Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joe owns a house in Bondi (NSW). Joe is also an alcoholic. Last year, Joe met Fran at a party and they spoke at

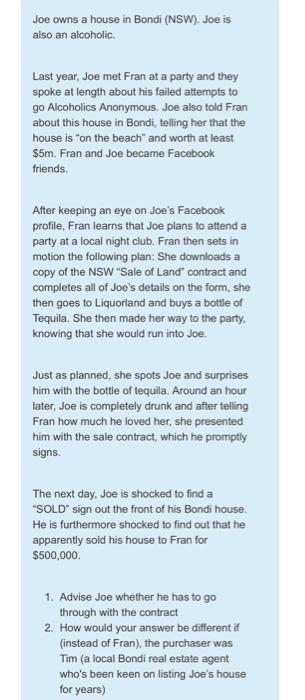

Joe owns a house in Bondi (NSW). Joe is also an alcoholic. Last year, Joe met Fran at a party and they spoke at length about his failed attempts to go Alcoholics Anonymous. Joe also told Fran about this house in Bondi, telling her that the house is "on the beach" and worth at least $5m. Fran and Joe became Facebook friends. After keeping an eye on Joe's Facebook profile, Fran learns that Joe plans to attend a party at a local night club. Fran then sets in motion the following plan: She downloads a copy of the NSW "Sale of Land" contract and completes all of Joe's details on the form, she then goes to Liquorland and buys a bottle of Tequila. She then made her way to the party. knowing that she would run into Joe. Just as planned, she spots Joe and surprises him with the bottle of tequila. Around an hour later, Joe is completely drunk and after telling Fran how much he loved her, she presented him with the sale contract, which he promptly signs. The next day, Joe is shocked to find a "SOLD" sign out the front of his Bondi house. He is furthermore shocked to find out that he apparently sold his house to Fran for $500,000. 1. Advise Joe whether he has to go through with the contract 2. How would your answer be different if (instead of Fran), the purchaser was Tim (a local Bondi real estate agent who's been keen on listing Joe's house for years)

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer This is the case of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started