Fairchild Centre is an NFPO funded by government grants and private donations. It was established on January 1, Year 5, to provide counselling services

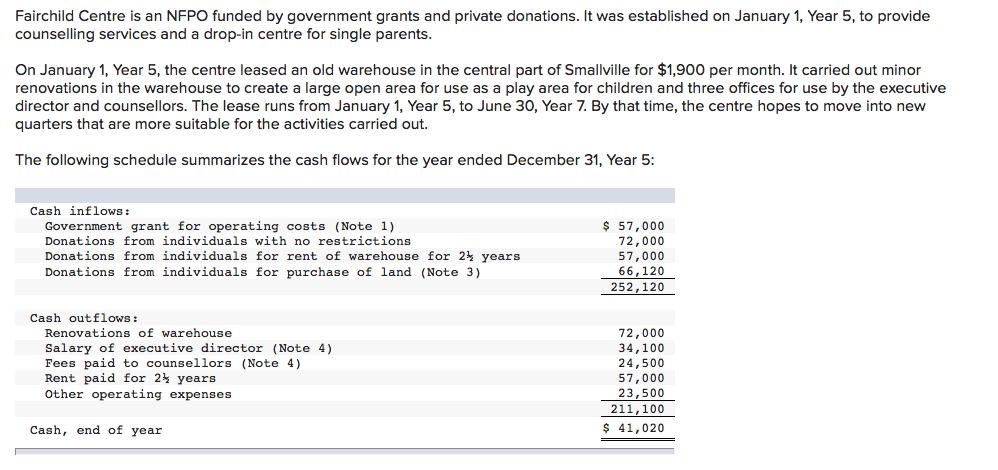

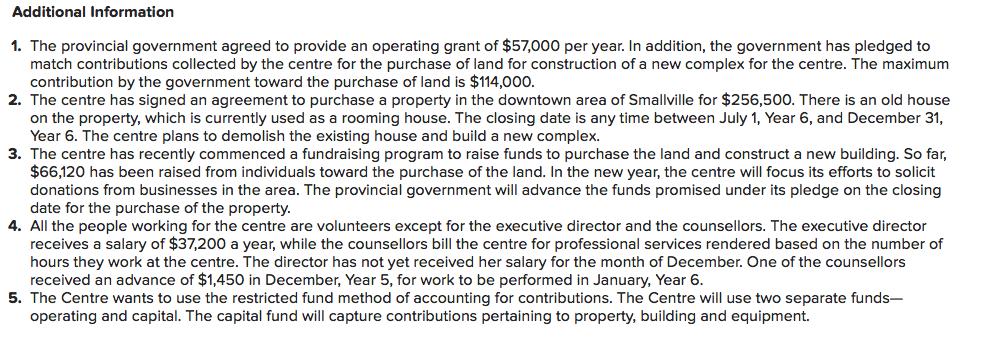

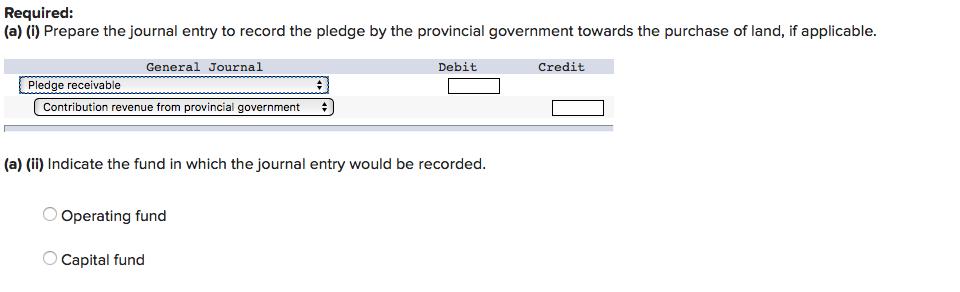

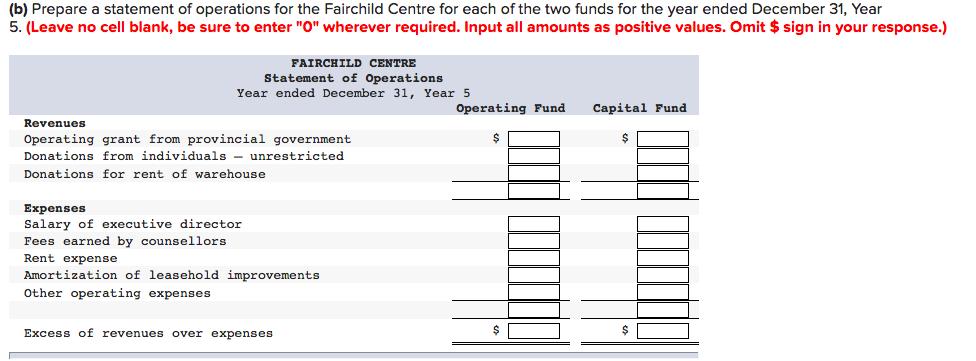

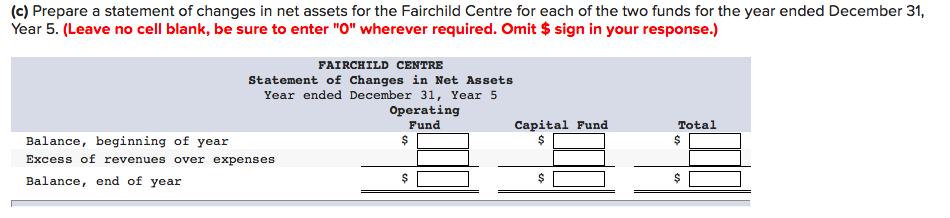

Fairchild Centre is an NFPO funded by government grants and private donations. It was established on January 1, Year 5, to provide counselling services and a drop-in centre for single parents. On January 1, Year 5, the centre leased an old warehouse in the central part of Smallville for $1,900 per month. It carried out minor renovations in the warehouse to create a large open area for use as a play area for children and three offices for use by the executive director and counsellors. The lease runs from January 1, Year 5, to June 30, Year 7. By that time, the centre hopes to move into new quarters that are more suitable for the activities carried out. The following schedule summarizes the cash flows for the year ended December 31, Year 5: Cash inflows : $ 57,000 72,000 57,000 66,120 252,120 Government grant for operating costs (Note 1) Donations from individuals with no restrictions Donations from individuals for rent of warehouse for 24 years Donations from individuals for purchase of land (Note 3) Cash outflows : Renovations of warehouse Salary of executive director (Note 4) Fees paid to counsellors (Note 4) Rent paid for 24 years Other operating expenses 72,000 34,100 24,500 57,000 23,500 211,100 Cash, end of year $ 41,020 Additional Information 1. The provincial government agreed to provide an operating grant of $57,000 per year. In addition, the government has pledged to match contributions collected by the centre for the purchase of land for construction of a new complex for the centre. The maximum contribution by the government toward the purchase of land is $114,000. 2. The centre has signed an agreement to purchase a property in the downtown area of Smallville for $256,500. There is an old house on the property, which is currently used as a rooming house. The closing date is any time between July 1, Year 6, and December 31, Year 6. The centre plans to demolish the existing house and build a new complex. 3. The centre has recently commenced a fundraising program to raise funds to purchase the land and construct a new building. So far, $66,120 has been raised from individuals toward the purchase of the land. In the new year, the centre will focus its efforts to solicit donations from businesses in the area. The provincial government will advance the funds promised under its pledge on the closing date for the purchase of the property. 4. All the people working for the centre are volunteers except for the executive director and the counsellors. The executive director receives a salary of $37,200 a year, while the counsellors bill the centre for professional services rendered based on the number of hours they work at the centre. The director has not yet received her salary for the month of December. One of the counsellors received an advance of $1,450 in December, Year 5, for work to be performed in January, Year 6. 5. The Centre wants to use the restricted fund method of accounting for contributions. The Centre will use two separate funds- operating and capital. The capital fund will capture contributions pertaining to property, building and equipment. Required: (a) (i) Prepare the journal entry to record the pledge by the provincial government towards the purchase of land, if applicable. General Journal Debit Credit Pledge receivable Contribution revenue from provincial government (a) (ii) Indicate the fund in which the journal entry would be recorded. O Operating fund OCapital fund (b) Prepare a statement of operations for the Fairchild Centre for each of the two funds for the year ended December 31, Year 5. (Leave no cell blank, be sure to enter "O" wherever required. Input all amounts as positive values. Omit $ sign in your response.) FAIRCHILD CENTRE Statement of Operations Year ended December 31, Year 5 Operating Fund Capital Fund Revenues Operating grant from provincial government Donations from individuals - unrestricted Donations for rent of warehouse Expenses Salary of executive director Fees earned by counsellors Rent expense Amortization of leasehold improvements Other operating expenses Excess of revenues over expenses (c) Prepare a statement of changes in net assets for the Fairchild Centre for each of the two funds for the year ended December 31, Year 5. (Leave no cell blank, be sure to enter "O" wherever required. Omit $ sign in your response.) FAIRCHILD CENTRE Statement of Changes in Net Assets Year ended December 31, Year 5 Operating Fund Capital Fund Total Balance, beginning of year Excess of revenues over expenses Balance, end of year %24 %24 %24

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a i JOURNAL PARTICULARS DEBIT CREDIT Pledge receivable AC Dr To Contribution Revenue from Provincial ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started