Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jones Inc. sells rugs for $505 each. The company manufactures the rugs themselves and is considering upgrading its machinery. They currently use medium sized

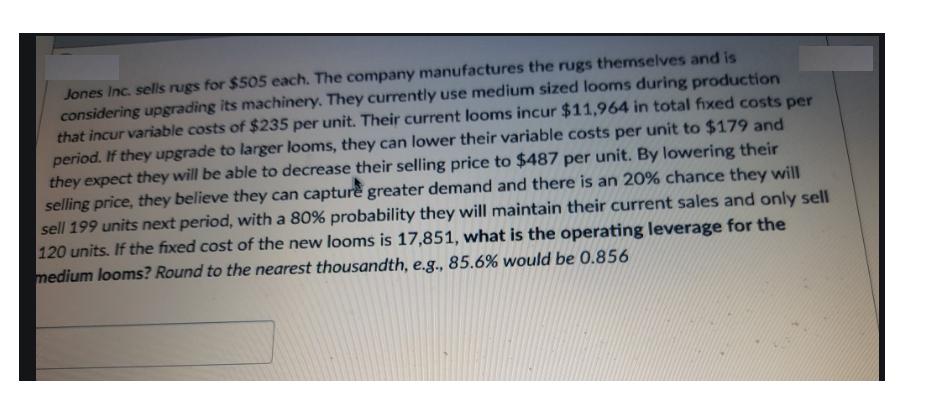

Jones Inc. sells rugs for $505 each. The company manufactures the rugs themselves and is considering upgrading its machinery. They currently use medium sized looms during production that incur variable costs of $235 per unit. Their current looms incur $11,964 in total fixed costs per period. If they upgrade to larger looms, they can lower their variable costs per unit to $179 and they expect they will be able to decrease their selling price to $487 per unit. By lowering their selling price, they believe they can capture greater demand and there is an 20% chance they will sell 199 units next period, with a 80% probability they will maintain their current sales and only sell 120 units. If the fixed cost of the new looms is 17,851, what is the operating leverage for the medium looms? Round to the nearest thousandth, e.g., 85.6% would be 0.856

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Jones Sells 505 each ougg Gun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started