Answered step by step

Verified Expert Solution

Question

1 Approved Answer

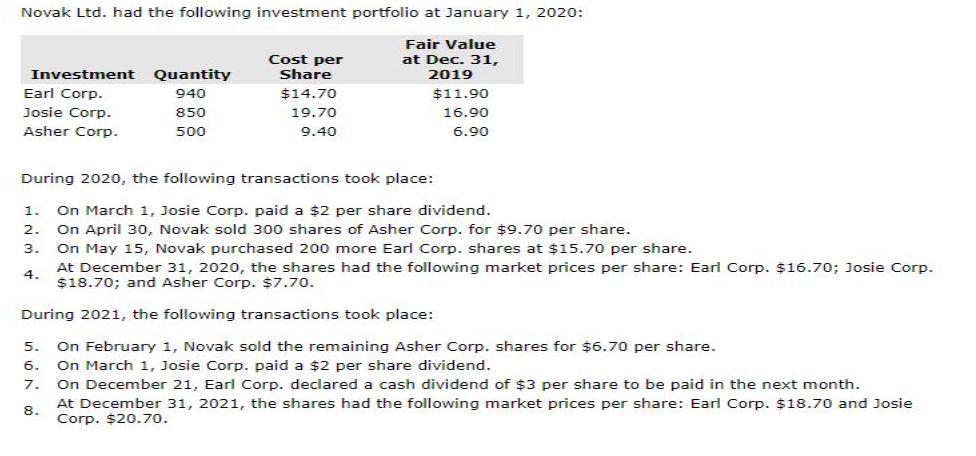

Novak Ltd. had the following investment portfolio at January 1, 2020: Fair Value at Dec. 31, 2019 Investment Earl Corp. Josie Corp. Asher Corp.

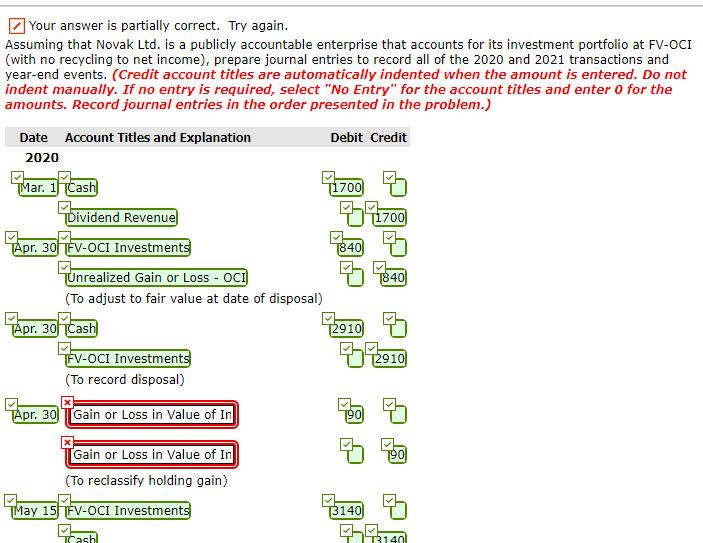

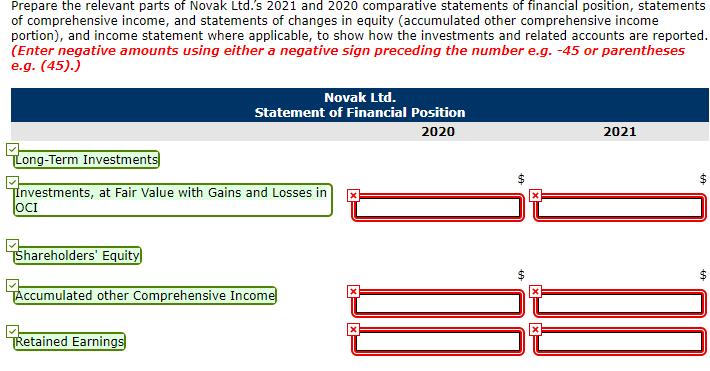

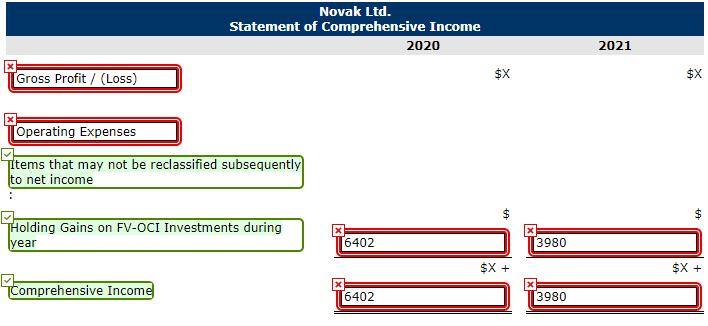

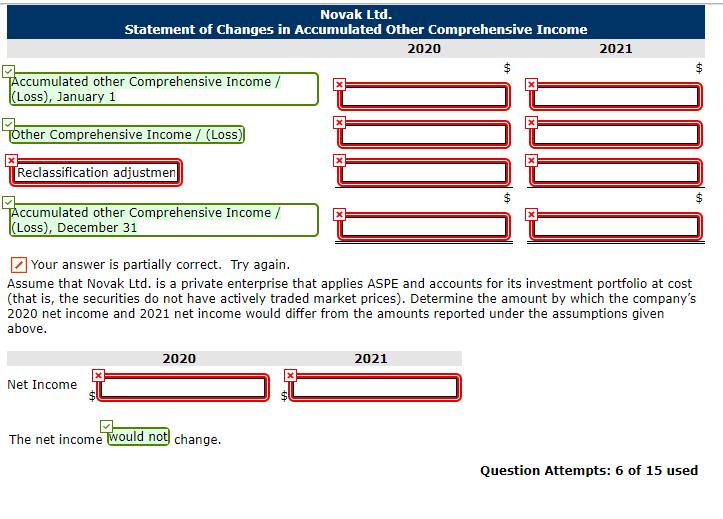

Novak Ltd. had the following investment portfolio at January 1, 2020: Fair Value at Dec. 31, 2019 Investment Earl Corp. Josie Corp. Asher Corp. Quantity 940 850 500 Cost per Share $14.70 19.70 9.40 $11.90 16.90 6.90 During 2020, the following transactions took place: 1. On March 1, Josie Corp. paid a $2 per share dividend. 2. On April 30, Novak sold 300 shares of Asher Corp. for $9.70 per share. 3. On May 15, Novak purchased 200 more Earl Corp. shares at $15.70 per share. At December 31, 2020, the shares had the following market prices per share: Earl Corp. $16.70; Josie Corp. $18.70; and Asher Corp. $7.70. During 2021, the following transactions took place: 5. On February 1, Novak sold the remaining Asher Corp. shares for $6.70 per share. 6. On March 1, Josie Corp. paid a $2 per share dividend. 7. On December 21, Earl Corp. declared a cash dividend of $3 per share to be paid in the next month. 8. At December 31, 2021, the shares had the following market prices per share: Earl Corp. $18.70 and Josie Corp. $20.70. Your answer is partially correct. Try again. Assuming that Novak Ltd. is a publicly accountable enterprise that accounts for its investment portfolio at FV-OCI (with no recycling to net income), prepare journal entries to record all of the 2020 and 2021 transactions and year-end events. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Debit Credit Date Account Titles and Explanation 2020 Mar. 1 Cash Dividend Revenue Apr. 30 FV-OCI Investments Unrealized Gain or Loss - OCI (To adjust to fair value at date of disposal) TApr. 30 Cash Apr. 30 FV-OCI Investments (To record disposal) Gain or Loss in Value of In Gain or Loss in Value of In (To reclassify holding gain) May 15 TFV-OCI Investments Tashl 1700 1700 1840 2910 3140 1840 7729 2910 190 T3140 2021 Feb. 1 Unrealized Gain or Loss - OCI FV-OCI Investments (To adjust to fair value at date of disposal) Feb. 1 Cash Feb. 1) TFV-OCI Investments (To record disposal) [FV-OCI Investments FV-OCI Investments (To reclassify holding loss) Mar. 1 Cash Dividend Revenue Dec. 21 Dividends Receivable Dividend Revenue Dec. 31 FV-OCI Investments Unrealized Gain or Loss - OCI 1200 1340 1540 1700 T3420 13980 1340 7540 1700 T3420 3980 Prepare the relevant parts of Novak Ltd. s 2021 and 2020 comparative statements of financial position, statements of comprehensive income, and statements of changes in equity (accumulated other comprehensive income portion), and income statement where applicable, to show how the investments and related accounts are reported. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Long-Term Investments Investments, at Fair Value with Gains and Losses in OCI Shareholders Equity Novak Ltd. Statement of Financial Position 2020 Accumulated other Comprehensive Income Retained Earnings 2021 69 +A x Gross Profit/ (Loss) Novak Ltd. Statement of Comprehensive Income Operating Expenses Items that may not be reclassified subsequently to net income Holding Gains on FV-OCI Investments during year Comprehensive Income x X 6402 6402 2020 $X $X+ X x 3980 3980 2021 $X +A $X + Novak Ltd. Statement of Changes in Accumulated Other Comprehensive Income 2020 Accumulated other Comprehensive Income / (Loss), January 1 Other Comprehensive Income / (Loss) Reclassification adjustmen Accumulated other Comprehensive Income / (Loss), December 31 Net Income 2020 Your answer is partially correct. Try again. Assume that Novak Ltd. is a private enterprise that applies ASPE and accounts for its investment portfolio at cost (that is, the securities do not have actively traded market prices). Determine the amount by which the company s 2020 net income and 2021 net income would differ from the amounts reported under the assumptions given above. The net income would not change. D 2021 2021 1011 Question Attempts: 6 of 15 used

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started