Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 31, Wilderness Resorts Inc. racquired 22,500 shares of its common stock at $31 per share. On April 20, Wildermess Resorts sold 12,800

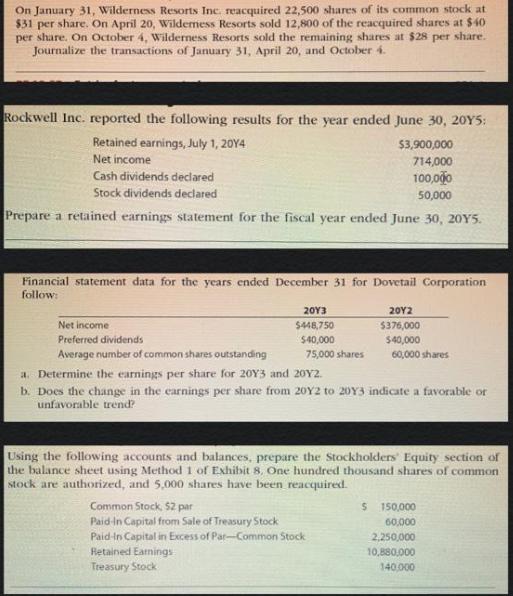

On January 31, Wilderness Resorts Inc. racquired 22,500 shares of its common stock at $31 per share. On April 20, Wildermess Resorts sold 12,800 of the reacquired shares at $40 per share. On October 4, Wilderness Resorts sold the remaining shares at $28 per share. Journalize the transactions of January 31, April 20, and October 4. Rockwell Inc. reported the following results for the year ended June 30, 20Y5: Retained earnings, July 1, 20Y4 $3,900,000 Net income 714,000 Cash dividends declared 100,000 Stock dividends declared 50,000 Prepare a retained earnings statement for the fiscal year ended June 30, 20Y5. Financial statement data for the years ended December 31 for Dovetail Corporation follow: 203 202 Net income $448,750 $376,000 Preferred dividends $40,000 $40,000 Average number of common shares outstanding 75,000 shares 60,000 shares a Determine the earnings per share for 20Y3 and 20Y2. b. Does the change in the carnings per share from 20Y2 to 20Y3 indicate a favorable or unfavorable trend? Using the following accounts and balances, prepare the Stockholders Equity section of the balance sheet using Method 1 of Exhibit 8. One hundred thousand shares of common stock are authorized, and 5,000 shares have been reacquired. $ 150,000 Common Stock, S2 par Paid In Capital from Sale of Treasury Stock Paid-in Capital in Excess of Par-Common Stock 60,000 2,250,000 Retained Earnings Treasury Stock 10,880,000 140,000

Step by Step Solution

★★★★★

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

QUESTION 1 Account title and description Debit Credit January ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started