Question

Negative Ltd commenced operations on 1 July 2017. The following has been extracted from their internal reports for the second year of operations (note: data

Negative Ltd commenced operations on 1 July 2017. The following has been extracted from their internal reports for the second year of operations (note: data for the first year of operations is available from SQ18.1–lecture example topic 1):

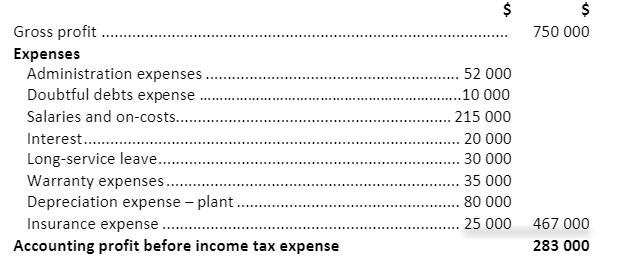

Income Statement (Extract) for the year ended 30 June 20119

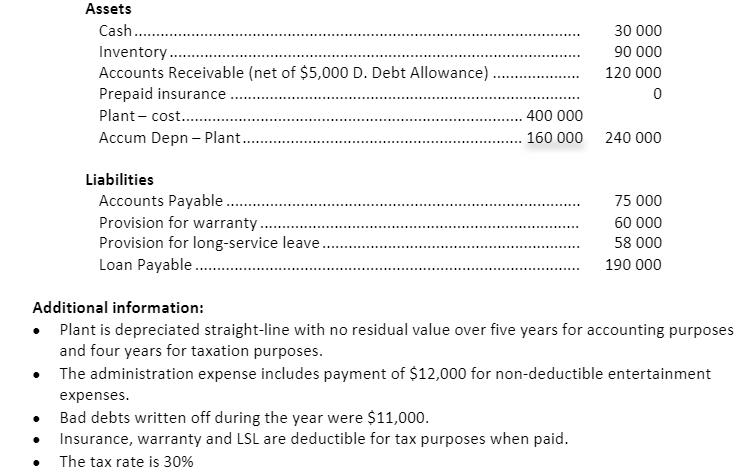

Assets and liabilities as disclosed in the balance sheet as at 30 June 2013 were:

Required:

1.Show the calculation of taxable income and its current tax consequence.

2. Prepare the journal entry for the current and deferred tax consequences for the year ended 30 June, 2019.

3.Prepare T-accounts for DTA and DTL to prove the balances as at 30 June 2019.

Gross profit Expenses Administration expenses. Doubtful debts expense Salaries and on-costs...... Interest ................ Long-service leave... Warranty expenses.. Depreciation expense - plant.. Insurance expense. Accounting profit before income tax expense $ 52 000 ...10 000 .215 000 20 000 . 30 000 35 000 .80 000 25 000 $ 750 000 467 000 283 000

Step by Step Solution

3.49 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Summarized the data and information in the question Yvestern Sydney Ltd comme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started