Let r be the risk-free interest rate. a) Suppose we buy one share for S(0), investing wS(0) of our own money and borrouing (1-

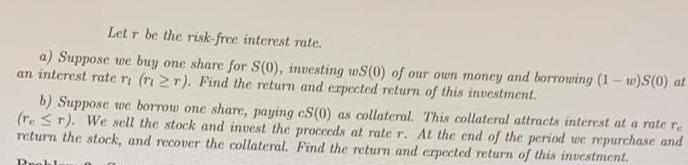

Let r be the risk-free interest rate. a) Suppose we buy one share for S(0), investing wS(0) of our own money and borrouing (1- w)S(0) at an interest rate ri (ri 2r). Find the return and erpected return of this investment. b) Suppose we borrow one share, paying cS(0) as collateral. This collateral attracts interest at a rate re (re Sr). We sell the stock and invest the procceds at rate r. At the end of the period we repurchase and return the stock, and recover the collateral. Find the return and erpected return of this investment. Pnebl

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started