Answered step by step

Verified Expert Solution

Question

1 Approved Answer

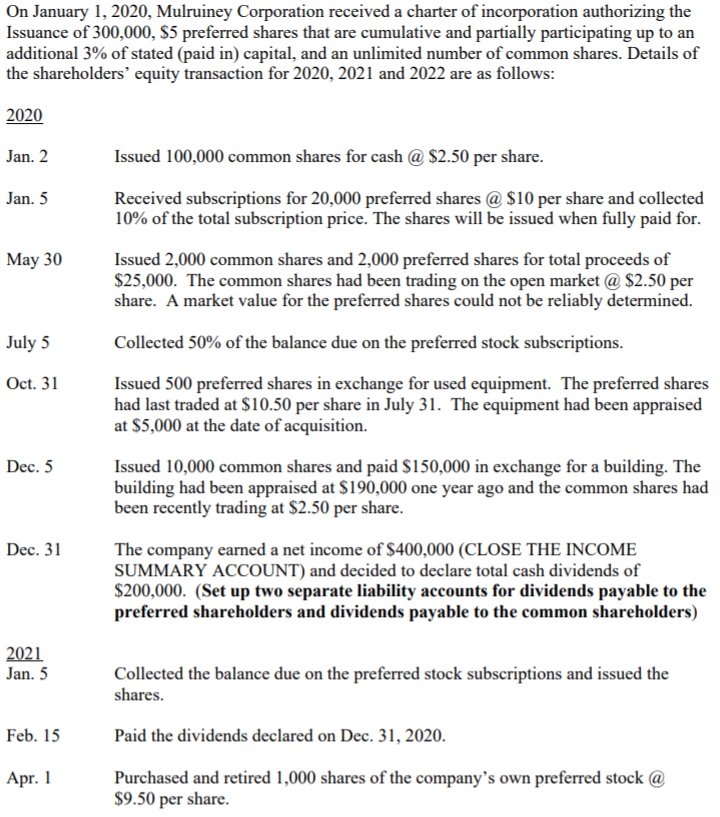

On January 1, 2020, Mulruiney Corporation received a charter of incorporation authorizing the Issuance of 300,000, $5 preferred shares that are cumulative and partially

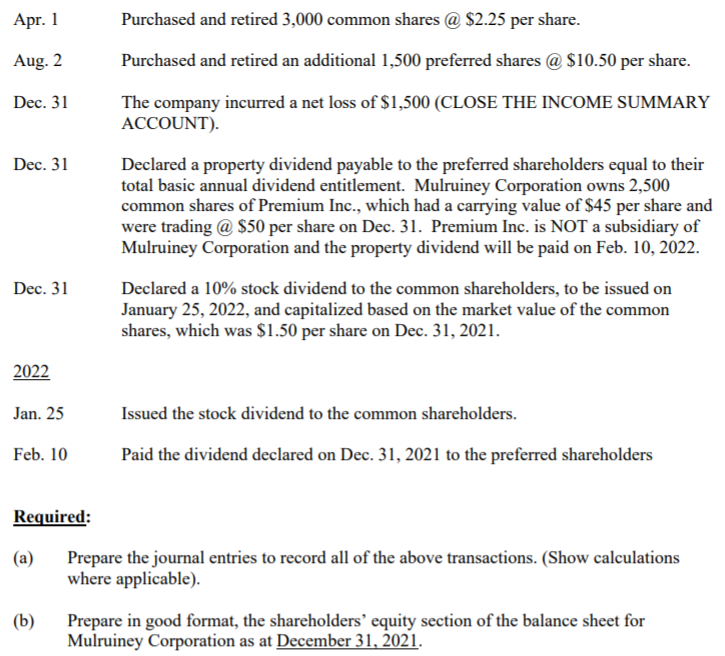

On January 1, 2020, Mulruiney Corporation received a charter of incorporation authorizing the Issuance of 300,000, $5 preferred shares that are cumulative and partially participating up to an additional 3% of stated (paid in) capital, and an unlimited number of common shares. Details of the shareholders' equity transaction for 2020, 2021 and 2022 are as follows: 2020 Jan. 2 Jan. 5 May 30 July 5 Oct. 31 Dec. 5 Dec. 31 2021 Jan. 5 Feb. 15 Apr. 1 Issued 100,000 common shares for cash @ $2.50 per share. Received subscriptions for 20,000 preferred shares @ $10 per share and collected 10% of the total subscription price. The shares will be issued when fully paid for. Issued 2,000 common shares and 2,000 preferred shares for total proceeds of $25,000. The common shares had been trading on the open market @ $2.50 per share. A market value for the preferred shares could not be reliably determined. Collected 50% of the balance due on the preferred stock subscriptions. Issued 500 preferred shares in exchange for used equipment. The preferred shares had last traded at $10.50 per share in July 31. The equipment had been appraised at $5,000 at the date of acquisition. Issued 10,000 common shares and paid $150,000 in exchange for a building. The building had been appraised at $190,000 one year ago and the common shares had been recently trading at $2.50 per share. The company earned a net income of $400,000 (CLOSE THE INCOME SUMMARY ACCOUNT) and decided to declare total cash dividends of $200,000. (Set up two separate liability accounts for dividends payable to the preferred shareholders and dividends payable to the common shareholders) Collected the balance due on the preferred stock subscriptions and issued the shares. Paid the dividends declared on Dec. 31, 2020. Purchased and retired 1,000 shares of the company's own preferred stock @ $9.50 per share. Apr. 1 Aug. 2 Dec. 31 Dec. 31 Dec. 31 2022 Jan. 25 Feb. 10 Required: (a) (b) Purchased and retired 3,000 common shares @ $2.25 per share. Purchased and retired an additional 1,500 preferred shares @ $10.50 per share. The company incurred a net loss of $1,500 (CLOSE THE INCOME SUMMARY ACCOUNT). Declared a property dividend payable to the preferred shareholders equal to their total basic annual dividend entitlement. Mulruiney Corporation owns 2,500 common shares of Premium Inc., which had a carrying value of $45 per share and were trading @ $50 per share on Dec. 31. Premium Inc. is NOT a subsidiary of Mulruiney Corporation and the property dividend will be paid on Feb. 10, 2022. Declared a 10% stock dividend to the common shareholders, to be issued on January 25, 2022, and capitalized based on the market value of the common shares, which was $1.50 per share on Dec. 31, 2021. Issued the stock dividend to the common shareholders. Paid the dividend declared on Dec. 31, 2021 to the preferred shareholders Prepare the journal entries to record all of the above transactions. (Show calculations where applicable). Prepare in good format, the shareholders' equity section of the balance sheet for Mulruiney Corporation as at December 31, 2021.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

JOURNAL ENTRIES Date Account Debit Credit 01022020 Cash 250000 Common Shares 250000 Issuance of 100000 common shares 250 per share 01052020 Cash 20000 Stocks Subscriptions Receivable 180000 Preferred ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started