Answered step by step

Verified Expert Solution

Question

1 Approved Answer

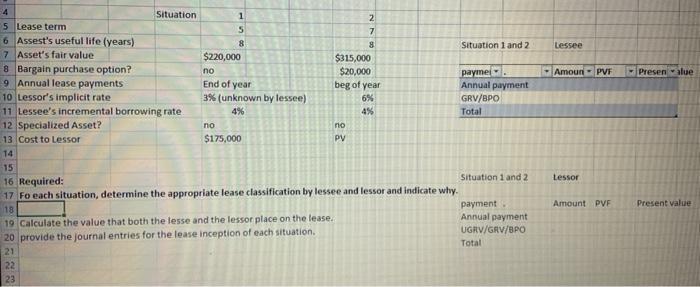

Use the charts at the right for lessee and lessor, and show each steps. 4 5 Lease term 6 Assest's useful life (years) 7 Asset's

Use the charts at the right for lessee and lessor, and show each steps.

4 5 Lease term 6 Assest's useful life (years) 7 Asset's fair value 8 Bargain purchase option? 9 Annual lease payments 10 Lessor's implicit rate 11 Lessee's incremental borrowing rate 12 Specialized Asset? 13 Cost to Lessor 14 Situation 1 5 8 $220,000 no End of year 3% (unknown by lessee) 4% no $175,000 19 Calculate the value that both the lesse and the lessor place on the lease. 20 provide the journal entries for the lease inception of each situation. 21 22 23 2 no PV 7 8 $315,000 $20,000 beg of year 6% 4% 15 16 Required: 17 Fo each situation, determine the appropriate lease classification by lessee and lessor and indicate why. 18 Situation 1 and 2 paymei Annual payment GRV/BPO Total Situation 1 and 2 payment. Annual payment UGRV/GRV/BPO Total Lessee Amoun PVF Lessor Amount PVF Presen alue Present value

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Lease accounting is the process by which a company records the financial impacts of its leasing activities Leases that meet specific classification requirements must be recorded on a companys financia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started