Question

A financial ratio analysis will spotlight potential issues that a business may not even be aware of. A good counselor follows several steps. The first

A financial ratio analysis will spotlight potential issues that a business may not even be aware of. A good counselor follows several steps. The first is listening to the client’s story. Make notes. The second step is performing a complete financial analysis. You must understand the ratios, and what they are telling you. There are many financial ratios, but not every ratio is needed in every case. However, there are several ratios that are needed in every instance. These include the liquidity ratios, both current and quick, the solvency ratio, debt to equity ratio, inventory turnover ratio, days receivable, and payables, and net profit ratio.

Other ratios that may be needed, at your discretion on case by case basis, include:

1. Profitability Ratios

A. ROA

B. ROE

C. COGS

D. ROI

2. Efficiency Ratios

A. Accounts receivable ratio

B. Fixed asset turnover

3. Coverage Ratio

A. Times interest earned

B. Debt service ratio

4. Market Ratios

A. Dividend yield

B. P/E Ratio

C. EPS

D. Dividend Payout Ratio

Analyze the company with the ratios you deem important to this case. The client has come to you for assistance. The owner wants to expand to another location in Raleigh. Should the owner continue on this venture?

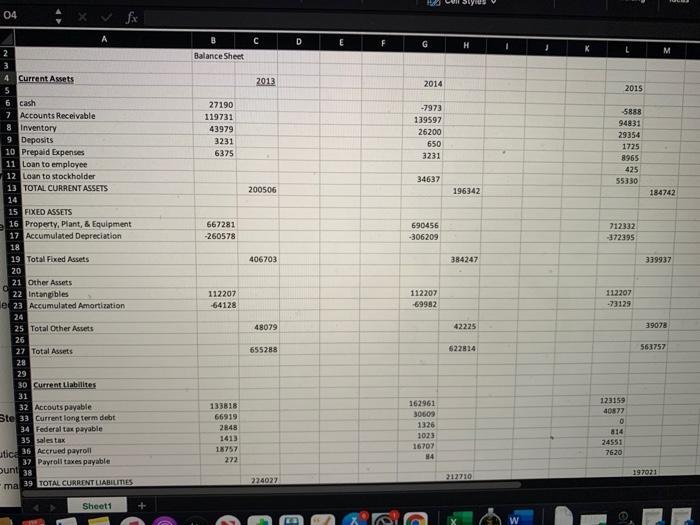

04 2 4 Current Assets 5 6 cash 7 Accounts Receivable 8 Inventory 9 Deposits 10 Prepaid Expenses 11 Loan to employee 12 Loan to stockholder 13 TOTAL CURRENT ASSETS 14 15 FIXED ASSETS 16 Property, Plant, & Equipment 17 Accumulated Depreciation 18 19 Total Fixed Assets 20 21 Other Assets 22 Intangibles e 23 Accumulated Amortization 24 25 Total Other Assets 26 27 Total Assets 28 29 30 Current Liabilites 31 32 Accouts payable Ste 33 Current long term debt 34 Federal tax payable 35 sales tax utica 36 Accrued payroll 37 Payroll taxes payable bunt 38 ma 39 TOTAL CURRENT LIABILITIES Sheet1 + B Balance Sheet 27190 119731 43979 3231 6375 667281 -260578 112207 -64128 133818 66919 2848 1413 18757 272 C 2013 200506 406703 48079 655288 224027 D E K F e G 2014 -7973 139597 26200 650 3231 34637 690456 -306209 112207 -69982 162961 30609 1326 1023 16707 84 H 196342 384247 42225 622814 212710 I K L 2015 -5888 94831 29354 1725 8965 425 55330 712332 -372395 112207 -73129 123159 40877 0 814 24551 7620 M 184742 339937 39078 563757 197021

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Instead knowledge skills and passion are equally important for succeeding as a new venture Ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started