Answered step by step

Verified Expert Solution

Question

1 Approved Answer

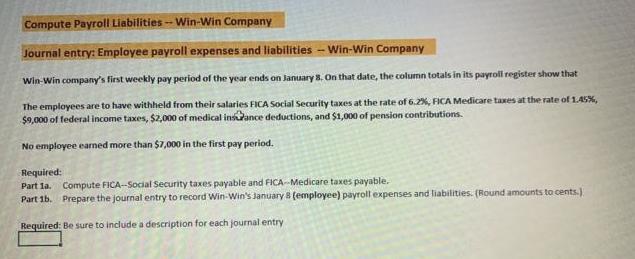

Compute Payroll Liabilities - Win-Win Company Journal entry: Employee payroll expenses and liabilities Win-Win Company Win-Win company's first weekly pay period of the year

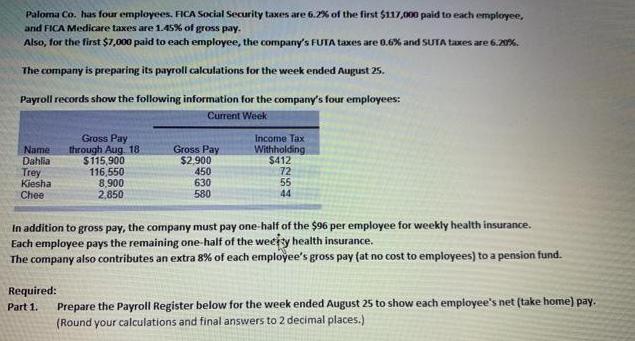

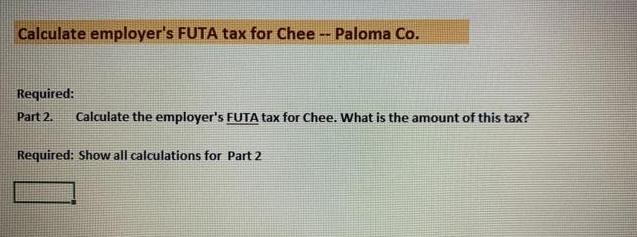

Compute Payroll Liabilities - Win-Win Company Journal entry: Employee payroll expenses and liabilities Win-Win Company Win-Win company's first weekly pay period of the year ends on January 8. On that date, the column totals in its payroll register show that The employees are to have withheld from their salaries FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $9,000 of federal income taxes, $2,000 of medical insance deductions, and $1,000 of pension contributions. No employee earned more than $7,000 in the first pay period. Required: Part la. Compute FICA--Social Security taxes payable and FICA-Medicare taxes payable. Part 1b. Prepare the journal entry to record Win-Win's January 8 (employee) payroll expenses and liabilities. (Round amounts to cents.) Required: Be sure to include a description for each journal entry Journal entry: Employer payroll taxes - Win-Win Company Prepare the journal entry to record Win-Win's (employer) payroll taxes resulting from the January 8 payroll. (Round amounts to cents.) Win-Win's merit rating reduces its state unemployment tax rate to 3.4% of the first $7,000 paid to each employee. Part 2. The federal unemployment tax rate is 0.6%. Required: Be sure to include a description for each journal entry Paloma Co. has four employees. FICA Social Security taxes are 6.2% of the first $117,000 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0.6% and SUTA taxes are 6.20%. The company is preparing its payroll calculations for the week ended August 25. Payroll records show the following information for the company's four employees: Current Week Name Dahlia Trey Kiesha Gross Pay through Aug. 18 $115,900 116,550 8,900 2,850 Gross Pay $2.900 450 630 580 Income Tax Withholding $412 72 55 44 Chee In addition to gross pay, the company must pay one-half of the $96 per employee for weekly health insurance. Each employee pays the remaining one-half of the weery health insurance. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund. Required: Prepare the Payroll Register below for the week ended August 25 to show each employee's net (take home) pay. (Round your calculations and final answers to 2 decimal places.) Part 1. Calculate employer's FUTA tax for Chee - Paloma Co. Required: Part 2. Calculate the employer's FUTA tax for Chee. What is the amount of this tax? Required: Show all calculations for Part 2 Calculate employer's SUTA tax for Chee - Paloma Co. Required: Part 3. Calculate the employer's SUTA tax for Chee. What is the amount of this tax? Required: Show all calculations for Part 3 Compute Payroll Liabilities - Win-Win Company Journal entry: Employee payroll expenses and liabilities Win-Win Company Win-Win company's first weekly pay period of the year ends on January 8. On that date, the column totals in its payroll register show that The employees are to have withheld from their salaries FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $9,000 of federal income taxes, $2,000 of medical insance deductions, and $1,000 of pension contributions. No employee earned more than $7,000 in the first pay period. Required: Part la. Compute FICA--Social Security taxes payable and FICA-Medicare taxes payable. Part 1b. Prepare the journal entry to record Win-Win's January 8 (employee) payroll expenses and liabilities. (Round amounts to cents.) Required: Be sure to include a description for each journal entry Journal entry: Employer payroll taxes - Win-Win Company Prepare the journal entry to record Win-Win's (employer) payroll taxes resulting from the January 8 payroll. (Round amounts to cents.) Win-Win's merit rating reduces its state unemployment tax rate to 3.4% of the first $7,000 paid to each employee. Part 2. The federal unemployment tax rate is 0.6%. Required: Be sure to include a description for each journal entry Paloma Co. has four employees. FICA Social Security taxes are 6.2% of the first $117,000 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0.6% and SUTA taxes are 6.20%. The company is preparing its payroll calculations for the week ended August 25. Payroll records show the following information for the company's four employees: Current Week Name Dahlia Trey Kiesha Gross Pay through Aug. 18 $115,900 116,550 8,900 2,850 Gross Pay $2.900 450 630 580 Income Tax Withholding $412 72 55 44 Chee In addition to gross pay, the company must pay one-half of the $96 per employee for weekly health insurance. Each employee pays the remaining one-half of the weery health insurance. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund. Required: Prepare the Payroll Register below for the week ended August 25 to show each employee's net (take home) pay. (Round your calculations and final answers to 2 decimal places.) Part 1. Calculate employer's FUTA tax for Chee - Paloma Co. Required: Part 2. Calculate the employer's FUTA tax for Chee. What is the amount of this tax? Required: Show all calculations for Part 2 Calculate employer's SUTA tax for Chee - Paloma Co. Required: Part 3. Calculate the employer's SUTA tax for Chee. What is the amount of this tax? Required: Show all calculations for Part 3 Compute Payroll Liabilities - Win-Win Company Journal entry: Employee payroll expenses and liabilities Win-Win Company Win-Win company's first weekly pay period of the year ends on January 8. On that date, the column totals in its payroll register show that The employees are to have withheld from their salaries FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $9,000 of federal income taxes, $2,000 of medical insance deductions, and $1,000 of pension contributions. No employee earned more than $7,000 in the first pay period. Required: Part la. Compute FICA--Social Security taxes payable and FICA-Medicare taxes payable. Part 1b. Prepare the journal entry to record Win-Win's January 8 (employee) payroll expenses and liabilities. (Round amounts to cents.) Required: Be sure to include a description for each journal entry Journal entry: Employer payroll taxes - Win-Win Company Prepare the journal entry to record Win-Win's (employer) payroll taxes resulting from the January 8 payroll. (Round amounts to cents.) Win-Win's merit rating reduces its state unemployment tax rate to 3.4% of the first $7,000 paid to each employee. Part 2. The federal unemployment tax rate is 0.6%. Required: Be sure to include a description for each journal entry Paloma Co. has four employees. FICA Social Security taxes are 6.2% of the first $117,000 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0.6% and SUTA taxes are 6.20%. The company is preparing its payroll calculations for the week ended August 25. Payroll records show the following information for the company's four employees: Current Week Name Dahlia Trey Kiesha Gross Pay through Aug. 18 $115,900 116,550 8,900 2,850 Gross Pay $2.900 450 630 580 Income Tax Withholding $412 72 55 44 Chee In addition to gross pay, the company must pay one-half of the $96 per employee for weekly health insurance. Each employee pays the remaining one-half of the weery health insurance. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund. Required: Prepare the Payroll Register below for the week ended August 25 to show each employee's net (take home) pay. (Round your calculations and final answers to 2 decimal places.) Part 1. Calculate employer's FUTA tax for Chee - Paloma Co. Required: Part 2. Calculate the employer's FUTA tax for Chee. What is the amount of this tax? Required: Show all calculations for Part 2 Calculate employer's SUTA tax for Chee - Paloma Co. Required: Part 3. Calculate the employer's SUTA tax for Chee. What is the amount of this tax? Required: Show all calculations for Part 3 Compute Payroll Liabilities - Win-Win Company Journal entry: Employee payroll expenses and liabilities Win-Win Company Win-Win company's first weekly pay period of the year ends on January 8. On that date, the column totals in its payroll register show that The employees are to have withheld from their salaries FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $9,000 of federal income taxes, $2,000 of medical insance deductions, and $1,000 of pension contributions. No employee earned more than $7,000 in the first pay period. Required: Part la. Compute FICA--Social Security taxes payable and FICA-Medicare taxes payable. Part 1b. Prepare the journal entry to record Win-Win's January 8 (employee) payroll expenses and liabilities. (Round amounts to cents.) Required: Be sure to include a description for each journal entry Journal entry: Employer payroll taxes - Win-Win Company Prepare the journal entry to record Win-Win's (employer) payroll taxes resulting from the January 8 payroll. (Round amounts to cents.) Win-Win's merit rating reduces its state unemployment tax rate to 3.4% of the first $7,000 paid to each employee. Part 2. The federal unemployment tax rate is 0.6%. Required: Be sure to include a description for each journal entry Paloma Co. has four employees. FICA Social Security taxes are 6.2% of the first $117,000 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0.6% and SUTA taxes are 6.20%. The company is preparing its payroll calculations for the week ended August 25. Payroll records show the following information for the company's four employees: Current Week Name Dahlia Trey Kiesha Gross Pay through Aug. 18 $115,900 116,550 8,900 2,850 Gross Pay $2.900 450 630 580 Income Tax Withholding $412 72 55 44 Chee In addition to gross pay, the company must pay one-half of the $96 per employee for weekly health insurance. Each employee pays the remaining one-half of the weery health insurance. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund. Required: Prepare the Payroll Register below for the week ended August 25 to show each employee's net (take home) pay. (Round your calculations and final answers to 2 decimal places.) Part 1. Calculate employer's FUTA tax for Chee - Paloma Co. Required: Part 2. Calculate the employer's FUTA tax for Chee. What is the amount of this tax? Required: Show all calculations for Part 2 Calculate employer's SUTA tax for Chee - Paloma Co. Required: Part 3. Calculate the employer's SUTA tax for Chee. What is the amount of this tax? Required: Show all calculations for Part 3 Compute Payroll Liabilities - Win-Win Company Journal entry: Employee payroll expenses and liabilities Win-Win Company Win-Win company's first weekly pay period of the year ends on January 8. On that date, the column totals in its payroll register show that The employees are to have withheld from their salaries FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $9,000 of federal income taxes, $2,000 of medical insance deductions, and $1,000 of pension contributions. No employee earned more than $7,000 in the first pay period. Required: Part la. Compute FICA--Social Security taxes payable and FICA-Medicare taxes payable. Part 1b. Prepare the journal entry to record Win-Win's January 8 (employee) payroll expenses and liabilities. (Round amounts to cents.) Required: Be sure to include a description for each journal entry Journal entry: Employer payroll taxes - Win-Win Company Prepare the journal entry to record Win-Win's (employer) payroll taxes resulting from the January 8 payroll. (Round amounts to cents.) Win-Win's merit rating reduces its state unemployment tax rate to 3.4% of the first $7,000 paid to each employee. Part 2. The federal unemployment tax rate is 0.6%. Required: Be sure to include a description for each journal entry Paloma Co. has four employees. FICA Social Security taxes are 6.2% of the first $117,000 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0.6% and SUTA taxes are 6.20%. The company is preparing its payroll calculations for the week ended August 25. Payroll records show the following information for the company's four employees: Current Week Name Dahlia Trey Kiesha Gross Pay through Aug. 18 $115,900 116,550 8,900 2,850 Gross Pay $2.900 450 630 580 Income Tax Withholding $412 72 55 44 Chee In addition to gross pay, the company must pay one-half of the $96 per employee for weekly health insurance. Each employee pays the remaining one-half of the weery health insurance. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund. Required: Prepare the Payroll Register below for the week ended August 25 to show each employee's net (take home) pay. (Round your calculations and final answers to 2 decimal places.) Part 1. Calculate employer's FUTA tax for Chee - Paloma Co. Required: Part 2. Calculate the employer's FUTA tax for Chee. What is the amount of this tax? Required: Show all calculations for Part 2 Calculate employer's SUTA tax for Chee - Paloma Co. Required: Part 3. Calculate the employer's SUTA tax for Chee. What is the amount of this tax? Required: Show all calculations for Part 3 Compute Payroll Liabilities - Win-Win Company Journal entry: Employee payroll expenses and liabilities Win-Win Company Win-Win company's first weekly pay period of the year ends on January 8. On that date, the column totals in its payroll register show that The employees are to have withheld from their salaries FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $9,000 of federal income taxes, $2,000 of medical insance deductions, and $1,000 of pension contributions. No employee earned more than $7,000 in the first pay period. Required: Part la. Compute FICA--Social Security taxes payable and FICA-Medicare taxes payable. Part 1b. Prepare the journal entry to record Win-Win's January 8 (employee) payroll expenses and liabilities. (Round amounts to cents.) Required: Be sure to include a description for each journal entry Journal entry: Employer payroll taxes - Win-Win Company Prepare the journal entry to record Win-Win's (employer) payroll taxes resulting from the January 8 payroll. (Round amounts to cents.) Win-Win's merit rating reduces its state unemployment tax rate to 3.4% of the first $7,000 paid to each employee. Part 2. The federal unemployment tax rate is 0.6%. Required: Be sure to include a description for each journal entry Paloma Co. has four employees. FICA Social Security taxes are 6.2% of the first $117,000 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0.6% and SUTA taxes are 6.20%. The company is preparing its payroll calculations for the week ended August 25. Payroll records show the following information for the company's four employees: Current Week Name Dahlia Trey Kiesha Gross Pay through Aug. 18 $115,900 116,550 8,900 2,850 Gross Pay $2.900 450 630 580 Income Tax Withholding $412 72 55 44 Chee In addition to gross pay, the company must pay one-half of the $96 per employee for weekly health insurance. Each employee pays the remaining one-half of the weery health insurance. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund. Required: Prepare the Payroll Register below for the week ended August 25 to show each employee's net (take home) pay. (Round your calculations and final answers to 2 decimal places.) Part 1. Calculate employer's FUTA tax for Chee - Paloma Co. Required: Part 2. Calculate the employer's FUTA tax for Chee. What is the amount of this tax? Required: Show all calculations for Part 2 Calculate employer's SUTA tax for Chee - Paloma Co. Required: Part 3. Calculate the employer's SUTA tax for Chee. What is the amount of this tax? Required: Show all calculations for Part 3

Step by Step Solution

★★★★★

3.56 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started