Answered step by step

Verified Expert Solution

Question

1 Approved Answer

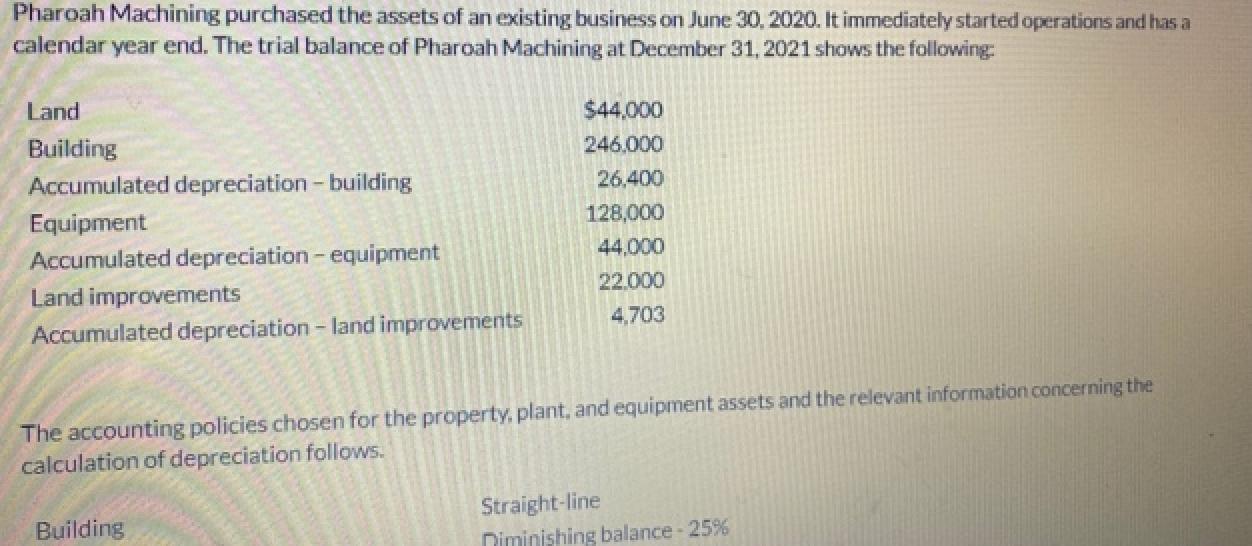

Pharoah Machining purchased the assets of an existing business on June 30, 2020. It immediately started operations and has a calendar year end. The

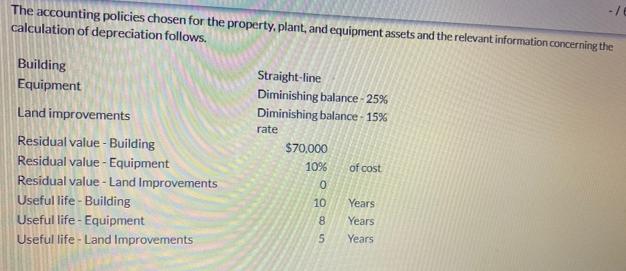

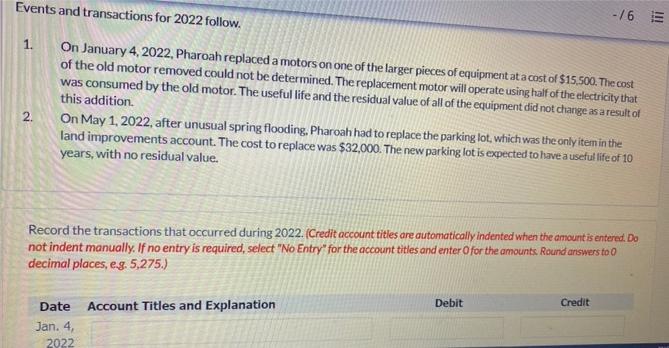

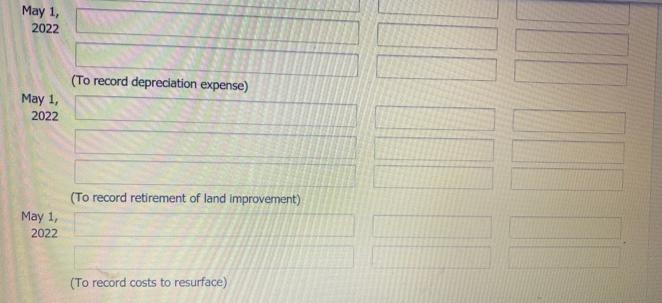

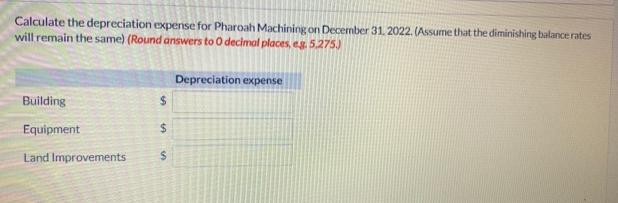

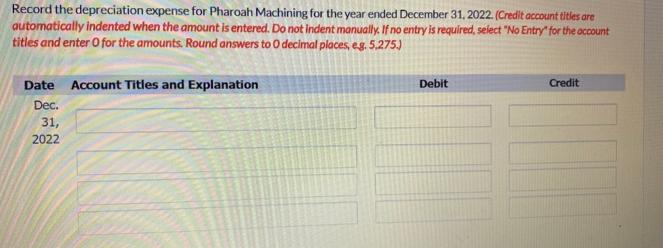

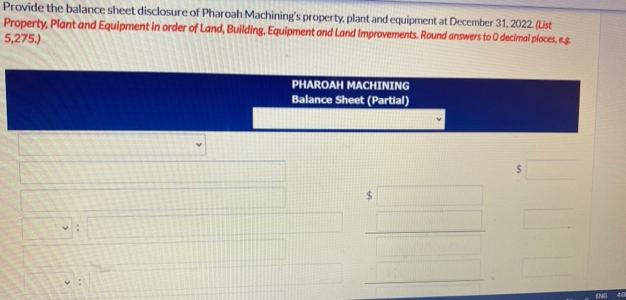

Pharoah Machining purchased the assets of an existing business on June 30, 2020. It immediately started operations and has a calendar year end. The trial balance of Pharoah Machining at December 31, 2021 shows the following: Land Building Accumulated depreciation building Equipment Accumulated depreciation - equipment Land improvements Accumulated depreciation - land improvements $44,000 246.000 26,400 128,000 44,000 22.000 4,703 The accounting policies chosen for the property, plant, and equipment assets and the relevant information concerning the calculation of depreciation follows. Building Straight-line Diminishing balance - 25% The accounting policies chosen for the property, plant, and equipment assets and the relevant information concerning the calculation of depreciation follows. Building Equipment Land improvements Residual value - Building Residual value - Equipment Residual value - Land Improvements Useful life - Building Useful life - Equipment Useful life - Land Improvements Straight-line Diminishing balance -25% Diminishing balance-15% rate $70,000 10% 0 985 10 of cost Years Years Years Events and transactions for 2022 follow. On January 4, 2022, Pharoah replaced a motors on one of the larger pieces of equipment at a cost of $15,500. The cost of the old motor removed could not be determined. The replacement motor will operate using half of the electricity that was consumed by the old motor. The useful life and the residual value of all of the equipment did not change as a result of this addition. 1. 2. On May 1, 2022, after unusual spring flooding, Pharoah had to replace the parking lot, which was the only item in the land improvements account. The cost to replace was $32,000. The new parking lot is expected to have a useful life of 10 years, with no residual value. Record the transactions that occurred during 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, e.g. 5,275.) Date Jan. 4, 2022 Account Titles and Explanation -16 Debit Credit May 1, 2022 May 1, 2022 May 1, 2022 (To record depreciation expense) (To record retirement of land improvement) (To record costs to resurface) Calculate the depreciation expense for Pharoah Machining on December 31, 2022. (Assume that the diminishing balance rates will remain the same) (Round answers to O decimal places, eg. 5.275.) Building Equipment Land Improvements $ $ 10 $ Depreciation expense Record the depreciation expense for Pharoah Machining for the year ended December 31, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to O decimal places, e.g. 5,275.) Date Account Titles and Explanation Dec. 31, 2022 Debit Credit Provide the balance sheet disclosure of Pharoah Machining's property, plant and equipment at December 31, 2022. (List Property, Plant and Equipment in order of Land, Building. Equipment and Land Improvements. Round answers to 0 decimal places, eg 5,275.) PHAROAH MACHINING Balance Sheet (Partial) ENG 400

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Balance sheet as at 31 December 2022 Assets 31 Dec ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started