciate in value. In the current year, her mother travelled with her to Ottawa when Jane attended a five-day conference for accountants. ABC Ltd. reimbursed her for the full cost of $5,400, of which $3,000 (including GST) was for expenses she incurred for her mother. On July 1 of the prior year, ABC provided Jane with an employee loan in the amount of $12,000 at the annual interest rate of 1%. The loan requires annual principal repayments of $2,600 on June 30 of each year. Jane made the first annual repayment on June 30 of the current year. Canada Revenue Agency's interest rates for the calendar quarters in the current year are as follows. Quarter Quarter #1 (January 1 to March 31) Quarter #2 (April 1 to June 30) Quarter #3 (July 1 to Sept 30) Quarter #4 (Oct 1 to Dec 31) Rates 3% 2% 3% 3% In the current year, Jane paid the following amount personally: CPA professional dues (annual) in the amount of $1,200 (paid on June 30). Employment expenses: Jane paid for supplies (used for employment purposes) in the amount of $1,400 (expenses occurred throughout the year). ABC Ltd. has authorized these expenses and filed Form T2200 accordingly.

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Let p 1 be the altitude of AD p 2 of BE and p 3 of F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started