Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1: An employee earned $50,000 during the year. FICA tax for Social Security is 6.2% and FICA tax for Medicare is 1.45%. The employer's

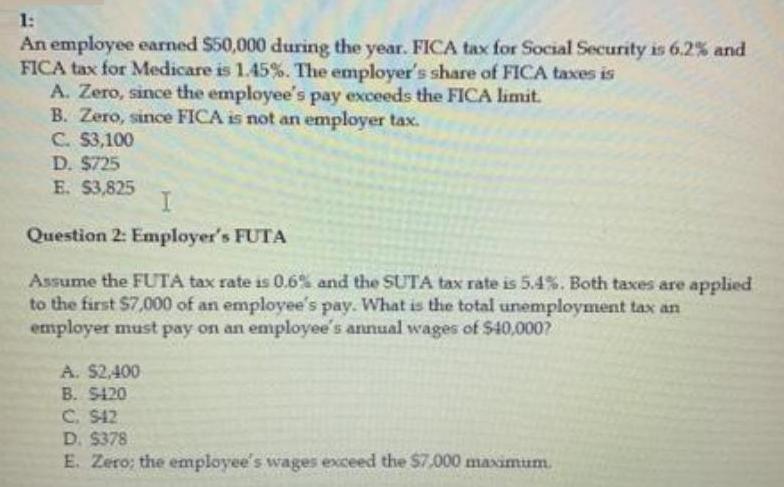

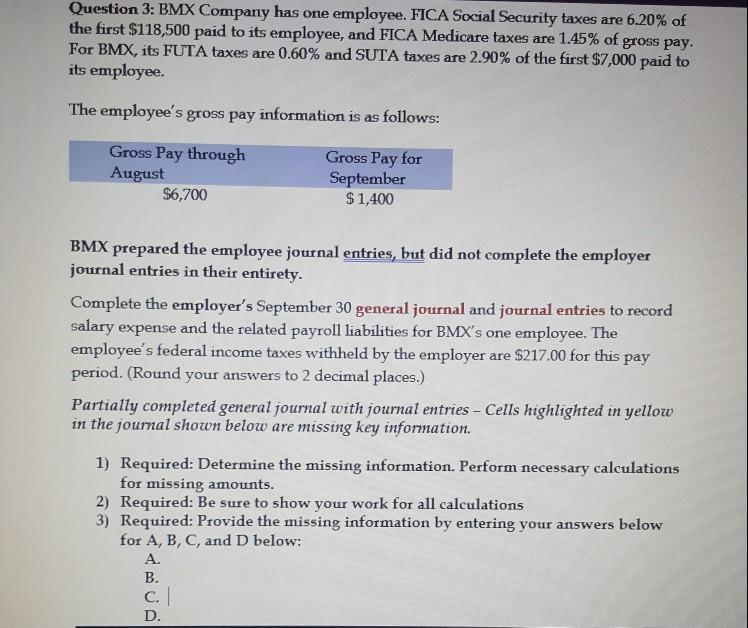

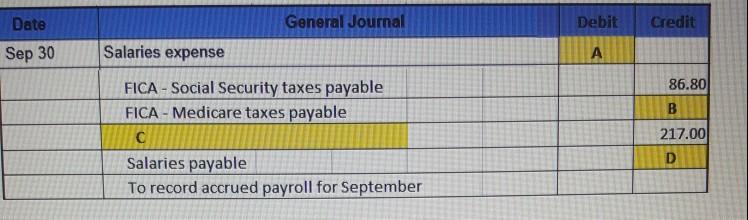

1: An employee earned $50,000 during the year. FICA tax for Social Security is 6.2% and FICA tax for Medicare is 1.45%. The employer's share of FICA taxes is A. Zero, since the employee's pay exceeds the FICA limit. B. Zero, since FICA is not an employer tax. C. S3,100 D. $725 E. $3,825 Question 2: Employer's FUTA Assume the FUTA tax rate is 0.6% and the SUTA tax rate is 5.4%. Both taxces are applied to the first $7,000 of an employee's pay. What is the total unemployment tax an employer must pay on an employee's annual wages of $40,000? A. S2,400 B. S420 C. $12 D. $378 E. Zero: the employee's wages exceed the $7,000 maximum. Question 3: BMX Company has one employee. FICA Social Security taxes are 6.20% of the first $118,500 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.60% and SUTA taxes are 2.90% of the first $7,000 paid to its employee. The employee's gross pay information is as follows: Gross Pay through August $6,700 Gross Pay for September $1,400 BMX prepared the employee journal entries, but did not complete the employer journal entries in their entirety. Complete the employer's September 30 general journal and journal entries to record salary expense and the related payroll liabilities for BMX's one employee. The employee's federal income taxes withheld by the employer are $217.00 for this pay period. (Round your answers to 2 decimal places.) Partially completed general journal with journal entries - Cells highlighted in yellow in the journal shown below are missing key information. 1) Required: Determine the missing information. Perform necessary calculations for missing amounts. 2) Required: Be sure to show your work for all calculations 3) Required: Provide the missing information by entering your answers below for A, B, C, and D below: . . C. D. Date General Journal Debit Credit Sep 30 Salaries expense A 86.80 FICA - Social Security taxes payable FICA - Medicare taxes payable B. 217.00 D Salaries payable To record accrued payroll for September

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Option E is correct a Earnings 5000000 ba62 So...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started