Question

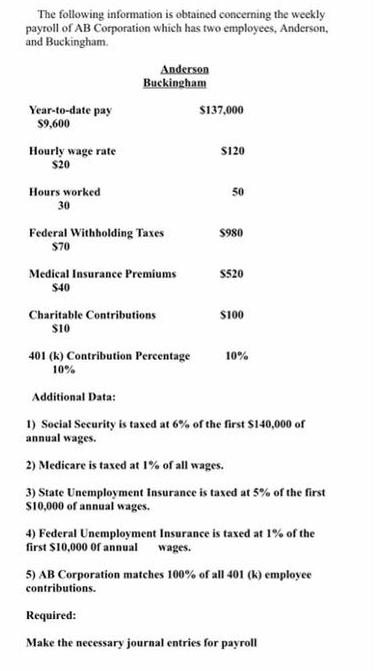

The following information is obtained concerning the weekly payroll of AB Corporation which has two employees, Anderson, and Buckingham. Anderson Buckingham Year-to-date pay $9,600

The following information is obtained concerning the weekly payroll of AB Corporation which has two employees, Anderson, and Buckingham. Anderson Buckingham Year-to-date pay $9,600 $137,000 Hourly wage rate $20 S120 Hours worked 50 30 Federal Withholding Taxes $980 S70 Medical Insurance Premiums $40 S520 Charitable Contributions s100 S10 401 (k) Contribution Percentage 10% 10% Additional Data: 1) Social Security is taxed at 6% of the first S140,000 of annual wages. 2) Medicare is taxed at 1% of all wages. 3) State Unemployment Insurance is taxed at 5% of the first s10,000 of annual wages. 4) Federal Unemployment Insurance is taxed at 1% of the first S10,000 of annual wages. 5) AB Corporation matches 100% of all 401 (k) employee contributions. Required: Make the necessary journal entries for payroll

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Mathematical Statistics With Applications In R

Authors: Chris P. Tsokos, K.M. Ramachandran

2nd Edition

124171133, 978-0124171138

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App