Answered step by step

Verified Expert Solution

Question

1 Approved Answer

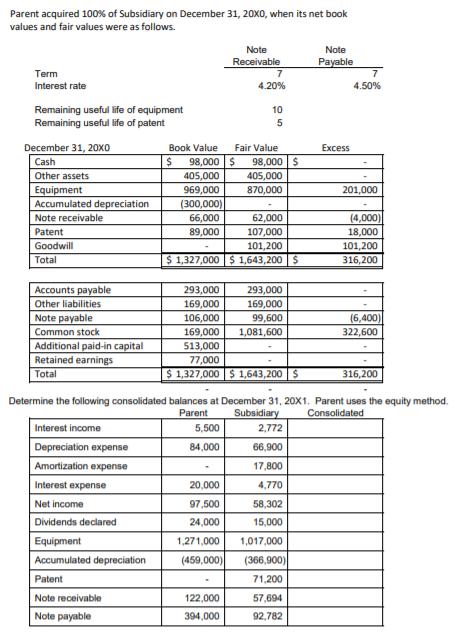

Parent acquired 100% of Subsidiary on December 31, 20X0, when its net book values and fair values were as follows. Note Note Receivable Payable

Parent acquired 100% of Subsidiary on December 31, 20X0, when its net book values and fair values were as follows. Note Note Receivable Payable 7 Term Interest rate 4.20% 4.50% Remaining useful life of equipment Remaining useful life of patent 10 December 31, 20xo Book Value Fair Value Excess Cash 98,000 $ 98,000 $ Other assets Equipment 405,000 405,000 969,000 870,000 201,000 (300,000) 66,000 Accumulated depreciation Note receivable 62,000 (4,000) 18,000 Patent 107,000 101,200 $ 1,327,000 $ 1,643,200 $ 89,000 Goodwill 101,200 Total 316,200 Accounts payable 293,000 293,000 169,000 Other liabilities 169,000 Note payable 106,000 99,600 (6,400) 322,600 Common stock 169,000 1,081,600 Additional paid-in capital Retained earnings 513,000 77,000 Total $1,327,000 $ 1,643,200 S 316,200 Determine the following consolidated balances at December 31, 20X1. Parent uses the equity method. Subsidiary Parent Consolidated Interest income 5,500 2,772 Depreciation expense 84,000 66,900 Amortization expense 17,800 Interest expense 20,000 4,770 Net income 97,500 58,302 Dividends declared 24,000 15,000 Equipment 1,271,000 1,017,000 Accumulated depreciation (459,000) (366,900) Patent 71,200 Note receivable 122,000 57,694 Note payable 394,000 92,782

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Calculation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started