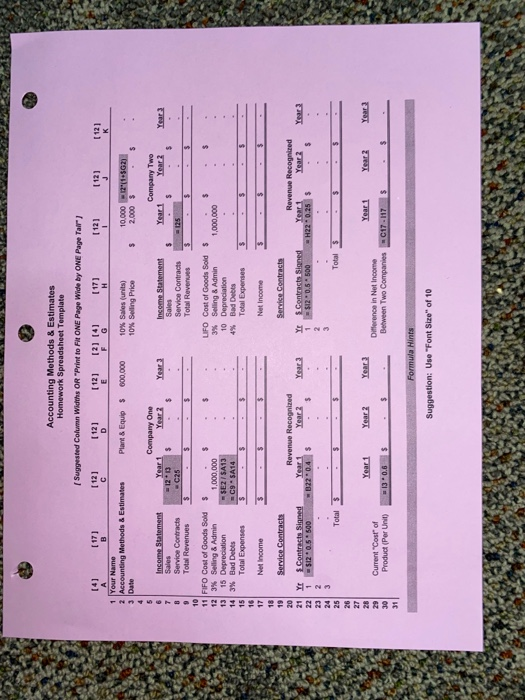

Accounting Methods & Estimates and Their Effects on Net Income Homework Two different companies were organized to sell gec-gaws to the public. Both companies expect this to be a widely used device with increasing Sales each year. With increased enhancements, each year, they expect the sales price per unit to increase each year. Both companies expect to sell 10,000 units, at a selling price of $2,000 each, during their first year of business. Sales are anticipated to increase by 10% (in units - at a compounded rate) during each of the next two years. At the same time, the selling price per unit will increase by a compounded annual rate of 10% The same supplier provides the devices to both companies. The cost of the product is 60% of the sales price. Like the sales price, the cost will increase each year. Both companies keep a safety stock equal to 1,000 units at all times. (For example, during the first year each company will purchase 11,000 units - the 10,000 units to be sold plus an additional 1,000 units "just in case." During the second year, 11,000 units will be purchased - 1,000 units will remain from the first year.) Service contracts are available with each hardware device. These contracts cover the device "top to bottom" for a period of four years. The service contract costs $500, for this period, and the price will remain the same for the first three years of business. One- half of all customers purchase the service contract. Selling & Administrative Expenses (Salaries, Advertising, and et. al.) are budgeted to be $1,000,000 during the first year and grow at a compounded rate of 3%. Plant & Equipment costing $600,000 will be purchased at inception and will be depreciated using the Straight-Line method assuming no salvage value. Using an electronic spreadsheet, please complete a three year Budgeted Income Statement for each of the companies using the following assumptions: Accounting Methods & Estimates Homework Spreadsheet Template Suggested Column Width OR "Print to Fit ONE Page Wide by ONE Page Tail"] [4] [17] [12] [12] 12) [4] [171 [12] [12] B D F G H 1 J 1 Your Name 2 Accounting Methods & Estimates Plant & Equips 000,000 10% Sales (units) 10,000 12+(1+562) 3 Date 10% Selling Price $ 2,000 $ [121 K $ Year Year 3 Income Statement Sales Service Contracts Total Revenues $ Company Two Year1 Year 2 $ $ 125 $ $ $ 1,000,000 Company One 6 Income Statement Year 1 Year 2 7 Sales - 12.13 $ $ B Service Contracts -C25 9 Total Revenues 5 $ 10 11 FIFO Cost of Goods Sold $ $ $ 12 3% Selling & Admin 1,000,000 13 15 Depreciation - SEZI SA13 14 3% Bad Debts C9 - SA14 15 Total Expenses $ 16 17 Net Income $ 18 Service Contracts 20 Revenue Recognized 21 Yt Contracts Signed Year 1 Year 2 22 1 - $120.5 500 B220.4 $ $ 23 2 24 3 25 Total $ $ LIFO Cost of Goods Sold $ 3% Selling & Admin 10 Depreciation 4% Bad Debts Total Expenses $ Net Income $ $ Service Contracts Year 3 YES.Contracts Signed 1 - $120.5 - 500 Revenue Recognized Year1 Year 2 - H22 -0.25 $ Year) Total Year 1 Year 2 Year 2 Year 2 Year 2 Current Cost of Product (Per Unit) Year 1 Difference in Net Income Between Two Companies -C17 - 117 $ 13 0.6 $ $ 31 Formula Hints Suggestion: Use "Font Size" of 10