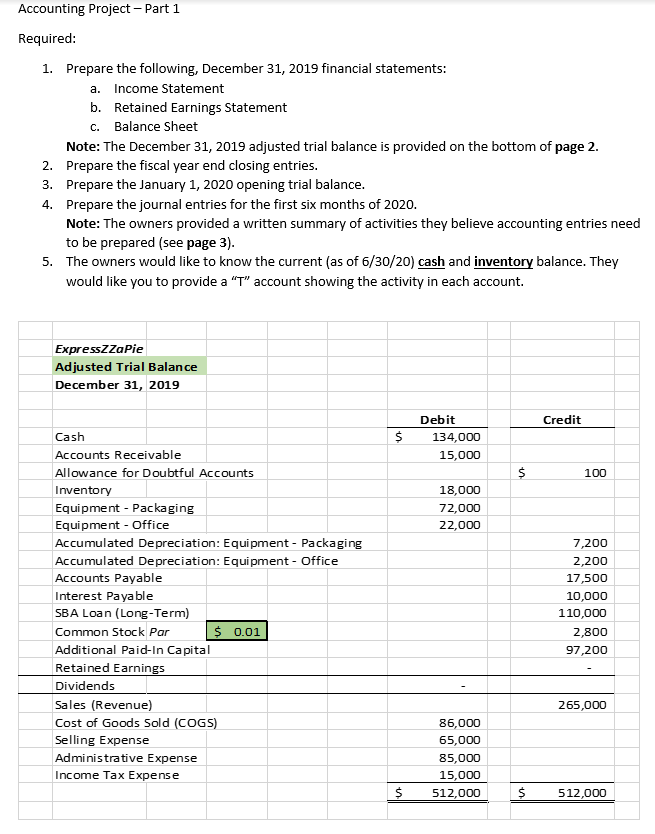

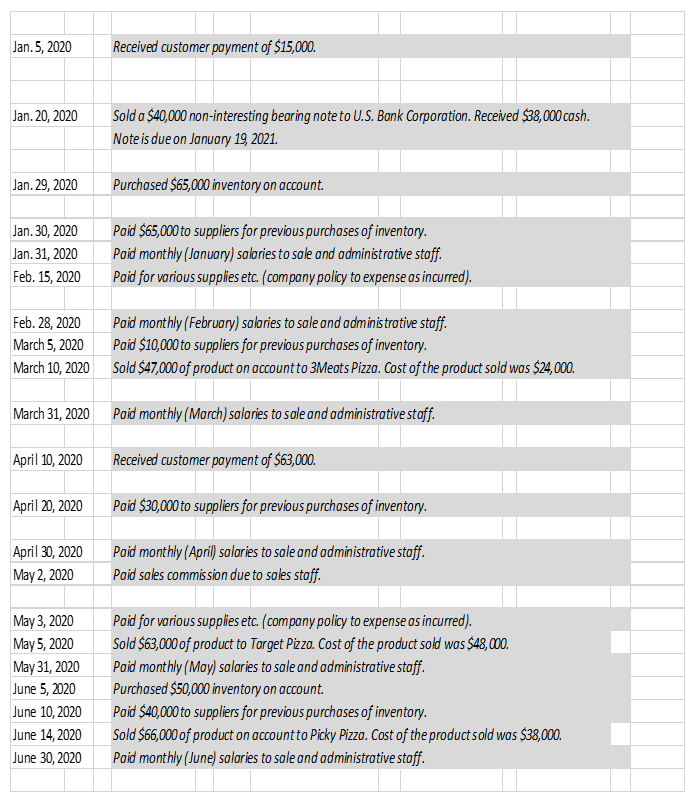

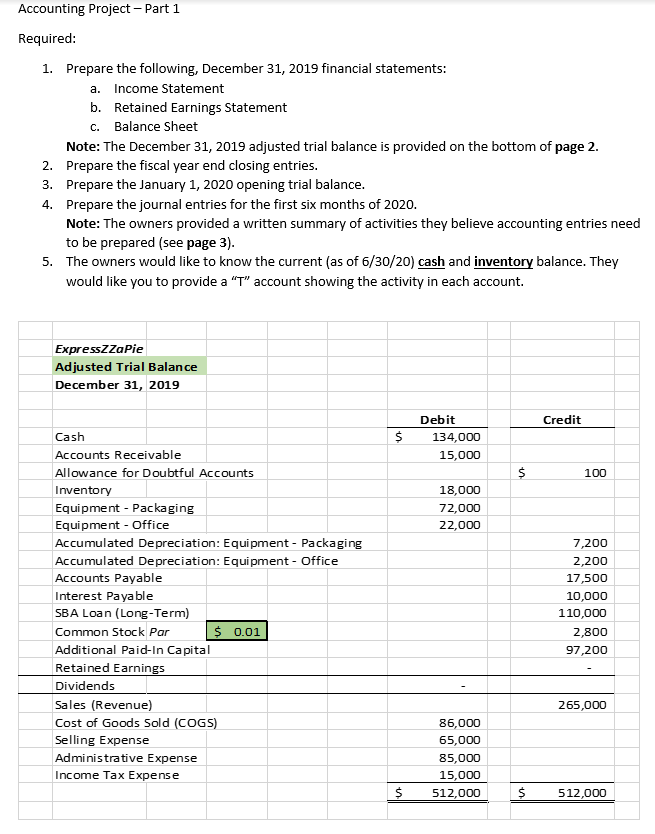

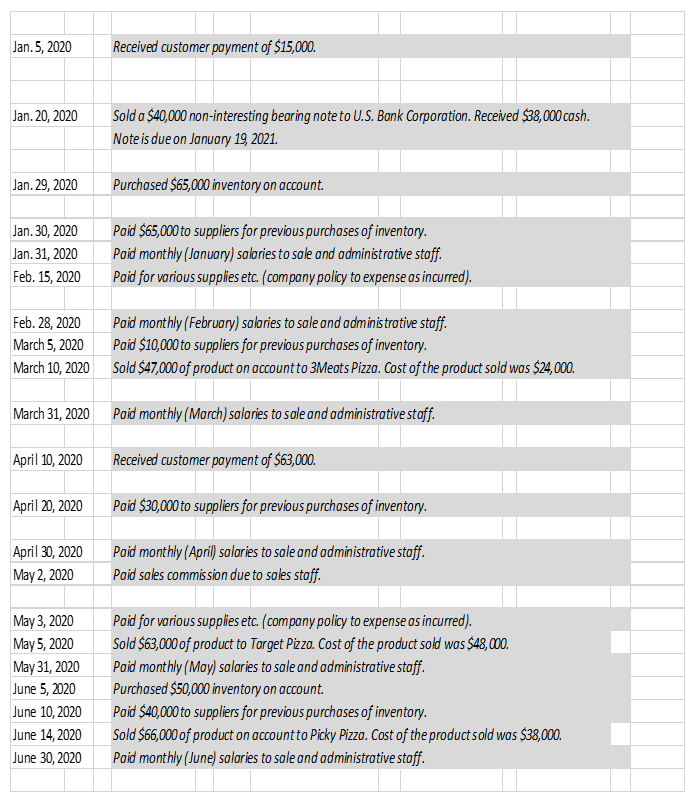

Accounting Project - Part 1 Required: 1. Prepare the following, December 31, 2019 financial statements: a. Income Statement b. Retained Earnings Statement C. Balance Sheet Note: The December 31, 2019 adjusted trial balance is provided on the bottom of page 2. 2. Prepare the fiscal year end closing entries. 3. Prepare the January 1, 2020 opening trial balance. 4. Prepare the journal entries for the first six months of 2020. Note: The owners provided a written summary of activities they believe accounting entries need to be prepared (see page 3). 5. The owners would like to know the current (as of 6/30/20) cash and inventory balance. They would like you to provide a "T" account showing the activity in each account. Express Zapie Adjusted Trial Balance December 31, 2019 Credit $ Debit 134,000 15,000 $ 100 18,000 72,000 22,000 Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Equipment - Packaging Equipment - Office Accumulated Depreciation: Equipment - Packaging Accumulated Depreciation: Equipment - Office Accounts Payable Interest Payable SBA Loan (Long-Term) Common Stock Par $ 0.01 Additional Paid-In Capital Retained Earnings Dividends Sales (Revenue) Cost of Goods Sold (COGS) Selling Expense Administrative Expense Income Tax Expense 7,200 2,200 17,500 10,000 110,000 2,800 97,200 265,000 86,000 65,000 85,000 15,000 512,000 $ $ 512,000 Jan.5, 2020 Received customer payment of $15,000. Jan.20, 2020 Sold a $40,000 non-interesting bearing note to U.S. Bank Corporation. Received $38,000 cash. Note is due on January 19, 2021. Jan. 29, 2020 Purchased $65,000 inventory on account. Jan. 30, 2020 Jan. 31, 2020 Feb. 15, 2020 Poid $65,000 to suppliers for previous purchases of inventory. Paid monthly (January) salaries to sale and administrative stoff. Poid for various supplies etc. (company policy to expense as incurred). Feb. 28, 2020 Paid monthly (February) salaries to sale and administrative stoff. March 5, 2020 Paid $10,000 to suppliers for previous purchases of inventory. March 10, 2020 Sold $47,000 of product on account to 3Meats Pizza. Cost of the product sold was $24,000. March 31, 2020 Poid monthly (March) salories to sale and administrative stoff. April 10, 2020 Received customer payment of $63,000. April 20, 2020 Paid $30,000 to suppliers for previous purchases of inventory. April 30, 2020 May 2, 2020 Poid monthly (April) salaries to sale and administrative staff. Paid sales commission due to sales staff. May 3, 2020 May 5, 2020 May 31, 2020 June 5, 2020 June 10, 2020 June 14, 2020 June 30, 2020 Poid for various supplies etc. (company policy to expense as incurred). Sold $63,000 of product to Target Pizza. Cost of the product sold was $48,000. Paid monthly (May) salaries to sale and administrative stoff. Purchased $50,000 inventory on account. Paid $40,000 to suppliers for previous purchases of inventory. Sold $66,000 of product on account to picky Pizzo. Cost of the product sold was $38,000. Paid monthly (June) salaries to sale and administrative staff