Answered step by step

Verified Expert Solution

Question

1 Approved Answer

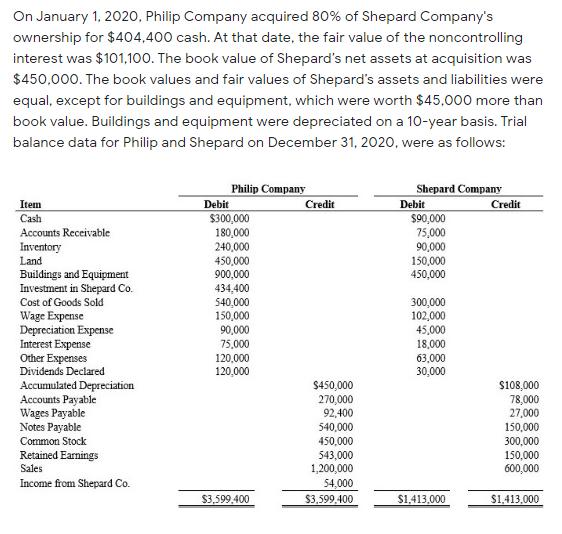

On January 1, 2020, Philip Company acquired 80% of Shepard Company's ownership for $404,400 cash. At that date, the fair value of the noncontrolling

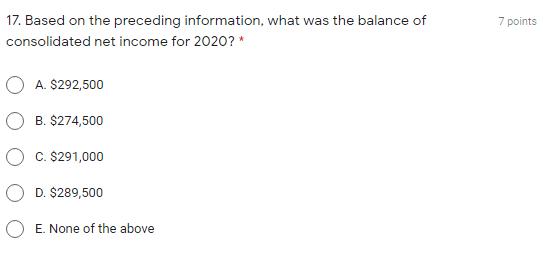

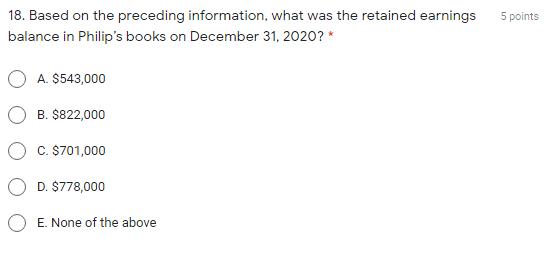

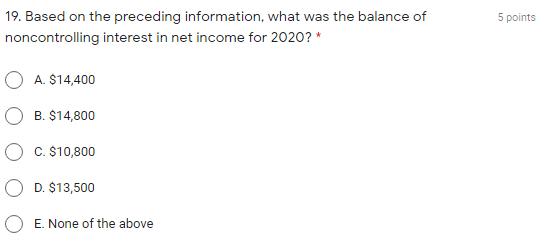

On January 1, 2020, Philip Company acquired 80% of Shepard Company's ownership for $404,400 cash. At that date, the fair value of the noncontrolling interest was $101,100. The book value of Shepard's net assets at acquisition was $450,000. The book values and fair values of Shepard's assets and liabilities were equal, except for buildings and equipment, which were worth $45,000 more than book value. Buildings and equipment were depreciated on a 10-year basis. Trial balance data for Philip and Shepard on December 31, 2020, were as follows: Philip Company Debit $300,000 Shepard Company Debit $90,000 Item Credit Credit Cash Accounts Receivable 180,000 240,000 450,000 900,000 434,400 540,000 150,000 90,000 75,000 90,000 150,000 450,000 Inventory Land Buildings and Equipment Investment in Shepard Co. Cost of Goods Sold Wage Expense Depreciation Expense 300,000 102,000 45,000 Interest Expense Other Expenses Dividends Declared 75,000 18,000 120,000 120,000 63,000 30,000 Accumulated Depreciation Accounts Payable Wages Payable Notes Payable $450,000 270,000 92,400 540,000 S108,000 78,000 27,000 150,000 Common Stock 450,000 300,000 Retained Earnings 543,000 1,200,000 54,000 150,000 600,000 Sales Income from Shepard Co. $3,599,400 $3,599,400 $1,413,000 $1,413,000 17. Based on the preceding information, what was the balance of 7 points consolidated net income for 2020? * O A. $292,500 B. $274,500 O c. $291,000 D. $289,500 O E. None of the above 18. Based on the preceding information, what was the retained earnings 5 points balance in Philip's books on December 31, 2020? * A. $543,000 B. $822,000 C. $701,000 D. $778,000 E. None of the above 19. Based on the preceding information, what was the balance of 5 points noncontrolling interest in net income for 2020? * A. $14,400 O B. $14,800 C. $10,800 O D. $13,500 E. None of the above

Step by Step Solution

★★★★★

3.60 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Complete solution is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started