Question

Journalize The Following Transactions For The Seller Bell Company, Using The Gross Method To Account For Sales Discounts. Assume A Perpetual Inventory System Make Sure

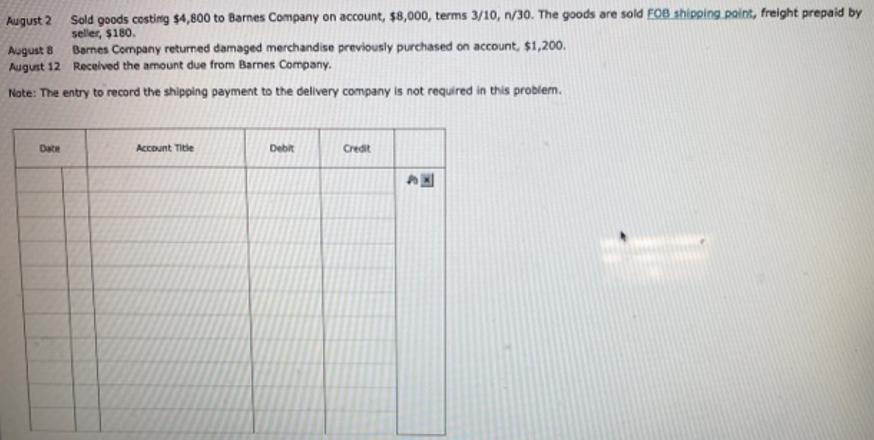

Journalize The Following Transactions For The Seller Bell Company, Using The Gross Method To Account For Sales Discounts. Assume A Perpetual Inventory System Make Sure To Enter The Day For Each Separate Transaction.

August 2 Sold goods costing $4,800 to Barnes Company on account, $8,000, terms 3/10, n/30. The goods are sold FOB shipping point, freight prepaid by seller, $180. Barnes Company returned damaged merchandise previously purchased on account, $1,200. August 8 August 12 Recelved the amount due from Barnes Company. Note: The entry to record the shipping payment to the delivery company is not required in this problem. Date Account Title Debit Credit

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Accounting

Authors: Tracie L. Miller Nobles, Brenda L. Mattison, Ella Mae Matsumura

10th edition

133117413, 978-0133129519, 133129519, 978-0133129557, 133129551, 978-0133117561, 133117561, 978-0133117417

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App