Question

Develop a delta neutral strategy for the period 03/08/2020 to 20/08/2020 to hedge against short term volatility. Explain how the strategy will work, and detail

Develop a delta neutral strategy for the period 03/08/2020 to 20/08/2020 to hedge against short term volatility. Explain how the strategy will work, and detail all transactions for undertaking the strategy. You are required to perform at least one re-balancing.

Data: daily stock and option prices Assessment criteria: o Clearly stated hedging objective(s), determined in light of prevailing market conditions o Clear explanation of why and how the strategy will contribute to your objective o Correct implementation of delta hedge o Correct implementation of at least one rebalancing transaction o Full details of transactions captured in a table with appropriate narrative of all relevant transactions that may occur in real world investment 3. At the end of the period, close all the positions and evaluate the effectiveness of your strategy. (5 points) Assessment criteria: o Correct liquidation of positions and calculations of profit/loss o Effectiveness of the hedge and reasons why the hedge strategy worked/failed to work as you expect o Discuss how the hedge can be improved taking into account the shortcomings you identified above Part B (7 marks)

Create a synthetic stock to replicate the payoff of the stock identified in Part A. Hold the synthetic stock for the same period as in Part A. Make a record of all transactions and profit/loss of the strategy. At the end of the said period, evaluate your position and the effectiveness of this replication strategy as compared to the delta hedge strategy in part A. Assessment criteria:

- The replication strategy must be consistent in addressing the hedging objective you specified in Part A3

- Explain how the portfolio can replicate the payoff of the stock o Correct implementation of replication strategy, showing full details of transactions o Evaluation of the strategy in comparison to the delta hedge in part A. Is one strategy necessarily superior than the other?

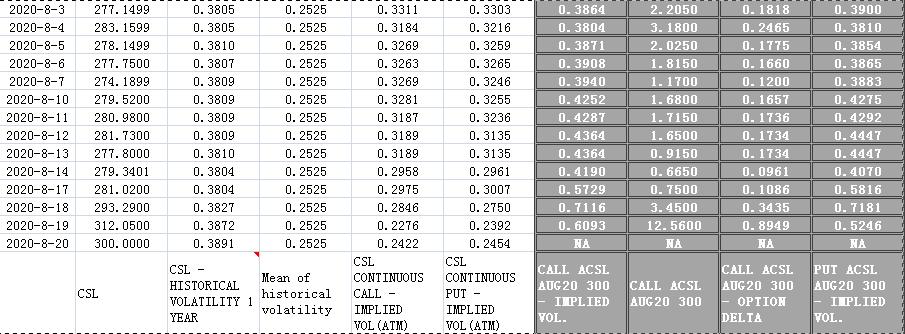

2020-8-3 277. 1499. 2020-8-4 283. 1599. 2020-8-5 278. 1499 2020-8-6 277. 7500 2020-8-7 274. 1899. 2020-8-10 279. 5200 2020-8-11 280.9800 2020-8-12 281.7300 2020-8-13 277.8000 2020-8-14 279. 3401 2020-8-17 281.0200 2020-8-18 293, 2900 2020-8-19 312.0500 2020-8-20 300.0000 CSL 0.3805 0.3805 0.3810 0.3807 0.3809 0.3809 0.3809 0.3809 0.3810 0.3804 0.3804 0.3827 0.3872 0.3891 CSL - HISTORICAL VOLATILITY 1 YEAR 0.2525 0.2525 0.2525 0.2525 0.2525 0.2525 0.2525 0.2525 0.2525 0.2525 0.2525 0.2525 0.2525 0.2525 CSL 0.3311 0.3184 0.3269 0.3263 0.3269 0.3281 0.3187 0.3189 0. 3189 0.2958 0.2975 0.2846 0.2276 0.2422 Mean of historical CALL volatility CONTINUOUS IMPLIED VOL (ATM) CSL 0.3303 0.3216 0.3259 0.3265 0.3246 0.3255 0.3236 0.3135 0.3135 0.2961 0.3007 0.2750 0.2392 0.2454 CONTINUOUS PUT - IMPLIED VOL (ATM) 0.3864 0.3804 0.3871 0.3908 0.3940 0.4252 0.4287 0.4364 0.4364 0.4190 0.5729 0.7116 0.6093 HA CALL ACSL AUG 20 300 IMPLIED VOL. 2. 2050 3. 1800 2.0250 1.8150 1.1700 1.6800 1.7150 1.6500 0.9150 0.6650 0.7500 3.4500 12.5600 N CALL ACSL AUG 20 300 0.1818 0.2465 0.1775 0.1660 0.1200 0. 1657 0.1736 0.1734 0. 1734 0.0961 0.1086 0.3435 0.8949 HA CALL ACSL AUG 20 300 OPTION DELTA 0.3900 0.3810 0.3854 0.3865 0.3883 0.4275 0.4292 0.4447 0.4447 0.4070 0.5816 0.7181 0.5246 N PUT ACSL AUG 20 300 - IMPLIED VOL.

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Delta Neutral Strategy The objective of this delta neutral strategy is to hedge against short term volatility in the stock market To do this we will use a combination of stocks and options to create a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started